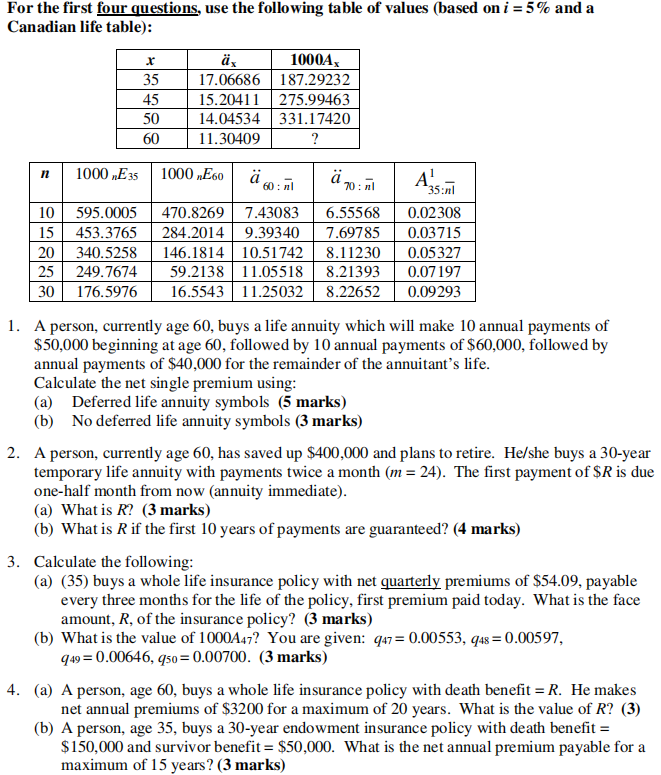

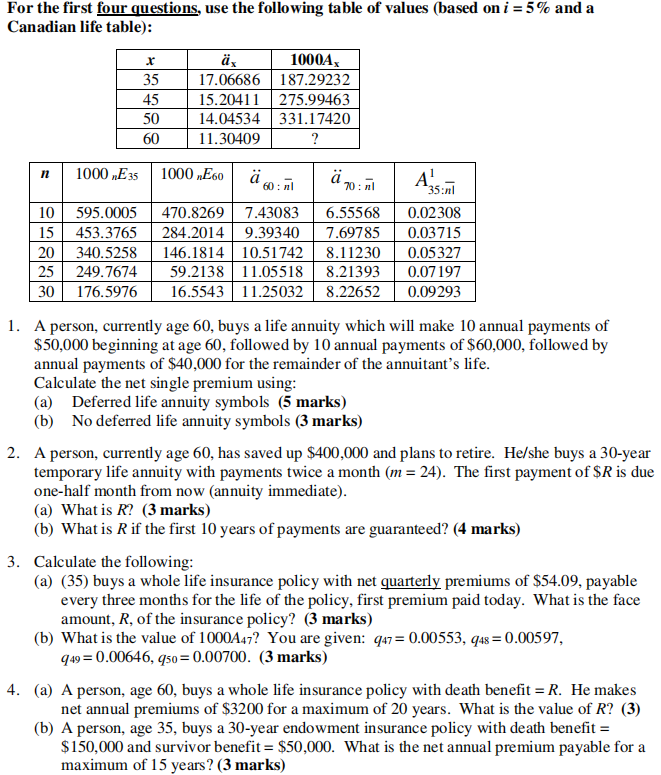

For the first four questions, use the following table of values (based on i = 5% and a Canadian life table): x 1000A, 35 17.06686 187.29232 45 15.20411 275.99463 50 14.04534 331.17420 60 11.30409 ? 1000 E 35 70:n Azsin 35:1 10 15 20 25 30 595.0005 453.3765 340.5258 249.7674 176.5976 1000 E60 6:11 470.8269 7.43083 6.55568 284.2014 9.39340 7.69785 146.1814 10.51 742 8.11230 59.2138 | 11.05518 8.21393 16.5543 | 11.25032 8.22652 0.02308 0.03715 0.05327 0.07197 0.09293 1. A person, currently age 60, buys a life annuity which will make 10 annual payments of $50,000 beginning at age 60, followed by 10 annual payments of $60,000, followed by annual payments of $40,000 for the remainder of the annuitant's life. Calculate the net single premium using: (a) Deferred life annuity symbols (5 marks) (b) No deferred life annuity symbols (3 marks) 2. A person, currently age 60, has saved up $400,000 and plans to retire. He/she buys a 30-year temporary life annuity with payments twice a month (m = 24). The first payment of $R is due one-half month from now (annuity immediate). (a) What is R? (3 marks) (b) What is Rif the first 10 years of payments are guaranteed? (4 marks) 3. Calculate the following: (a) (35) buys a whole life insurance policy with net quarterly premiums of $54.09, payable every three months for the life of the policy, first premium paid today. What is the face amount, R, of the insurance policy? (3 marks) (b) What is the value of 1000A47? You are given: 947= 0.00553, 948 = 0.00597, 949=0.00646, 450=0.00700. (3 marks) 4. (a) A person, age 60, buys a whole life insurance policy with death benefit = R. He makes net annual premiums of $3200 for a maximum of 20 years. What is the value of R? (3) (b) A person, age 35, buys a 30-year endowment insurance policy with death benefit = $150,000 and survivor benefit = $50,000. What is the net annual premium payable for a maximum of 15 years? (3 marks) For the first four questions, use the following table of values (based on i = 5% and a Canadian life table): x 1000A, 35 17.06686 187.29232 45 15.20411 275.99463 50 14.04534 331.17420 60 11.30409 ? 1000 E 35 70:n Azsin 35:1 10 15 20 25 30 595.0005 453.3765 340.5258 249.7674 176.5976 1000 E60 6:11 470.8269 7.43083 6.55568 284.2014 9.39340 7.69785 146.1814 10.51 742 8.11230 59.2138 | 11.05518 8.21393 16.5543 | 11.25032 8.22652 0.02308 0.03715 0.05327 0.07197 0.09293 1. A person, currently age 60, buys a life annuity which will make 10 annual payments of $50,000 beginning at age 60, followed by 10 annual payments of $60,000, followed by annual payments of $40,000 for the remainder of the annuitant's life. Calculate the net single premium using: (a) Deferred life annuity symbols (5 marks) (b) No deferred life annuity symbols (3 marks) 2. A person, currently age 60, has saved up $400,000 and plans to retire. He/she buys a 30-year temporary life annuity with payments twice a month (m = 24). The first payment of $R is due one-half month from now (annuity immediate). (a) What is R? (3 marks) (b) What is Rif the first 10 years of payments are guaranteed? (4 marks) 3. Calculate the following: (a) (35) buys a whole life insurance policy with net quarterly premiums of $54.09, payable every three months for the life of the policy, first premium paid today. What is the face amount, R, of the insurance policy? (3 marks) (b) What is the value of 1000A47? You are given: 947= 0.00553, 948 = 0.00597, 949=0.00646, 450=0.00700. (3 marks) 4. (a) A person, age 60, buys a whole life insurance policy with death benefit = R. He makes net annual premiums of $3200 for a maximum of 20 years. What is the value of R? (3) (b) A person, age 35, buys a 30-year endowment insurance policy with death benefit = $150,000 and survivor benefit = $50,000. What is the net annual premium payable for a maximum of 15 years