Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the first one I just need help on C-2 Thank you in advance. The Gilster Company, a machine tooling firm, has several plants. One

For the first one I just need help on C-2

Thank you in advance.

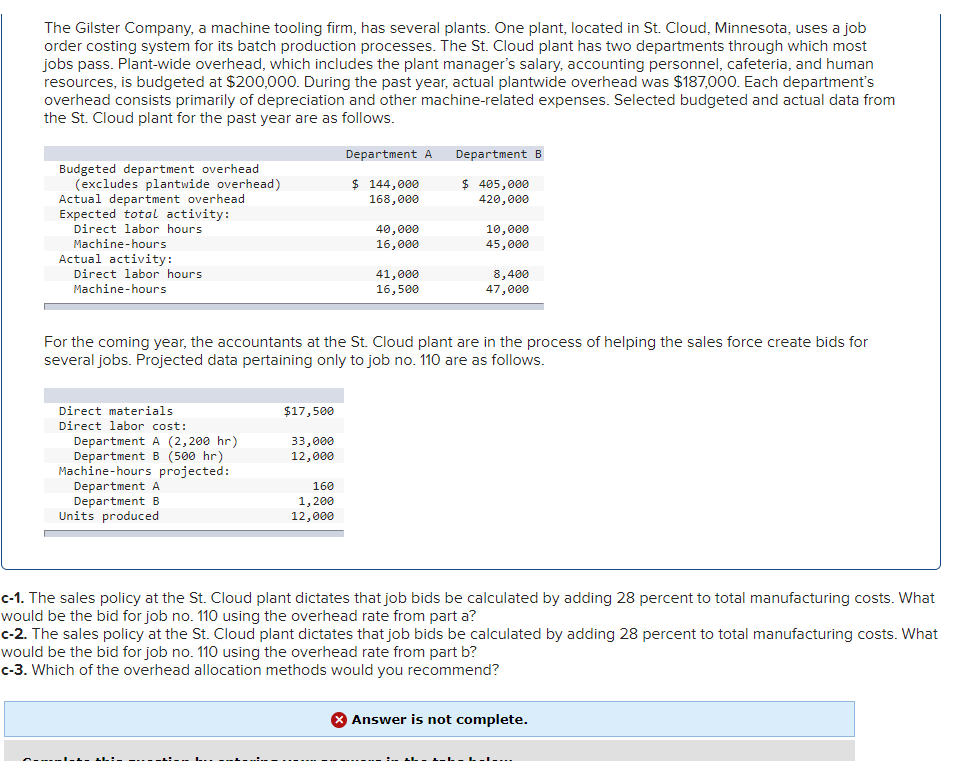

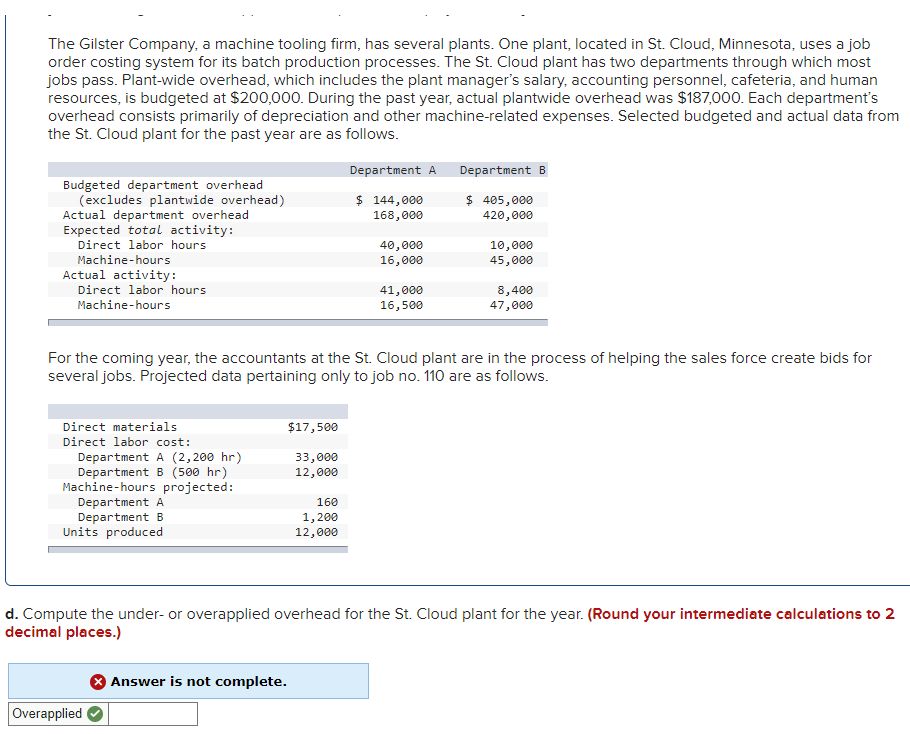

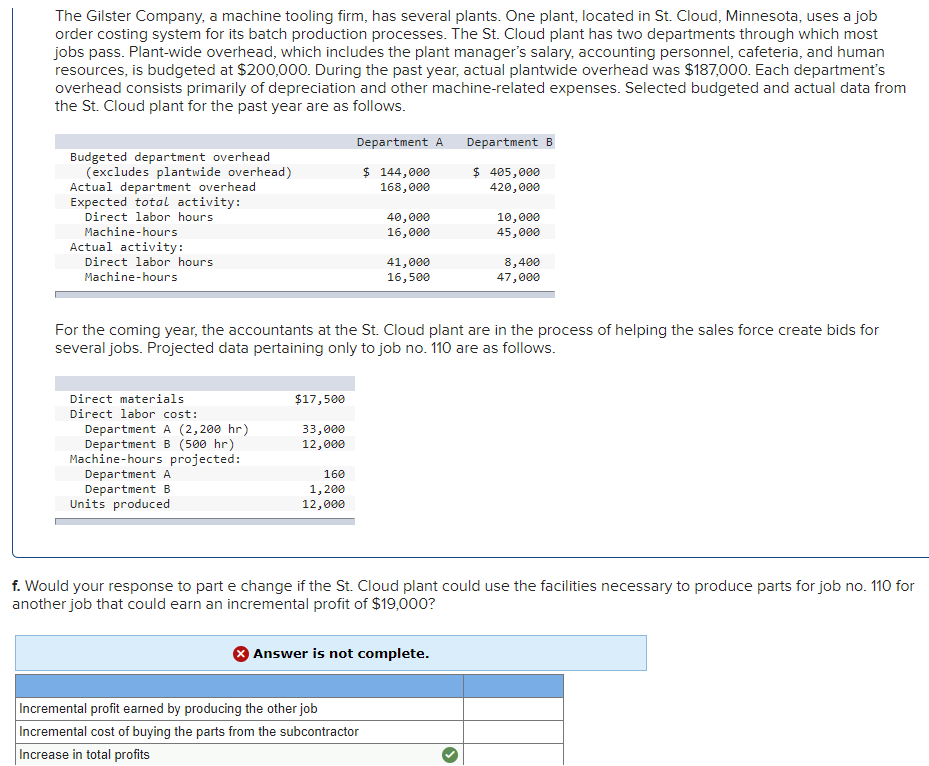

The Gilster Company, a machine tooling firm, has several plants. One plant, located in St. Cloud, Minnesota, uses a job order costing system for its batch production processes. The St. Cloud plant has two departments through which most jobs pass. Plant-wide overhead, which includes the plant manager's salary, accounting personnel, cafeteria, and human resources, is budgeted at $200,000. During the past year, actual plantwide overhead was $187,000. Each department's overhead consists primarily of depreciation and other machine-related expenses. Selected budgeted and actual data from the St. Cloud plant for the past year are as follows. Department A Department B $ 144,000 168,000 $ 405,000 420,000 Budgeted department overhead (excludes plantwide overhead) Actual department overhead Expected total activity: Direct labor hours Machine-hours Actual activity: Direct labor hours Machine-hours 40,000 16,000 10,000 45,000 41,000 16,500 8,400 47,000 For the coming year, the accountants at the St. Cloud plant are in the process of helping the sales force create bids for several jobs. Projected data pertaining only to job no. 110 are as follows. $17,500 33,000 12,000 Direct materials Direct labor cost: Department A (2,200 hr) Department B (500 hr) Machine-hours projected: Department A Department B Units produced 160 1,200 12,000 c-1. The sales policy at the St. Cloud plant dictates that job bids be calculated by adding 28 percent to total manufacturing costs. What would be the bid for job no. 110 using the overhead rate from part a? c-2. The sales policy at the St. Cloud plant dictates that job bids be calculated by adding 28 percent to total manufacturing costs. What would be the bid for job no. 110 using the overhead rate from part b? c-3. Which of the overhead allocation methods would you recommend? Answer is not complete. The Gilster Company, a machine tooling firm, has several plants. One plant, located in St. Cloud, Minnesota, uses a job order costing system for its batch production processes. The St. Cloud plant has two departments through which most jobs pass. Plant-wide overhead, which includes the plant manager's salary, accounting personnel, cafeteria, and human resources, is budgeted at $200,000. During the past year, actual plantwide overhead was $187,000. Each department's overhead consists primarily of depreciation and other machine-related expenses. Selected budgeted and actual data from the St. Cloud plant for the past year are as follows. Department A Department B $ 144,000 168,000 $ 405,000 420,000 Budgeted department overhead (excludes plantwide overhead) Actual department overhead Expected total activity: Direct labor hours Machine-hours Actual activity: Direct labor hours Machine-hours 40,000 16,000 10,000 45,000 41,000 16,500 8,400 47,000 For the coming year, the accountants at the St. Cloud plant are in the process of helping the sales force create bids for several jobs. Projected data pertaining only to job no. 110 are as follows. $17,500 33,000 12,000 Direct materials Direct labor cost: Department A (2,200 hr) Department B (500 hr) Machine-hours projected: Department A Department B Units produced 160 1,200 12,000 d. Compute the under- or overapplied overhead for the St. Cloud plant for the year. (Round your intermediate calculations to 2 decimal places.) Answer is not complete. Overapplied The Gilster Company, a machine tooling firm, has several plants. One plant, located in St. Cloud, Minnesota, uses a job order costing system for its batch production processes. The St. Cloud plant has two departments through which most jobs pass. Plant-wide overhead, which includes the plant manager's salary, accounting personnel, cafeteria, and human resources, is budgeted at $200,000. During the past year, actual plantwide overhead was $187,000. Each department's overhead consists primarily of depreciation and other machine-related expenses. Selected budgeted and actual data from the St. Cloud plant for the past year are as follows. Department A Department B $ 144,000 168,000 $ 405,000 420,000 Budgeted department overhead (excludes plantwide overhead) Actual department overhead Expected total activity: Direct labor hours Machine-hours Actual activity: Direct labor hours Machine-hours 40,000 16,000 10,000 45,000 41,000 16,500 8,400 47,000 For the coming year, the accountants at the St. Cloud plant are in the process of helping the sales force create bids for several jobs. Projected data pertaining only to job no. 110 are as follows. $17,500 33,000 12,000 Direct materials Direct labor cost: Department A (2,200 hr) Department B (500 hr) Machine-hours projected: Department A Department B Units produced 160 1,200 12,000 f. Would your response to parte change if the St. Cloud plant could use the facilities necessary to produce parts for job no. 110 for another job that could earn an incremental profit of $19,000? Answer is not complete. Incremental profit earned by producing the other job Incremental cost of buying the parts from the subcontractor Increase in total profitsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started