Question

For the first seven questions, consider the economy of Columbia. In this economy, there are three firms potentially interested in issuing a $100,000 bond

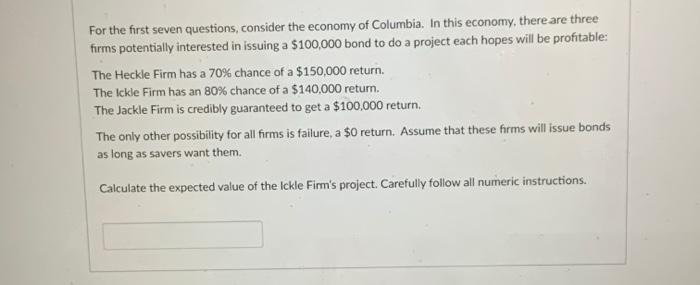

For the first seven questions, consider the economy of Columbia. In this economy, there are three firms potentially interested in issuing a $100,000 bond to do a project each hopes will be profitable: The Heckle Firm has a 70% chance of a $150,000 return. The Ickle Firm has an 80% chance of a $140,000 return. The Jackle Firm is credibly guaranteed to get a $100,000 return. The only other possibility for all firms is failure, a $0 return. Assume that these firms will issue bonds as long as savers want them. Calculate the expected value of the Ickle Firm's project. Carefully follow all numeric instructions.

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate the expected value of the Ickle ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Entrepreneurship

Authors: Andrew Zacharakis, William D Bygrave

5th Edition

1119563097, 9781119563099

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App