Question

For the following annual bond index and stock index returns, please calculate the average return and standard deviation for each. If a portfolio is made

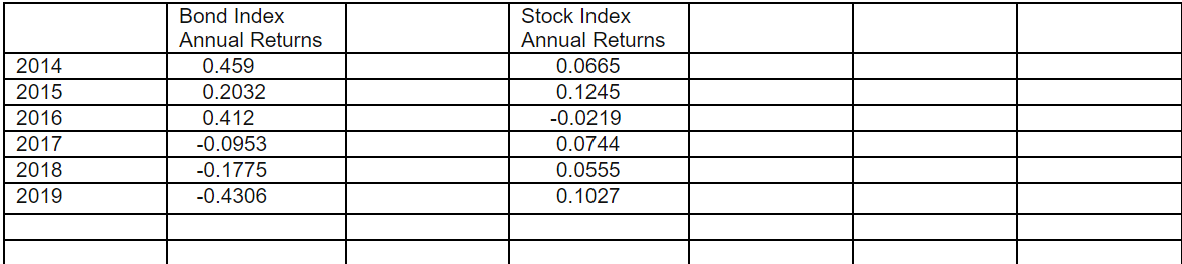

For the following annual bond index and stock index returns, please calculate the average return and standard deviation for each.

If a portfolio is made up of 40% invested in the bond index and 60% invested in the stock index and the correlation coefficient between the two indexes is .047. What are the expected average return and standard deviation of the portfolio?

With a 95% probability, what is the expected range of returns for the portfolio? (Note the table has blank columns in case you want to use them for your calculations). Show your work for full marks and clearly label your calculations. Assume n-1 is the divisor for the calculation of variance and standard deviation.

2014 2015 2016 2017 2018 2019 Bond Index Annual Returns 0.459 0.2032 0.412 -0.0953 -0.1775 -0.4306 Stock Index Annual Returns 0.0665 0.1245 -0.0219 0.0744 0.0555 0.1027 2014 2015 2016 2017 2018 2019 Bond Index Annual Returns 0.459 0.2032 0.412 -0.0953 -0.1775 -0.4306 Stock Index Annual Returns 0.0665 0.1245 -0.0219 0.0744 0.0555 0.1027

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started