Question

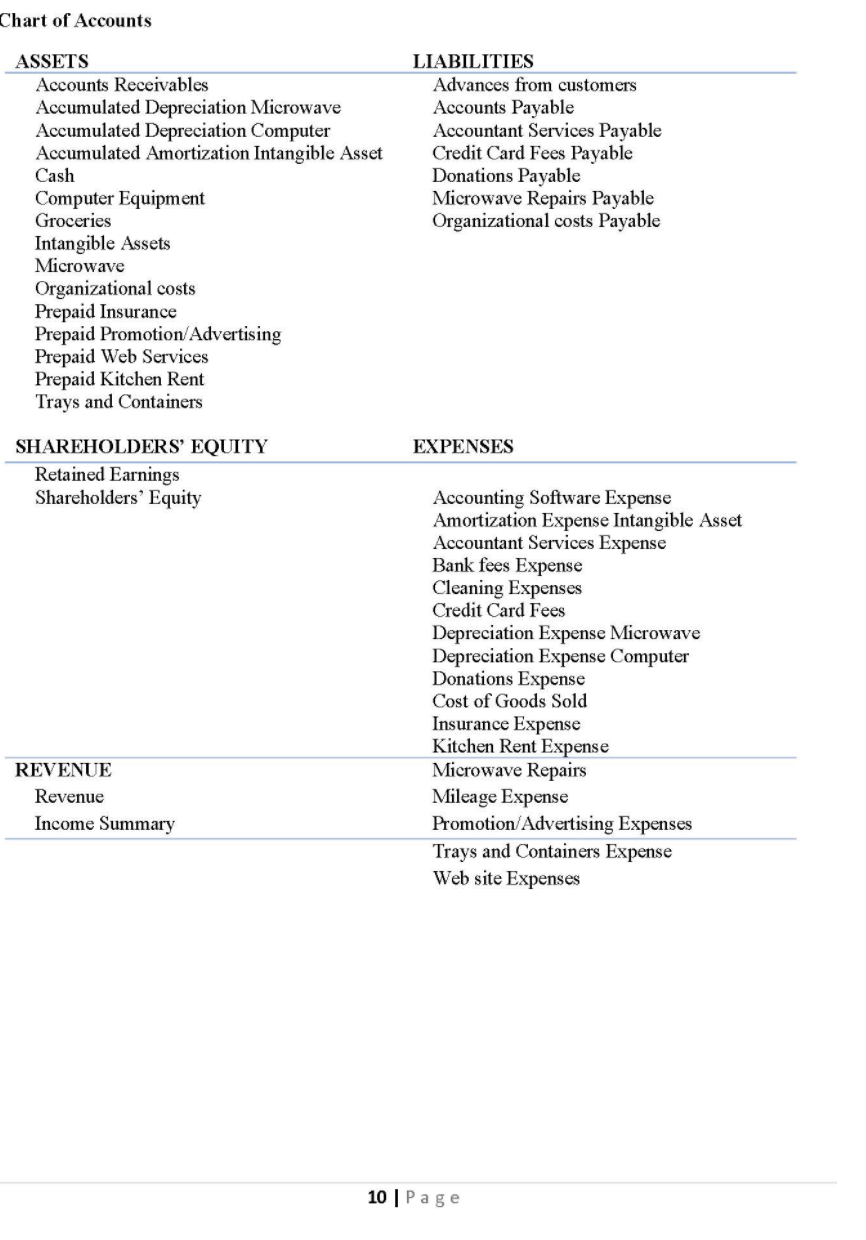

For the following case below please do the followings: 1. Check and use the Chart of Accounts provided (do not create new accounts). 2. Make

For the following case below please do the followings:

1. Check and use the Chart of Accounts provided (do not create new accounts).

2. Make the General Journal for the month (all journal entries including AJE). Make Closing Entries for the month. Get the books ready to continue with business in the next period.

3. Each General Journal entry should have the date (omit the brief explanation under).

4. Post all transactions to the T-accounts and make a Trial Balance. Show a detailed balance of each of these accounts for the first month of operations (end of Month).

5. Make a financial Statement in good form including contingency disclosures that are exclusive of the transactions of this case. Make an Income statement, A statement of Owners Equity - Retained Earnings, and a Balance Sheet.

The Case starts from here: (there are pictures attached below that are part of the case):

Veronica has been linked directly and indirectly with restaurants all her life. First because her grandparents had a food joint in Sutton by lake Simcoe where she would spend her summers as a child, and second because her professional career after graduating with a BCom has been evolving at the headquarters of a well-known restaurant chain (sports bar) located in Woodbridge, Ontario, where she works as a social media marketing and promotions manager from 9 am to 5 pm every day.

One afternoon she was visiting her friend Wanda who has a family of 4 as she saw her friend juggling with her daily routine when all of a sudden, she turned around and asked:

Veronica, please, would you help me with dinner!? I do not have a clue of what we are going to eat tonight.

It doesn't have to be fancy, just healthy and easy food.

On her way home she started to think about what Wanda asked her.

Veronica discovered a need for everyday prepared healthy and convenient food delivered to your door. So, she thought about transforming that need into her own business, considering her experience in the food sector. And then, "Let me cook for you" was created.

Veronica is the founder of LET ME COOK FOR YOU Inc., an Ontario food prepared meal delivered Service Company located in the Greater Toronto Area. The company is based on the values of healthy food and environmental sustainability. Veronica also believes in corporate social responsibility. She likes to donate a percentage of the company's monthly profits to community projects. LET ME COOK FOR YOU Inc. sells "green" brands and uses alternative energy sources whenever possible.

As Let me cook for you Inc.'s owner, Veronica contacted a lawyer for advice about incorporating. The legal firm The 6 Law provided the necessary legal advice and did all the necessary paperwork to incorporate as a Canada Business Corporation. Initial capitalization allowed for 100 no par value shares.

At the beginning of April 2020, Veronica had a meeting with the Accountant and explained in great detail what happened during March 2020, the first month of the business, from her personal daily diary. She also gave the Accountant a shoe box full of Invoices and receipts she has collected during the month.

In order to be connected in a secure and professional way with her customers, LET ME COOK FOR YOU Inc. hired NO Danny for the Company's website needs such as: Domain Name Register, DNS, Web hosting, SSL certificate and Dedicated IP. Also, No Danny is providing E-Commerce Web design, Logo design, Online Marketing - Search engine visibility and "Email plus" in order to expand the Company services worldwide. It is estimated the web design is the only element of the invoice that can be amortized in 25 months.

Also, a Computer Service company was hired to update the company's computer and network system.

The company's computer has been contributed by Veronica in exchange for 10 shares of the company. The computer was brought 2 years ago for $2,200 and has an estimated useful life of 5 years with no residual value. Veronica asked the Computer Service Company to appraise it at current market value. Veronica also contributed $3,500 plus $2500 in cash in exchange for another 90 shares of the company that were deposited in the Company's bank account on the first day of operations.

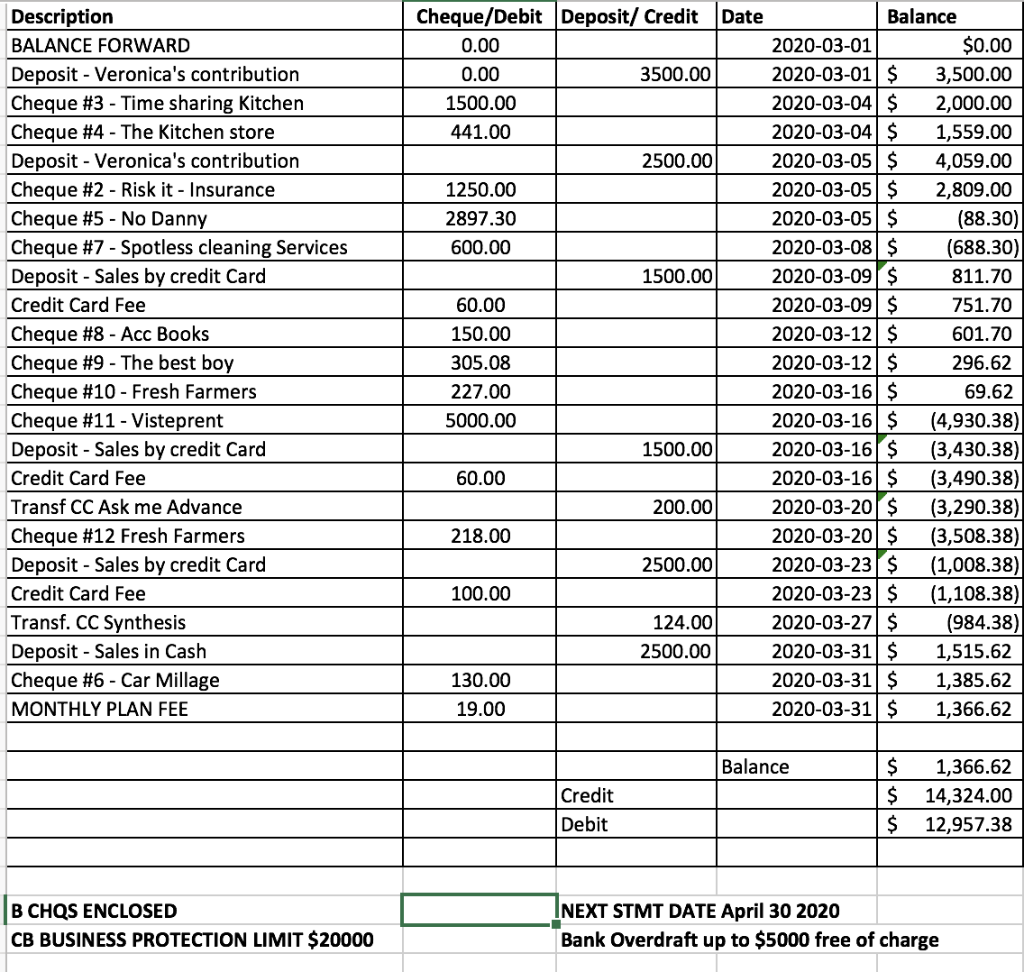

A corporate bank account was set up with a Credit Union. The bank account, a standard commercial chequing account that gave up to 12 cheques returned with monthly statements for a monthly fee, can have overdrafts at no cost for the first three months. The first deposit into the bank account were made by

Veronica, as an owner of LET ME COOK FOR YOU 1nc. Also, as a credit card merchant LET ME COOK FOR YOU 1nc. is using the Credit Union services in order to collect their customer's payments.

An annual subscription billed monthly for accounts-books, a business accounting software program was bought lo manage sales and expenses and keep track of daily transactions.

LET ME COOK FOR YOU Inc. hired MPM Accountants, an award-winning firm of Chartered Professional Accountants, Tax Advisors and Business Advisors for the professional services. The firm disclosed the annual fee structure to be paid at the end of each year of operations (for instance pay in March 2021for all services provided in the calendar year 2020).

Veronica agreed to use her car for deliveries and transportation to conduct business, LET ME COOK FOR YOU Inc. would pay for the use of the car every month after approving a valid Vehicle Mileage/Expense Log presented by Veronica. In order to be ready for the winter season, Veronica needed to change her car's tires, so she contacted Good Tires se1vice to do so.

Veronica realized that the company needed some sort of third-party liability insurance as a Commercial General Liability (CGL); in case the service that the Company provides leads to bodily injury, property damage, or another type of loss to a third party. There was a good offer where she would get a hefty discount if paying an annual premium in advance, so she did it.

Veronica decided to enter in a time share arrangement for a professional restaurant kitchen. She was able to work out suitable hours that would allow her to cook before going to her job and prepare all kits and bases after her job. The restaurant kitchen was 5 blocks from her job, so it was very convenient; also in the time share agreement, she was able to include space in the fridge for those meals that were to be picked up directly by customers. The restaurant kitchen already had most of the kitchen tools she needed, but there was specific equipment she needed to buy, like a new professional grade microwave oven. It is estimated it will last two full years with a residual value of $17.08 at the end of its useful life. Veronica got a very good deal on the microwave, but after two weeks of use the oven igniter as well as a temperature sensor needed a replacement, Veronica contacted ARS, a repair and installation service company, to do the job.

Veronica is really conscious about sustainability, so she decided to go as green as possible. In order to provide proper delivery of the meals, Veronica purchase some friendly environmental trays and containers at the kitchen store.

Veronica knew that a kitchen could get messy. In order to maintain everything clean and tidy, she contacted a cleaning service to help her on a daily routine. One of the conditions of the kitchen time sharing is to leave all pristine after the time is up and Veronica had no time to do the cleaning, cooking and her 9 to 5 job.

Veronica wanted to print an eye-catching, fully customized menu flyers. Vistaprint was a good option for the job.

In the first days of operations a number of customer contacted Veronica for her service. Most of them were office employees located either in the same building or adjacent buildings, what significantly simplified her deliveries because she would use her lunch hour to pick up the trays and deliver. Veronica would eat in her car in between deliveries.

Veroruca's best friend husband decided to contact Veronica to provide free lunches in his consulting company, ASK ME, for a period of one month. There are S employees, one of them is a vegetarian. The menu for four weeks was assembled, and deliveries slated on the 20th of March. An amount in advance was paid al the first delivery and the balance will be collected on the 25"' of April.

Another company named, Synthesis, decided to buy every Friday lunches for a month. The menu for four weeks was assembled, and deliveries started on the 27th of March. The balance was fully collected in the first delivery.

Last Friday, Veronica received a phone call from her time-sharing kitchen's landlord asking her what happened with the ice cream machine. He had found the machine was broken and some pieces were missing, the total damage is priced at $5,700 and demanded Veronica to either replace or fix it. Veronica had to explain to hin1that she did not know about the situation because she does not use the equipment. There is no ice cream on her menu.

At the end of the month Veroruca met the accountant to find out how much profit she made and determine if she can afford the donation of $1,5OO already promised to one community project. On the morning of April 1 Veronica gave to her accountant all the invoices, receipts, deposit slips and all other information she has. While talking to the accountant Veronica said that she voided cheque number 1.

More Transaction Start from here:

- Veronica has to pay for lawyer fees a total of $1000 (Lawyer)

- On March 5th 2020, Veronica paid with check number 5, to "No Danny" of a total of $2897.30 for the following services:

- Domain Name Register - $14.99

- DNS - $40.68 ($3.39 monthly)

- Web Hosting - $119.88 ($9.99 monthly)

- E - commerce Web design - $2000

- Logo Design - $395.99

- Online Marketing - $119.88 ($9.99 monthly)

- E-mail plus - $95.88 ($7.99 monthly)

- SSL Certificate - $50

- Dedicated IP - $60 ($5 monthly)

- The computer that Veronica brought to the company was send to a Computer Service Company to appraise it at current market value. On Feb 29th 2020, Veronica paid $149.99 for the appraise and the Computer Service Company estimated that with an upgrade of $390 and proper maintenance at least once a year the computer will last for 3 years.

- On March 12th 2020, Veronica paid for $150 with cheque number 8 for Accounting Software Enterprise, it is an annual subscription that is billed monthly.

- On March 3rd 2020, Veronica received an invoice for MPM Chartered Accountants of a total of $2500.

- On March 30th 2020, Veronica paid with cheque number 6 for Vehicle Mileage/Expense Log for $130.

- On March 2nd 2020, Veronica Paid $1250 with cheque #2 to Riskit Insurance Group.

- The kitchen that Veronica rented from the Italian Bistro Inc. to prep the meals for her company "Let me Cook for you" she signed an agreement on March 1, 2020 for $500 per month for the kitchen. On March 1st 2020, she paid $1500 with cheque #3 for the kitchen.

- On March 12th 2020, Veronica paid with cheque #9 of a total of $305.08 for the microwave oven that she brought from Best Boy.

- On March 7th 2020, Veronica received an invoice of $282.23 for the repairs of the microwave oven that she brought and the payment is due by April 27th, 2020.

- On March 4th 2020, Veronica brought some friendly environmental trays and containers at the kitchen store and paid with cheque number 4 of $441. At the end of the month, she had $241 worth of supplies left.

- On March 8th 2020, Veronica paid with cheque number 7 for the cleaning services a total of $600.

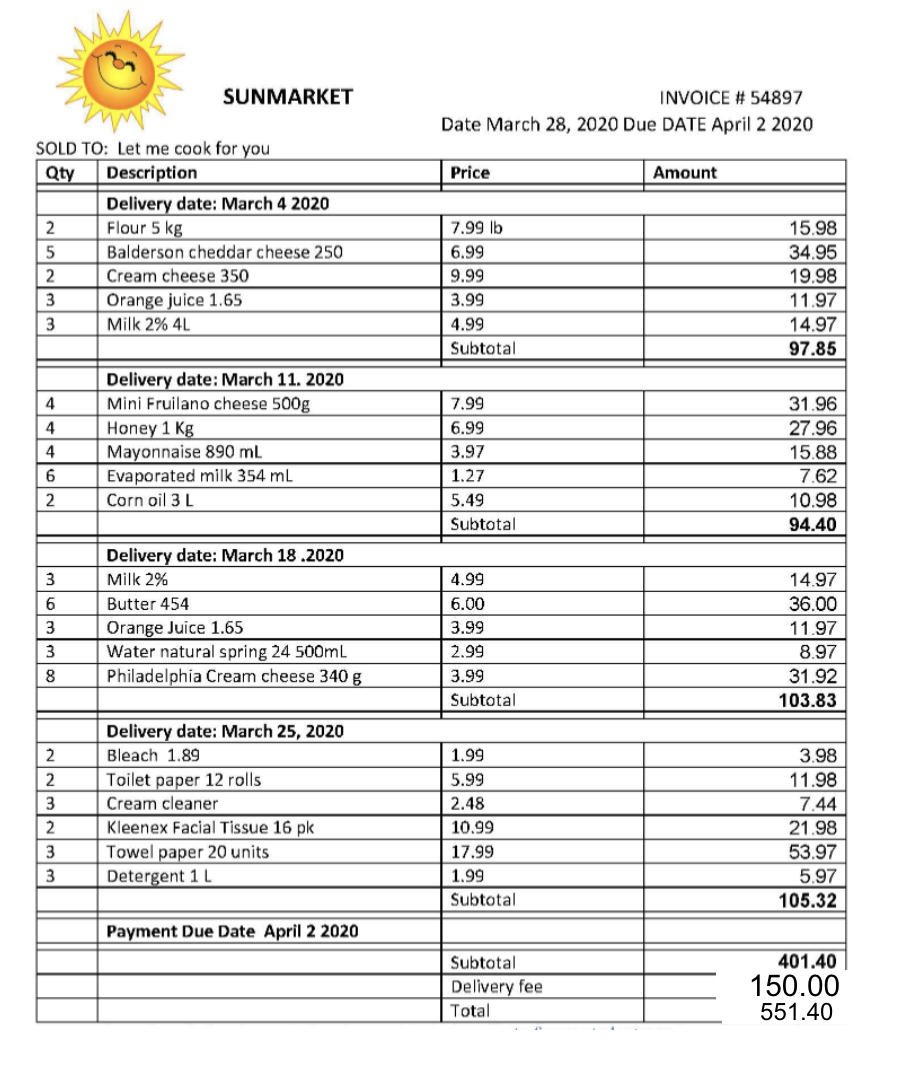

- On March 11th, 2020, Veronica received an invoice from the Fresh Farmers she previously ordered some vegetables. She paid with cheque #10 of a total of $227 that was due on March 16th 2020.

- On March 24th, 2020, Veronica received an invoice from the Fresh Farmers she previously ordered some vegetables. She paid with cheque #12 of a total of $218 that was due on March 30th 2020.

- Groceries available for the use at the end of the month of March is $150.

- On March 1st, 2020, Veronica received an invoice from Visteprent, for the eye-catching fully customized menu flyers that she ordered. She paid with cheque #11 of a total of $5000 that was due on March 16th 2020. At the end of the month there were still $3500 worth of flyers left.

- Note for revenue recognition: Sales by credit card of the last week will be deposited on April 1st. On March 31st the following is known: Sales by credit card of $1550 and Credit card fee of $62.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started