Question

For the following independent cases, determine whether economic income is present and, if so, whether it must be included in gross income (i.e., is it

For the following independent cases, determine whether economic income is present and, if so, whether it must be included in gross income (i.e., is it realized and recognized for tax purposes?).

a. Asia owns stock that is listed on the New York Stock Exchange, and this year the stock increased in value by $18,250.

b. Jim received $275 of car repair services from another member of the club.

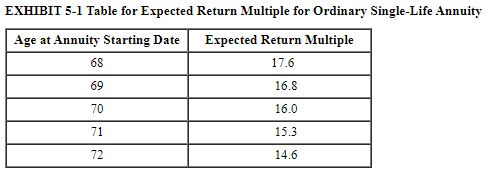

c. Larry purchased an annuity from an insurance company that promises to pay him $12,500 per month for the rest of his life. Larry paid $1,533,000 for the annuity. Larry is in good health and is 72 years old. Larry received the first annuity payment of $12,500 this month. Use the expected number of payments in Exhibit 5-1 for this problem.

How much of the first payment should Larry include in gross income?

exhibit 5-1:

\begin{tabular}{|l|l|} \hline Economic Income & Amount \\ \hline Amount included in Gross Income & \\ \hline \end{tabular} Amount included in Gross Income EXHIBIT 5-1 Table for Expected Return Multiple for Ordinary Single-Life Annuity

\begin{tabular}{|l|l|} \hline Economic Income & Amount \\ \hline Amount included in Gross Income & \\ \hline \end{tabular} Amount included in Gross Income EXHIBIT 5-1 Table for Expected Return Multiple for Ordinary Single-Life Annuity Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started