Answered step by step

Verified Expert Solution

Question

1 Approved Answer

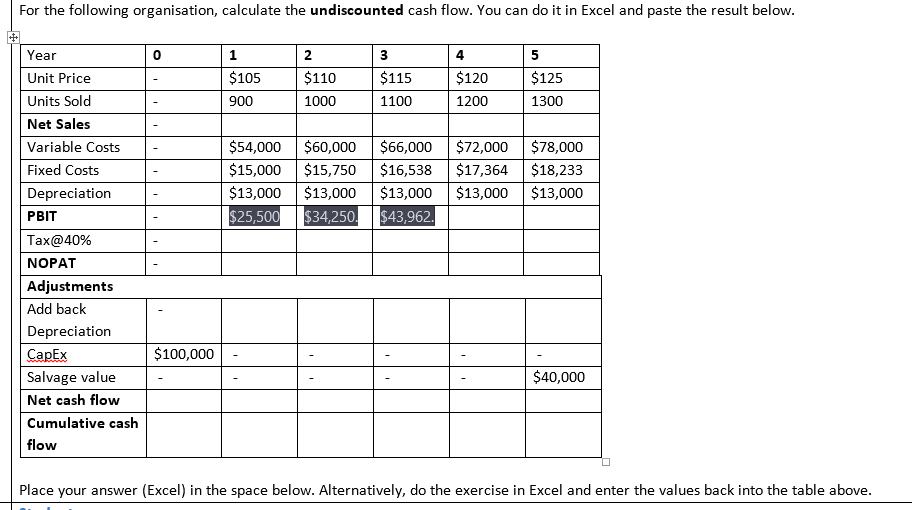

For the following organisation, calculate the undiscounted cash flow. You can do it in Excel and paste the result below. begin{tabular}{|l|l|l|l|l|l|l|} hline Year & (

For the following organisation, calculate the undiscounted cash flow. You can do it in Excel and paste the result below. \\begin{tabular}{|l|l|l|l|l|l|l|} \\hline Year & \\( \\mathbf{0} \\) & \\( \\mathbf{1} \\) & \\( \\mathbf{2} \\) & \\( \\mathbf{3} \\) & \\( \\mathbf{4} \\) & \\( \\mathbf{5} \\) \\\\ \\hline Unit Price & - & \\( \\$ 105 \\) & \\( \\$ 110 \\) & \\( \\$ 115 \\) & \\( \\$ 120 \\) & \\( \\$ 125 \\) \\\\ \\hline Units Sold & - & 900 & 1000 & 1100 & 1200 & 1300 \\\\ \\hline Net Sales & - & & & & & \\\\ \\hline Variable Costs & - & \\( \\$ 54,000 \\) & \\( \\$ 60,000 \\) & \\( \\$ 66,000 \\) & \\( \\$ 72,000 \\) & \\( \\$ 78,000 \\) \\\\ \\hline Fixed Costs & - & \\( \\$ 15,000 \\) & \\( \\$ 15,750 \\) & \\( \\$ 16,538 \\) & \\( \\$ 17,364 \\) & \\( \\$ 18,233 \\) \\\\ \\hline Depreciation & - & \\( \\$ 13,000 \\) & \\( \\$ 13,000 \\) & \\( \\$ 13,000 \\) & \\( \\$ 13,000 \\) & \\( \\$ 13,000 \\) \\\\ \\hline PBIT & - & \\( \\$ 25,500 \\) & \\( \\$ 34,250 \\) & \\( \\$ 43,962 \\). & & \\\\ \\hline Tax@40\\% & - & & & & & \\\\ \\hline NOPAT & - & & & & & \\\\ \\hline Adjustments & - & & & & & \\\\ \\hline \\( \\begin{array}{l}\\text { Add back } \\\\ \\text { Depreciation }\\end{array} \\) & & & & & & \\\\ \\hline \\( \\begin{array}{l}\\text { CapEx }\\end{array} \\) & & & & & & \\\\ \\hline Salvage value & - & - & - & - & - & \\( \\$ 40,000 \\) \\\\ \\hline Net cash flow & & & & & & \\\\ \\hline \\( \\begin{array}{l}\\text { Cumulative cash } \\\\ \\text { flow }\\end{array} \\) & & & & & & \\\\ \\hline \\end{tabular} Place your answer (Excel) in the space below. Alternatively, do the exercise in Excel and enter the values back into the table above

For the following organisation, calculate the undiscounted cash flow. You can do it in Excel and paste the result below. \\begin{tabular}{|l|l|l|l|l|l|l|} \\hline Year & \\( \\mathbf{0} \\) & \\( \\mathbf{1} \\) & \\( \\mathbf{2} \\) & \\( \\mathbf{3} \\) & \\( \\mathbf{4} \\) & \\( \\mathbf{5} \\) \\\\ \\hline Unit Price & - & \\( \\$ 105 \\) & \\( \\$ 110 \\) & \\( \\$ 115 \\) & \\( \\$ 120 \\) & \\( \\$ 125 \\) \\\\ \\hline Units Sold & - & 900 & 1000 & 1100 & 1200 & 1300 \\\\ \\hline Net Sales & - & & & & & \\\\ \\hline Variable Costs & - & \\( \\$ 54,000 \\) & \\( \\$ 60,000 \\) & \\( \\$ 66,000 \\) & \\( \\$ 72,000 \\) & \\( \\$ 78,000 \\) \\\\ \\hline Fixed Costs & - & \\( \\$ 15,000 \\) & \\( \\$ 15,750 \\) & \\( \\$ 16,538 \\) & \\( \\$ 17,364 \\) & \\( \\$ 18,233 \\) \\\\ \\hline Depreciation & - & \\( \\$ 13,000 \\) & \\( \\$ 13,000 \\) & \\( \\$ 13,000 \\) & \\( \\$ 13,000 \\) & \\( \\$ 13,000 \\) \\\\ \\hline PBIT & - & \\( \\$ 25,500 \\) & \\( \\$ 34,250 \\) & \\( \\$ 43,962 \\). & & \\\\ \\hline Tax@40\\% & - & & & & & \\\\ \\hline NOPAT & - & & & & & \\\\ \\hline Adjustments & - & & & & & \\\\ \\hline \\( \\begin{array}{l}\\text { Add back } \\\\ \\text { Depreciation }\\end{array} \\) & & & & & & \\\\ \\hline \\( \\begin{array}{l}\\text { CapEx }\\end{array} \\) & & & & & & \\\\ \\hline Salvage value & - & - & - & - & - & \\( \\$ 40,000 \\) \\\\ \\hline Net cash flow & & & & & & \\\\ \\hline \\( \\begin{array}{l}\\text { Cumulative cash } \\\\ \\text { flow }\\end{array} \\) & & & & & & \\\\ \\hline \\end{tabular} Place your answer (Excel) in the space below. Alternatively, do the exercise in Excel and enter the values back into the table above Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started