Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the following problems: Elliot has $ 2 0 0 , 0 0 0 that he would like to invest and is considering two different

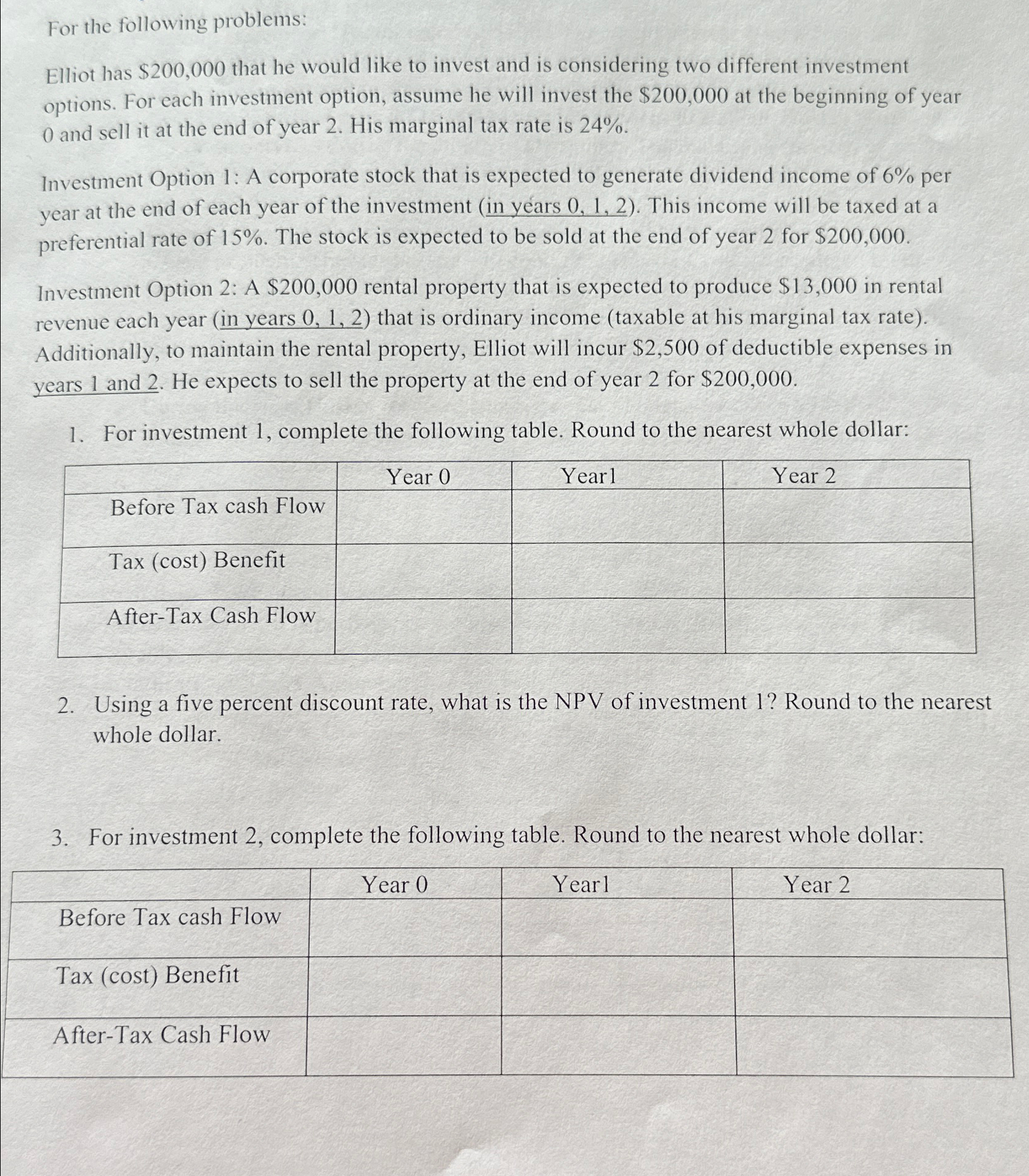

For the following problems:

Elliot has $ that he would like to invest and is considering two different investment options. For each investment option, assume he will invest the $ at the beginning of year and sell it at the end of year His marginal tax rate is

Investment Option : A corporate stock that is expected to generate dividend income of per year at the end of each year of the investment in years This income will be taxed at a preferential rate of The stock is expected to be sold at the end of year for $

Investment Option : A $ rental property that is expected to produce $ in rental revenue each year in years that is ordinary income taxable at his marginal tax rate Additionally, to maintain the rental property, Elliot will incur $ of deductible expenses in years and He expects to sell the property at the end of year for $

For investment complete the following table. Round to the nearest whole dollar:

tableYear Year Year Before Tax cash Flow,,,Tax cost Benefit,,,AfterTax Cash Flow,,,

Using a five percent discount rate, what is the NPV of investment Round to the nearest whole dollar.

For investment complete the following table. Round to the nearest whole dollar:

tableYear Year lYear Before Tax cash Flow,,,Tax cost Benefit,,,AfterTax Cash Flow,,,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started