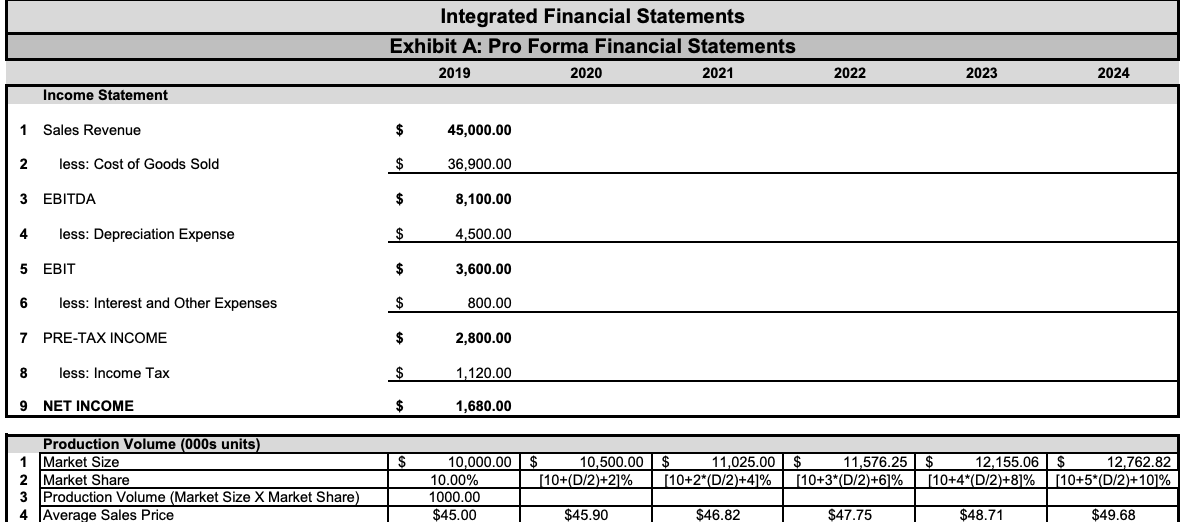

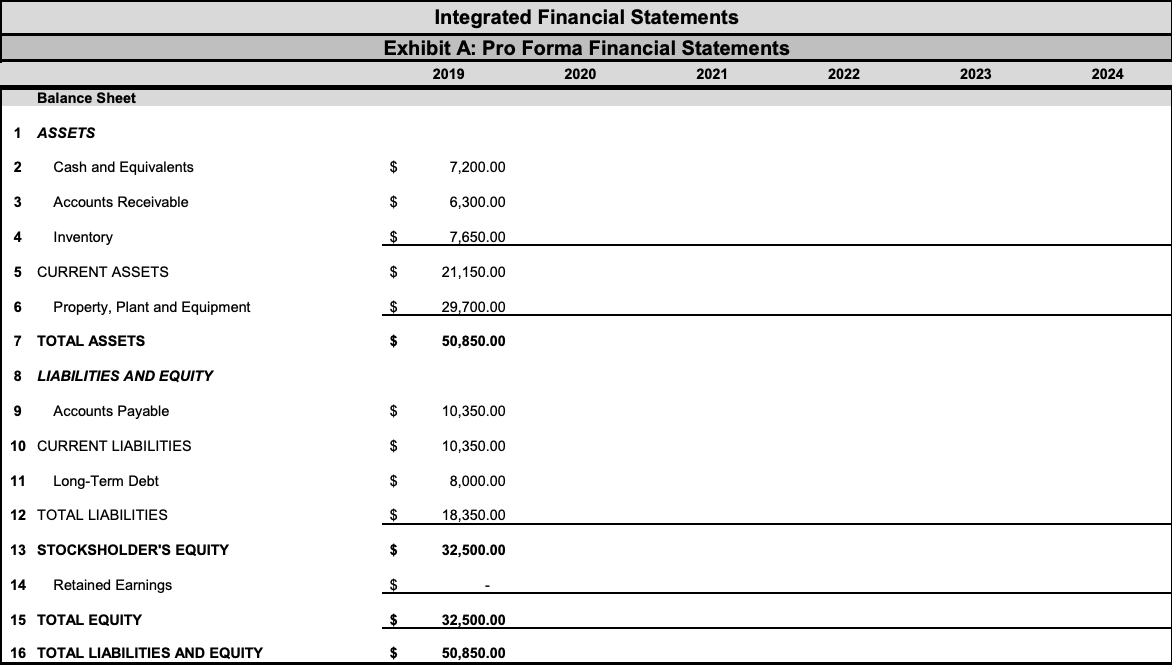

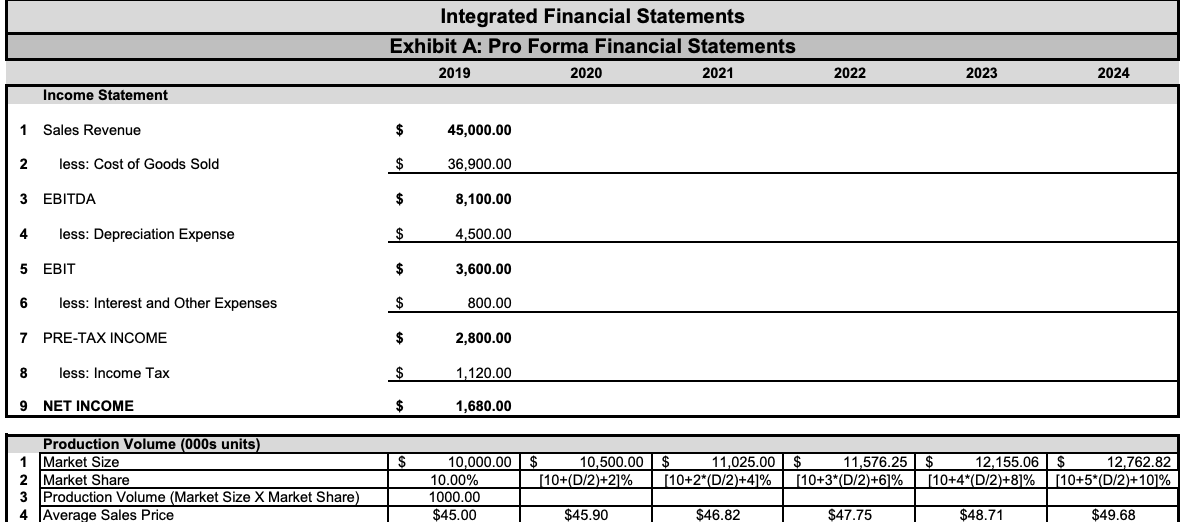

) For the following problems, use Exhibit A. For exhibit A, the amount of sales depends on

the production volume shown below. The dividend policy is to pay 25% in

dividends. Construct the Production volume table instructions shown below.

a. What will be the depreciation for 2023? PLEASE PUT ANSWERS ON THE SIDE IN ORDER

b. What will be the cash and equivalents for 2020?

c. What will be the accounts payable for 2021?

d. Imagine that the corporation decides to use debt for any external financing, what

would be the amount of debt in 2020? (If no net new financing is needed, then

answer with a negative number)

DEPRECIATION IS GIVEN PLEASE DO NOT USE STRAIGHT LINE METHOD THERE IS NO PURCHASE OF EQUIPMENT

****NOTE MARKET SHARE PLUG IN 4 FOR D***** PLEASE DONT FORGET AND ILL LIKE IT UP

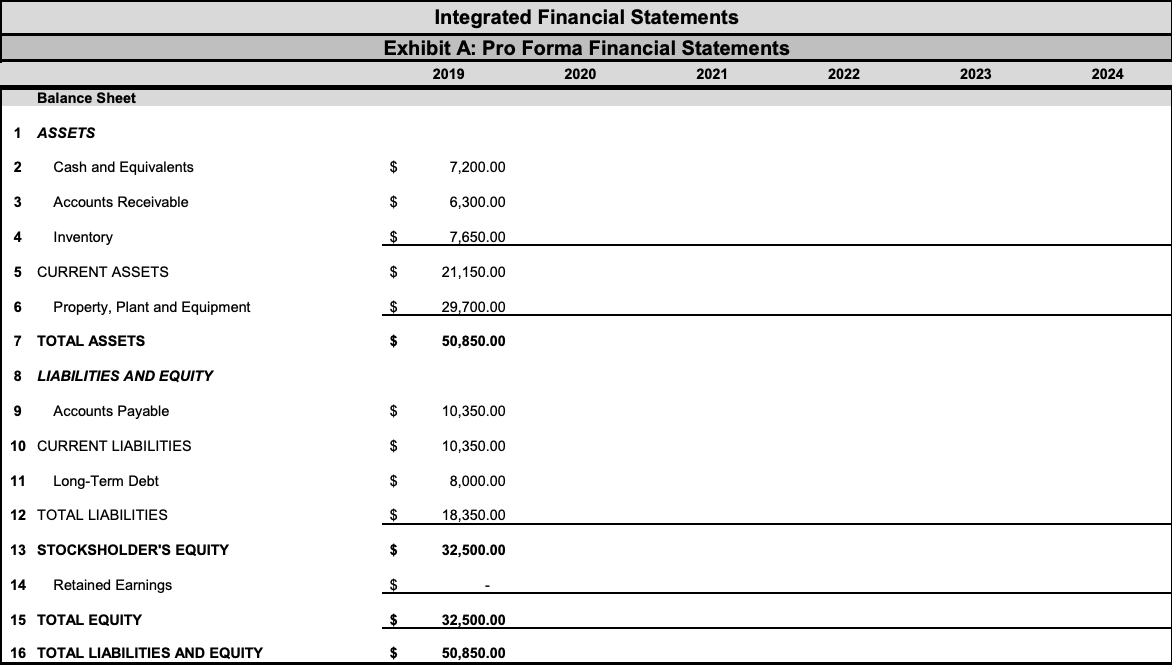

Integrated Financial Statements Exhibit A: Pro Forma Financial Statements 2019 2020 2021 2022 2023 2024 Income Statement 1 Sales Revenue $ 45,000.00 2 less: Cost of Goods Sold $ 36,900.00 3 EBITDA $ 8,100.00 4 less: Depreciation Expense $ 4,500.00 5 EBIT $ 3,600.00 6 less: Interest and Other Expenses $ 800.00 7 PRE-TAX INCOME $ 2,800.00 8 less: Income Tax $ 1,120.00 9 NET INCOME $ 1,680.00 $ Production Volume (000s units) 1 Market Size 2 Market Share 3 Production Volume (Market Size X Market Share) 4 Average Sales Price 10,000.00 $ 10,500.00 $ 11,025.00 $ 11,576.25 $ 12,155.06 $ 12.762.82 10.00% [10+(D/2)+21% (10+2*(D/2) +4 % [10+3*(D/2)+61% [10+4*(D/2)+8 % (10+5*(D/2)+10% 1000.00 $45.00 $45.90 $46.82 $47.75 $48.71 $49.68 Integrated Financial Statements Exhibit A: Pro Forma Financial Statements 2019 2020 2021 2022 2023 2024 Balance Sheet 1 ASSETS 2 Cash and Equivalents $ 7,200.00 3 Accounts Receivable $ 6,300.00 4 Inventory $ 7,650.00 5 CURRENT ASSETS $ 21,150.00 6 Property, plant and Equipment $ 29,700.00 7 TOTAL ASSETS $ 50,850.00 8 LIABILITIES AND EQUITY 9 Accounts Payable $ 10,350.00 10 CURRENT LIABILITIES $ 10,350.00 11 Long-Term Debt $ 8,000.00 12 TOTAL LIABILITIES $ 18.350.00 13 STOCKSHOLDER'S EQUITY $ 32,500.00 14 Retained Earnings $ 15 TOTAL EQUITY $ 32,500.00 16 TOTAL LIABILITIES AND EQUITY 50,850.00 Integrated Financial Statements Exhibit A: Pro Forma Financial Statements 2019 2020 2021 2022 2023 2024 Income Statement 1 Sales Revenue $ 45,000.00 2 less: Cost of Goods Sold $ 36,900.00 3 EBITDA $ 8,100.00 4 less: Depreciation Expense $ 4,500.00 5 EBIT $ 3,600.00 6 less: Interest and Other Expenses $ 800.00 7 PRE-TAX INCOME $ 2,800.00 8 less: Income Tax $ 1,120.00 9 NET INCOME $ 1,680.00 $ Production Volume (000s units) 1 Market Size 2 Market Share 3 Production Volume (Market Size X Market Share) 4 Average Sales Price 10,000.00 $ 10,500.00 $ 11,025.00 $ 11,576.25 $ 12,155.06 $ 12.762.82 10.00% [10+(D/2)+21% (10+2*(D/2) +4 % [10+3*(D/2)+61% [10+4*(D/2)+8 % (10+5*(D/2)+10% 1000.00 $45.00 $45.90 $46.82 $47.75 $48.71 $49.68 Integrated Financial Statements Exhibit A: Pro Forma Financial Statements 2019 2020 2021 2022 2023 2024 Balance Sheet 1 ASSETS 2 Cash and Equivalents $ 7,200.00 3 Accounts Receivable $ 6,300.00 4 Inventory $ 7,650.00 5 CURRENT ASSETS $ 21,150.00 6 Property, plant and Equipment $ 29,700.00 7 TOTAL ASSETS $ 50,850.00 8 LIABILITIES AND EQUITY 9 Accounts Payable $ 10,350.00 10 CURRENT LIABILITIES $ 10,350.00 11 Long-Term Debt $ 8,000.00 12 TOTAL LIABILITIES $ 18.350.00 13 STOCKSHOLDER'S EQUITY $ 32,500.00 14 Retained Earnings $ 15 TOTAL EQUITY $ 32,500.00 16 TOTAL LIABILITIES AND EQUITY 50,850.00