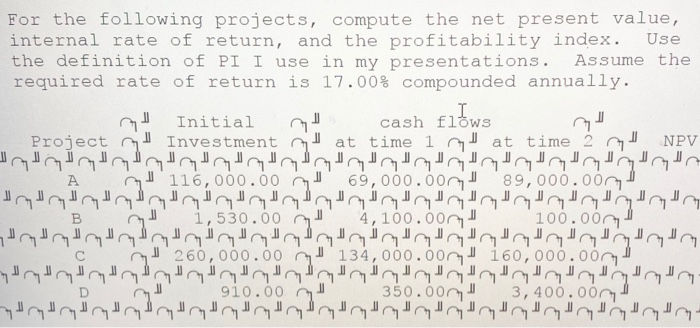

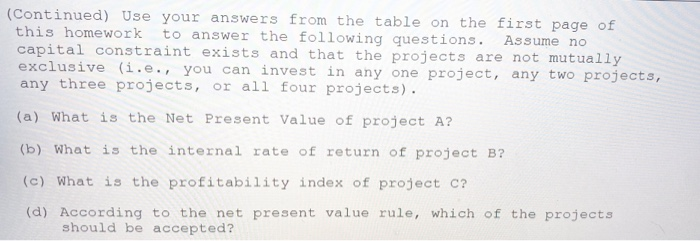

For the following projects, compute the net present value, internal rate of return, and the profitability index. Use the definition of PI I use in my presentations. Assume the required rate of return is 17.00% compounded annually. Initial cash flows Project Investment at time 1 at time 2 NPV | 10 | 101 10 | 11 | 10 | 11 | 10 | 11 | 10 A C 1 116,000.00 0 1 69,000.00 | 89,000,000 1 | | | | | | | | | | | | | | 11 1 B C 1 1,530.00 0 1 4,100.00 1 100.0001 | C | 260,000.00 C 134,000.00 160,000.00 1 D C | 910.00 C | 350.00 1 3,400.000 1 C IC IC IC (Continued) Use your answers from the table on the first page of this homework to answer the following questions. Assume no capital constraint exists and that the projects are not mutually exclusive (i.e., you can invest in any one project, any two projects, any three projects, or all four projects). (a) What is the Net Present Value of project A? (b) What is the internal rate of return of project B? (c) What is the profitability index of project c? (d) According to the net present value rule, which of the projects should be accepted? Choices: 2 - A only 3 - B only 4 - C only 5 - Donly 6 - A and B only 8 - A and C only 10 - A and Donly 2 - B and C only 5 - B and D 24 - A, B, and C only 30 - A, B, and D only 60 - B, C, and Donly 120 - all projects should be accepted (e) According to the internal rate of return rule, which of the projects should be accepted? (Same choices as in part (d)) (f) According to the profitability-index rule, which of the projects should be accepted? (Same choices as in part (d)) (g) For this part only, assume no capital constraint exists but that projects A, B, C, and Dare mutually exclusive, i.e., only one of these projects can be undertaken. Which project should the company undertake in order to make its stockholders as well off as possible? (In the computer, type "A", "B", "C", or "D".) For the following projects, compute the net present value, internal rate of return, and the profitability index. Use the definition of PI I use in my presentations. Assume the required rate of return is 17.00% compounded annually. Initial cash flows Project Investment at time 1 at time 2 NPV | 10 | 101 10 | 11 | 10 | 11 | 10 | 11 | 10 A C 1 116,000.00 0 1 69,000.00 | 89,000,000 1 | | | | | | | | | | | | | | 11 1 B C 1 1,530.00 0 1 4,100.00 1 100.0001 | C | 260,000.00 C 134,000.00 160,000.00 1 D C | 910.00 C | 350.00 1 3,400.000 1 C IC IC IC (Continued) Use your answers from the table on the first page of this homework to answer the following questions. Assume no capital constraint exists and that the projects are not mutually exclusive (i.e., you can invest in any one project, any two projects, any three projects, or all four projects). (a) What is the Net Present Value of project A? (b) What is the internal rate of return of project B? (c) What is the profitability index of project c? (d) According to the net present value rule, which of the projects should be accepted? Choices: 2 - A only 3 - B only 4 - C only 5 - Donly 6 - A and B only 8 - A and C only 10 - A and Donly 2 - B and C only 5 - B and D 24 - A, B, and C only 30 - A, B, and D only 60 - B, C, and Donly 120 - all projects should be accepted (e) According to the internal rate of return rule, which of the projects should be accepted? (Same choices as in part (d)) (f) According to the profitability-index rule, which of the projects should be accepted? (Same choices as in part (d)) (g) For this part only, assume no capital constraint exists but that projects A, B, C, and Dare mutually exclusive, i.e., only one of these projects can be undertaken. Which project should the company undertake in order to make its stockholders as well off as possible? (In the computer, type "A", "B", "C", or "D".)