Answered step by step

Verified Expert Solution

Question

1 Approved Answer

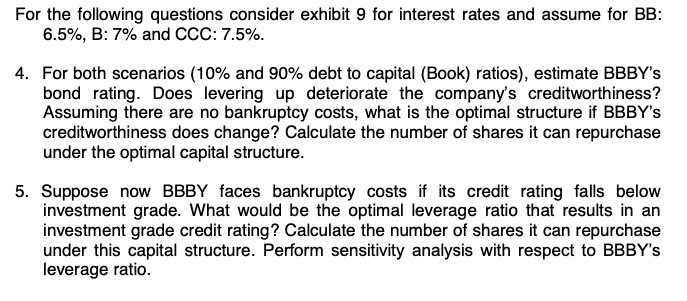

For the following questions consider exhibit 9 for interest rates and assume for BB: 6.5%, B: 7% and CCC: 7.5%. 4. For both scenarios

For the following questions consider exhibit 9 for interest rates and assume for BB: 6.5%, B: 7% and CCC: 7.5%. 4. For both scenarios (10% and 90% debt to capital (Book) ratios), estimate BBBY's bond rating. Does levering up deteriorate the company's creditworthiness? Assuming there are no bankruptcy costs, what is the optimal structure if BBBY's creditworthiness does change? Calculate the number of shares it can repurchase under the optimal capital structure. 5. Suppose now BBBY faces bankruptcy costs if its credit rating falls below investment grade. What would be the optimal leverage ratio that results in an investment grade credit rating? Calculate the number of shares it can repurchase under this capital structure. Perform sensitivity analysis with respect to BBBY's leverage ratio.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To estimate BBBYs bond rating for both scenarios of 10 and 90 debt to capital ratios we need ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started