Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions: You are BBBY's CEO, Steven Temares. It is April 2004 and you are about to decide what to do with the company's excess

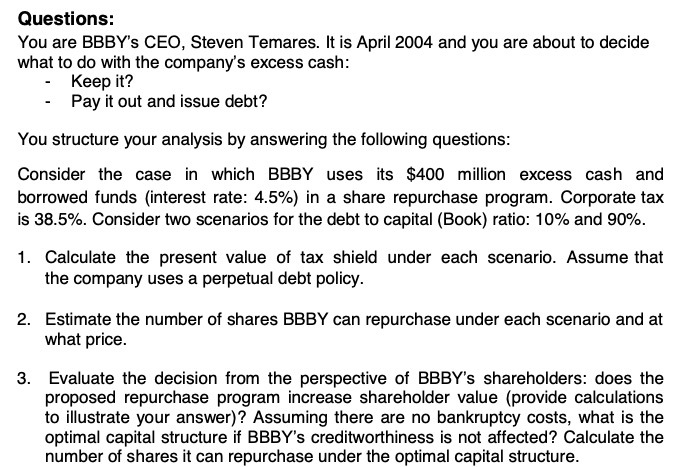

Questions: You are BBBY's CEO, Steven Temares. It is April 2004 and you are about to decide what to do with the company's excess cash: - Keep it? - Pay it out and issue debt? You structure your analysis by answering the following questions: Consider the case in which BBBY uses its $400 million excess cash and borrowed funds (interest rate: 4.5%) in a share repurchase program. Corporate tax is 38.5%. Consider two scenarios for the debt to capital (Book) ratio: 10% and 90%. 1. Calculate the present value of tax shield under each scenario. Assume that the company uses a perpetual debt policy. 2. Estimate the number of shares BBBY can repurchase under each scenario and at what price. 3. Evaluate the decision from the perspective of BBBY's shareholders: does the proposed repurchase program increase shareholder value (provide calculations to illustrate your answer)? Assuming there are no bankruptcy costs, what is the optimal capital structure if BBBY's creditworthiness is not affected? Calculate the number of shares it can repurchase under the optimal capital structure.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sure lets break it down step by step 1 Present Value of Tax Shield For Scenario 1 10 debt to capital ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started