Answered step by step

Verified Expert Solution

Question

1 Approved Answer

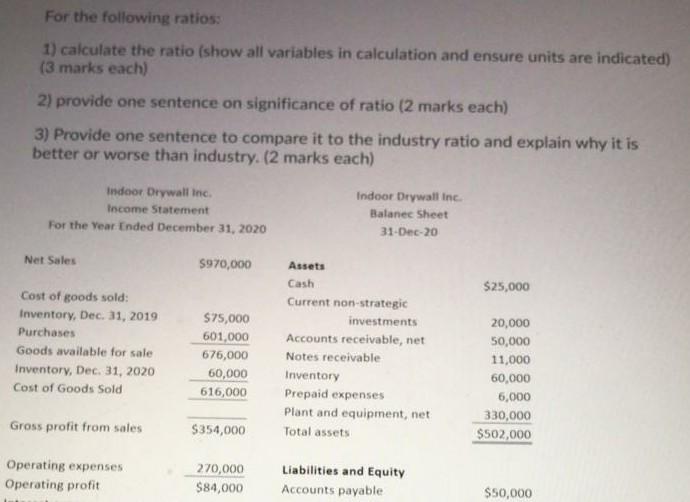

For the following ratios: 1) calculate the ratio (show all variables in calculation and ensure units are indicated) (3 marks each) 2) provide one sentence

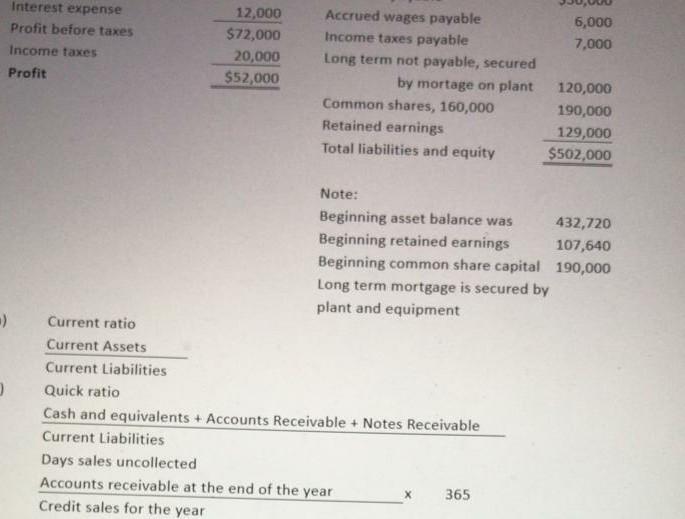

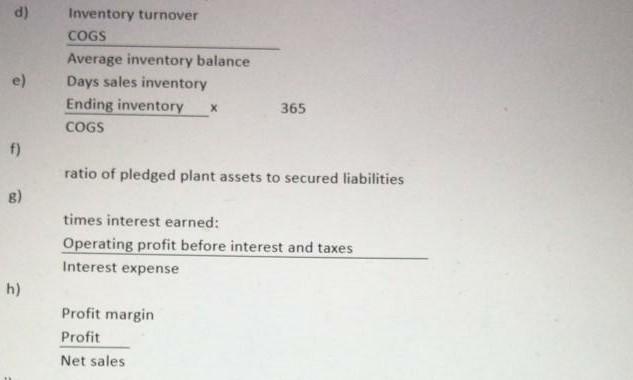

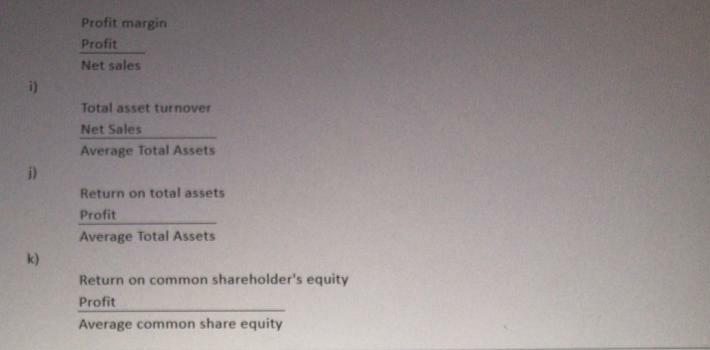

For the following ratios: 1) calculate the ratio (show all variables in calculation and ensure units are indicated) (3 marks each) 2) provide one sentence on significance of ratio (2 marks each) 3) Provide one sentence to compare it to the industry ratio and explain why it is better or worse than industry. (2 marks each) Indoor Drywall inc Income Statement For the Year Ended December 31, 2020 Indoor Drywall inc Balanec Sheet 31-Dec-20 Net Sales $970,000 $25,000 Cost of goods sold: Inventory, Dec 31, 2019 Purchases Goods available for sale Inventory, Dec 31, 2020 Cost of Goods Sold $75,000 601,000 676,000 60,000 616,000 Assets Cash Current non-strategic investments Accounts receivable, net Notes receivable Inventory Prepaid expenses Plant and equipment, net Total assets 20,000 50,000 11,000 60,000 6,000 330,000 $502,000 Gross profit from sales $354,000 Operating expenses Operating profit 270,000 $84,000 Liabilities and Equity Accounts payable $50,000 Interest expense Profit before taxes Income taxes Profit 12,000 $72,000 20,000 $52,000 6,000 7,000 Accrued wages payable Income taxes payable Long term not payable, secured by mortage on plant Common shares, 160,000 Retained earnings Total liabilities and equity 120,000 190,000 129,000 $502,000 :) Note: Beginning asset balance was 432,720 Beginning retained earnings 107,640 Beginning common share capital 190,000 Long term mortgage is secured by plant and equipment Current ratio Current Assets Current Liabilities Quick ratio Cash and equivalents + Accounts Receivable + Notes Receivable Current Liabilities Days sales uncollected Accounts receivable at the end of the year 365 Credit sales for the year X d) Inventory turnover COGS Average inventory balance Days sales inventory Ending inventory X COGS 365 f) ratio of pledged plant assets to secured liabilities B) times interest earned: Operating profit before interest and taxes Interest expense h) Profit margin Profit Net sales Profit margin Profit Net sales Total asset turnover Net Sales Average Total Assets 1) Return on total assets Profit Average Total Assets k) Return on common shareholder's equity Profit Average common share equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started