For the following two alternatives the tax rate is 50% and after tax MARR is 10%. Show the before-tax and after-tax cash flows in

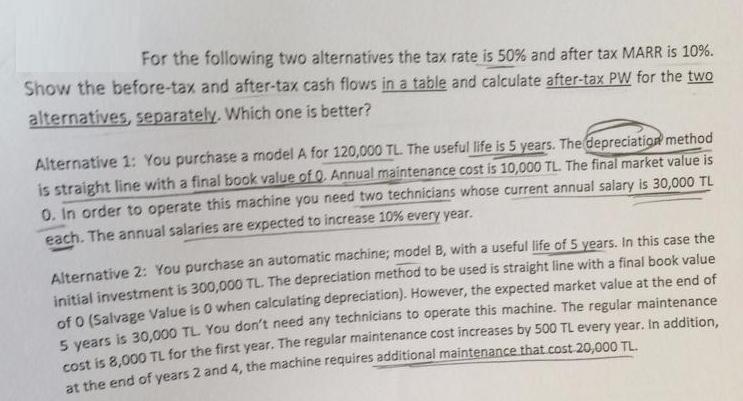

For the following two alternatives the tax rate is 50% and after tax MARR is 10%. Show the before-tax and after-tax cash flows in a table and calculate after-tax PW for the two alternatives, separately. Which one is better? Alternative 1: You purchase a model A for 120,000 TL. The useful life is 5 years. The depreciation method is straight line with a final book value of 0. Annual maintenance cost is 10,000 TL. The final market value is 0. In order to operate this machine you need two technicians whose current annual salary is 30,000 TL each. The annual salaries are expected to increase 10% every year. Alternative 2: You purchase an automatic machine, model B, with a useful life of 5 years. In this case the initial investment is 300,000 TL. The depreciation method to be used is straight line with a final book value of 0 (Salvage Value is 0 when calculating depreciation). However, the expected market value at the end of 5 years is 30,000 TL You don't need any technicians to operate this machine. The regular maintenance cost is 8,000 TL for the first year. The regular maintenance cost increases by 500 TL every year. In addition, at the end of years 2 and 4, the machine requires additional maintenance that cost 20,000 TL.

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

ALTERNATIVE1 YEAR PURCHASE COST EXPENSES MAINTENCE COST SALAR...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started