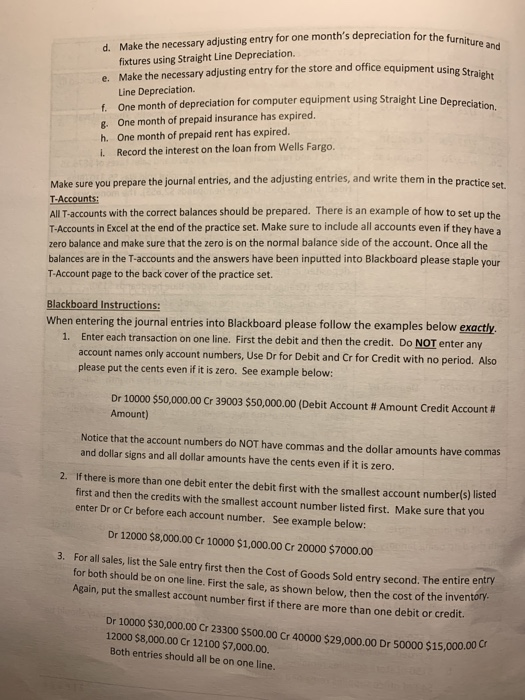

for the furniture and quipment using Straight d. Make the necessary adjusting entry for one month's depreciation for the fixtures using Straight Line Depreciation. e. Make the necessary adjusting entry for the store and office equipment usin Line Depreciation. f. One month of depreciation for computer equipment using Straight Line Depre 8. One month of prepaid insurance has expired. h. One month of prepaid rent has expired. I Record the interest on the loan from Wells Fargo. aight Line Depreciation. Make sure you prepare the journal entries, and the adjusting entries, and write them in the pract T-Accounts: All T-accounts with the correct balances should be prepared. There is an example of how to set up the T-Accounts in Excel at the end of the practice set. Make sure to include all accounts even if they have a zero balance and make sure that the zero is on the normal balance side of the account. Once all the balances are in the T-accounts and the answers have been inputted into Blackboard please staple vour T-Account page to the back cover of the practice set. Blackboard Instructions: When entering the journal entries into Blackboard please follow the examples below exactly 1. Enter each transaction on one line. First the debit and then the credit. Do NOT enter any account names only account numbers, Use Dr for Debit and Cr for Credit with no period. Also please put the cents even if it is zero. See example below: Dr 10000 $50,000.00 Cr 39003 $50,000.00 (Debit Account # Amount Credit Account ! Amount) Notice that the account numbers do NOT have commas and the dollar amounts have commas and dollar signs and all dollar amounts have the cents even if it is zero. 2. If there is more than one debit enter the debit first with the smallest account number(s) listed first and then the credits with the smallest account number listed first. Make sure that you enter Dr or Cr before each account number. See example below: Dr 12000 $8,000.00 Cr 10000 $1,000.00 Cr 20000 $7000,00 3. For all sales, list the Sale entry first then the cost of Goods Sold entry second. The entire for both should be on one line. First the sale, as shown below, then the cost of the inven Again, put the smallest account number first if there are more than one debit or credit. Dr 10000 $30,000.00 Cr 23300 $500.00 Cr 40000 $29,000.00 Dr 50000 $15,000.00 12000 $8,000.00 Cr 12100 $7,000.00 Both entries should all be on one line