For the Germany and Japan currency inflows you have to show which strategy is better for the company (that is, generates more US $):

(Strategy A) use the Forward Market to hedge the foreign currency inflow.

- (Strategy B) use a Money Market hedge to hedge the foreign currency inflow.

In the case of the two Singapore currency inflows, there are no Forward contracts available, so calculate the US $ inflow for each using a Money Market hedge.

Show your calculations and answers in an Excel spreadsheet.

Guidelines: 1. Today is mid-August 1991 in the case.

2. Just a quick review a Money Market hedge requires the following three steps: (2.1) Borrow in the foreign country an amount that is equal to the Present Value of the foreign cash flow expected. Use the foreign Libor % if available to get the PV, if not available then use the Prime rate %. (2.2) Convert the foreign currency amount (the calculated PV amount from (2.1) above), to US $ using the given Spot exchange rates. (2.3) Invest the US $ from (2.2) above in the US at the US Libor %. Calculate the Future Value of the invested amount. Compare the $ FV to what the firm would have received if it had use the Forward market to convert the foreign currency into US $ (use the Forward rates given in Table 1 of the case).

IMPORTANT NOTE: In Table 2 of the case, all the interest rates shown are Annual % rates. In both (2.1) and (2.3) above, make sure that when you use an interest rate of X% (for example), that you adjust the interest rate appropriately for the PV and FV calculations to reflect the time period of the transaction. For example, if you are borrowing or investing money for 30 days at an Annual rate of say, 5%, then the appropriate interest rate you should use for the 30 day transaction is (5% / 12 = 0.4167%).

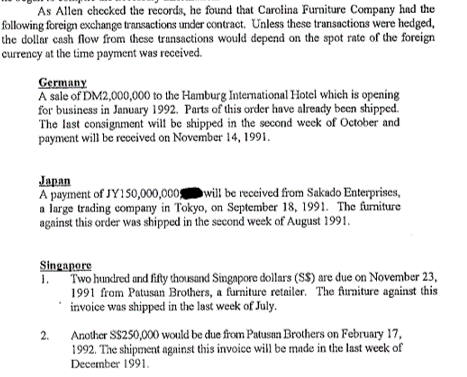

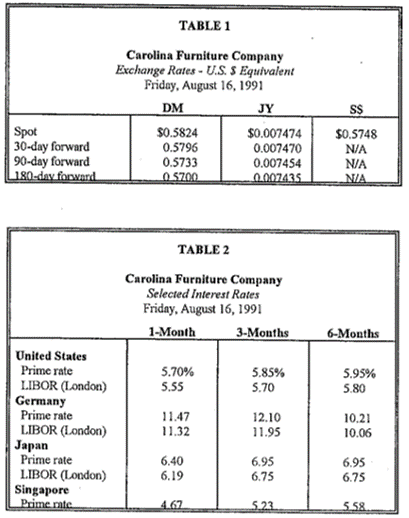

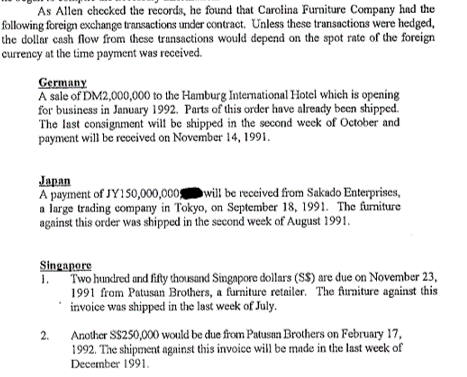

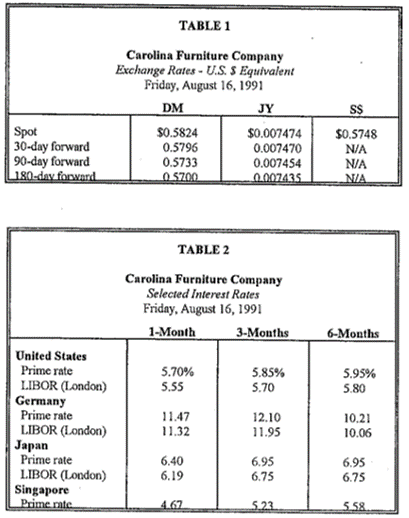

As Allen checked the records, he found that Carolina Pumiture Company had the following foreign exchange transactions under contract. Unless these transactions were hedged, the dollar cash flow from these transactions would depend on the spot rate of the foreign currency at the time payment was received. Germany A sale of DM2,000,000 to the Hamburg International Hotel which is opening for business in January 1992. Parts of this order have already been shipped. The last consignment will be shipped in the second week of October and payment will be received on November 14, 1991. Japan A payment of JY150,000,000 will be received from Sakado Enterprises, a large trading company in Tokyo, on September 18, 1991. The furniture against this order was shipped in the second week of August 1991. Singapore 1. Two hundred and fifty thousand Singapore dollars (SS) are due on November 23, 1991 from Patusan Brothers, a furniture retailer. The furniture against this invoice was shipped in the last week of July. Another S$250,000 would be due from Patusin Brothers on February 17, 1992. The shipment against this invoice will be made in the last week of December 1991 2. TABLE 1 Carolina Furniture Company Exchange Rates - U.S. s Equivalent Friday, August 16, 1991 DM JY Spot 30-day forward 90-day forward 180-day forward $0.5824 0.5796 0.5733 0 5700 $0.007474 0.007470 0.007454 0.007435 S$ $0.5748 NA NA NA TABLE 2 Carolina Furniture Company Selected Interest Rates Friday, August 16, 1991 1-Month 3-Months 6-Months 5.70% 5.55 5.85% 5.70 5.95% 5.80 United States Prime rate LIBOR (London) Germany Prime rate LIBOR (London) Japan Prime rate LIBOR (London) Singapore Primente 11.47 11.32 12.10 11.95 10.21 10.06 6.40 6.19 6.95 6.75 6.95 6.75 5.23 5.58 As Allen checked the records, he found that Carolina Pumiture Company had the following foreign exchange transactions under contract. Unless these transactions were hedged, the dollar cash flow from these transactions would depend on the spot rate of the foreign currency at the time payment was received. Germany A sale of DM2,000,000 to the Hamburg International Hotel which is opening for business in January 1992. Parts of this order have already been shipped. The last consignment will be shipped in the second week of October and payment will be received on November 14, 1991. Japan A payment of JY150,000,000 will be received from Sakado Enterprises, a large trading company in Tokyo, on September 18, 1991. The furniture against this order was shipped in the second week of August 1991. Singapore 1. Two hundred and fifty thousand Singapore dollars (SS) are due on November 23, 1991 from Patusan Brothers, a furniture retailer. The furniture against this invoice was shipped in the last week of July. Another S$250,000 would be due from Patusin Brothers on February 17, 1992. The shipment against this invoice will be made in the last week of December 1991 2. TABLE 1 Carolina Furniture Company Exchange Rates - U.S. s Equivalent Friday, August 16, 1991 DM JY Spot 30-day forward 90-day forward 180-day forward $0.5824 0.5796 0.5733 0 5700 $0.007474 0.007470 0.007454 0.007435 S$ $0.5748 NA NA NA TABLE 2 Carolina Furniture Company Selected Interest Rates Friday, August 16, 1991 1-Month 3-Months 6-Months 5.70% 5.55 5.85% 5.70 5.95% 5.80 United States Prime rate LIBOR (London) Germany Prime rate LIBOR (London) Japan Prime rate LIBOR (London) Singapore Primente 11.47 11.32 12.10 11.95 10.21 10.06 6.40 6.19 6.95 6.75 6.95 6.75 5.23 5.58