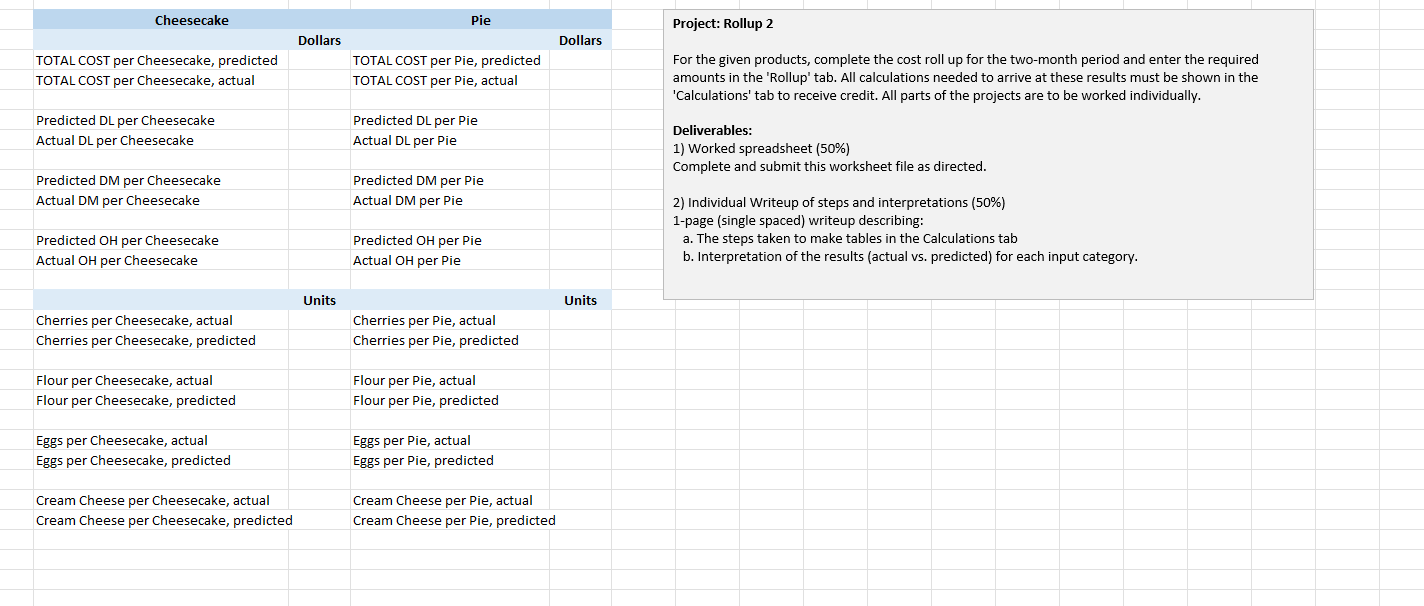

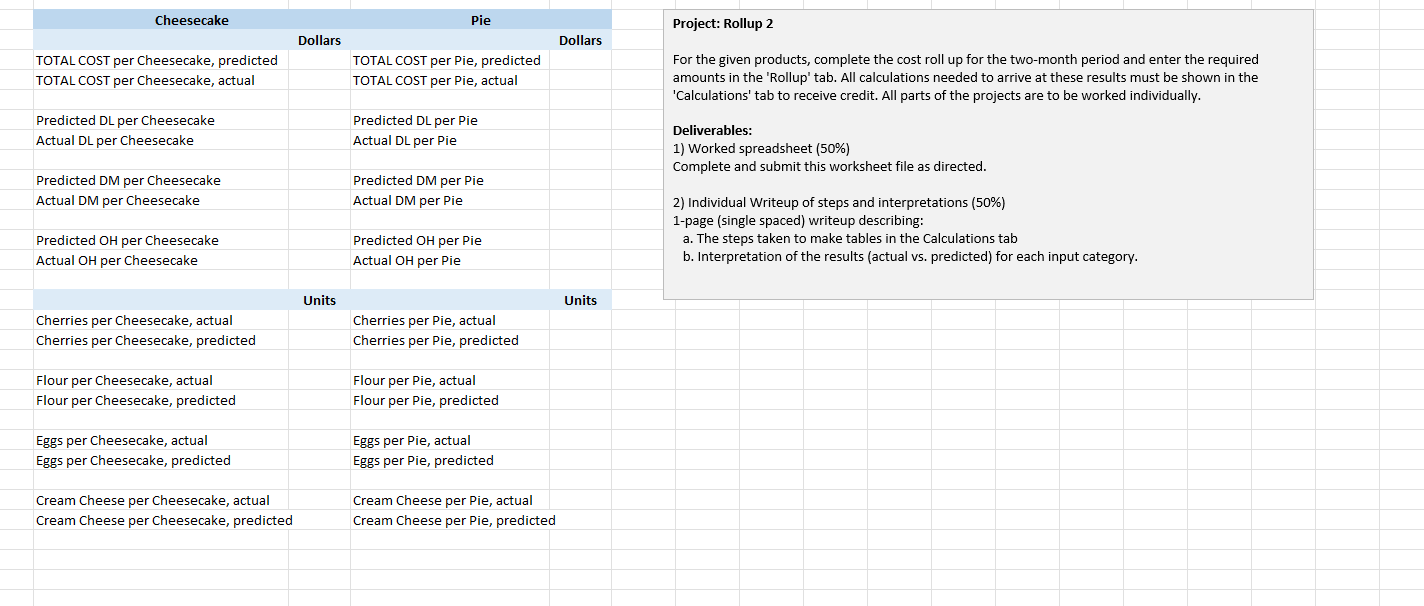

For the given products, complete the cost roll up for the two-month period and enter the required amounts in the 'Rollup' tab. All calculations needed to arrive at these results must be shown in the 'Calculations' tab to receive credit. All parts of the projects are to be worked individually.

Deliverables:

1) Worked spreadsheet (50%)

Complete and submit this worksheet file as directed.

2) Individual Writeup of steps and interpretations (50%)

1-page (single spaced) writeup describing:

a. The steps taken to make tables in the Calculations tab

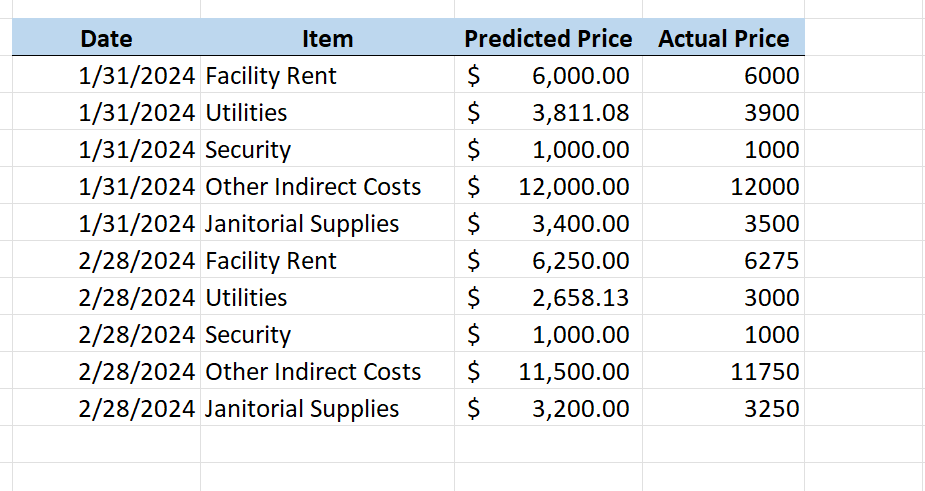

b. Interpretation of the results (actual vs. predicted) for each input category.

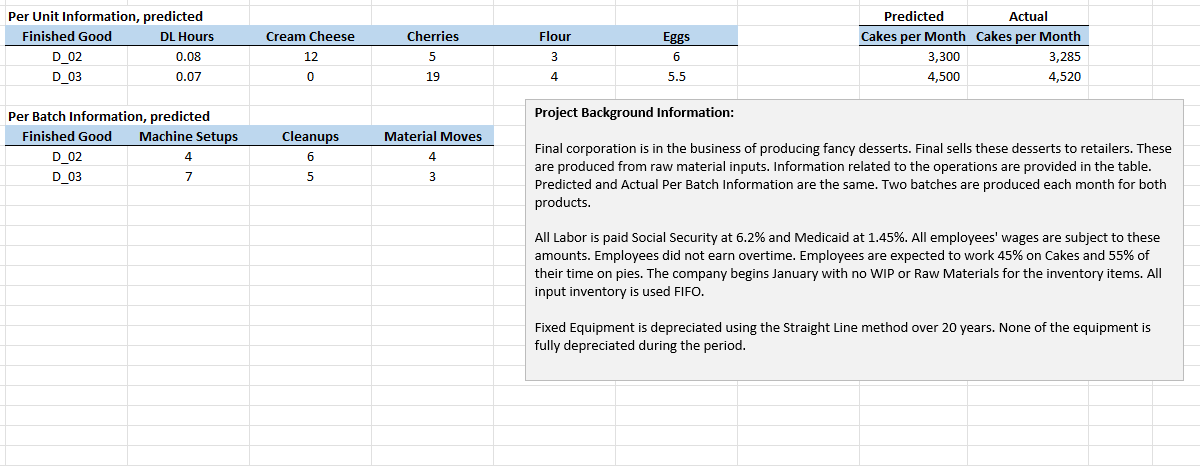

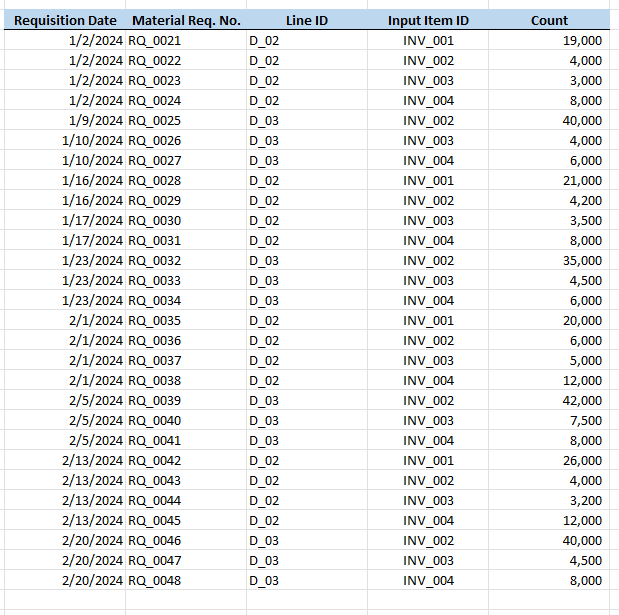

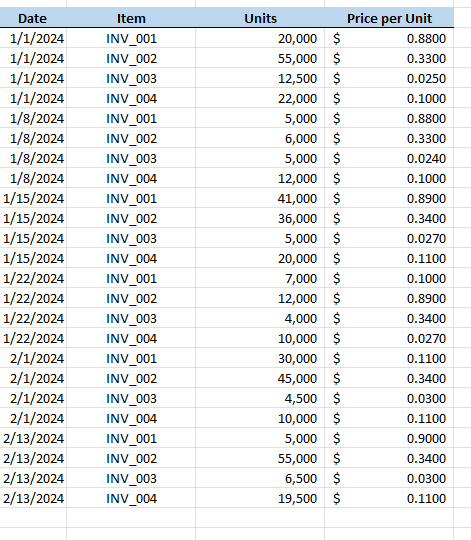

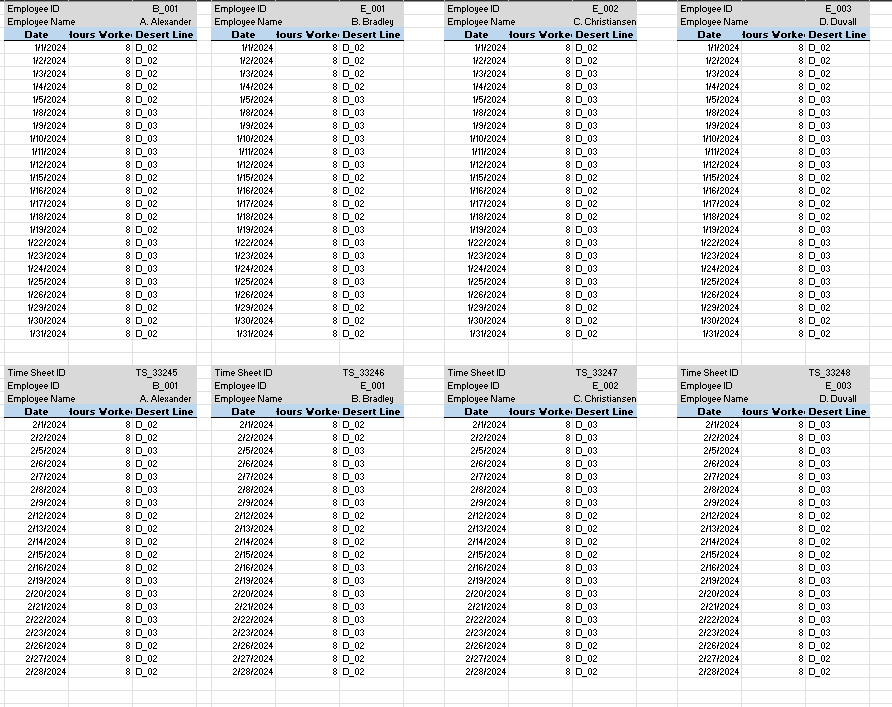

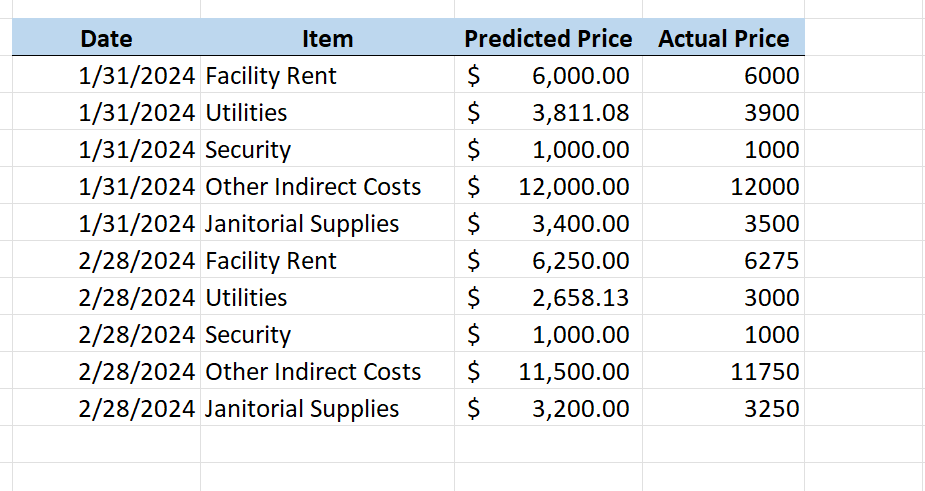

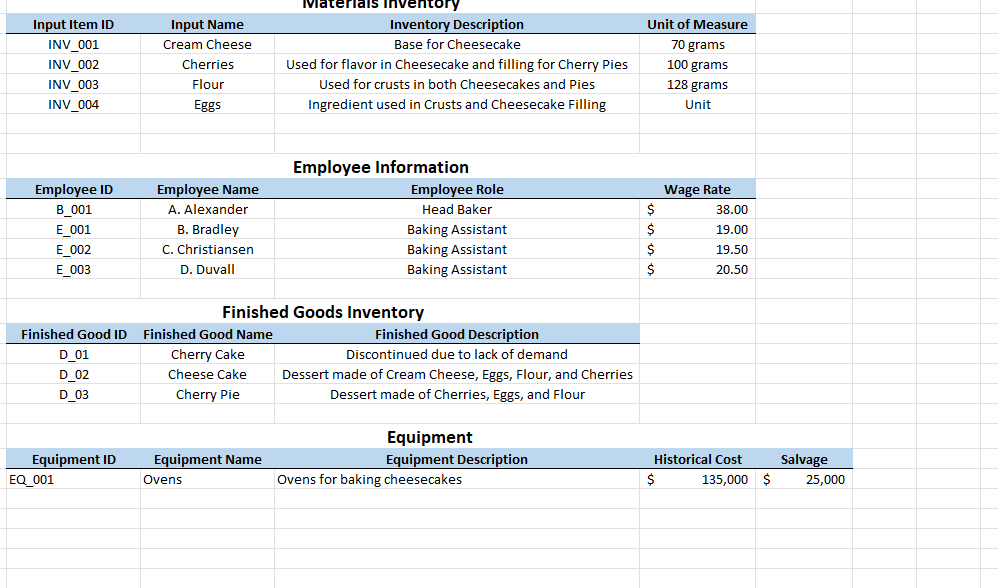

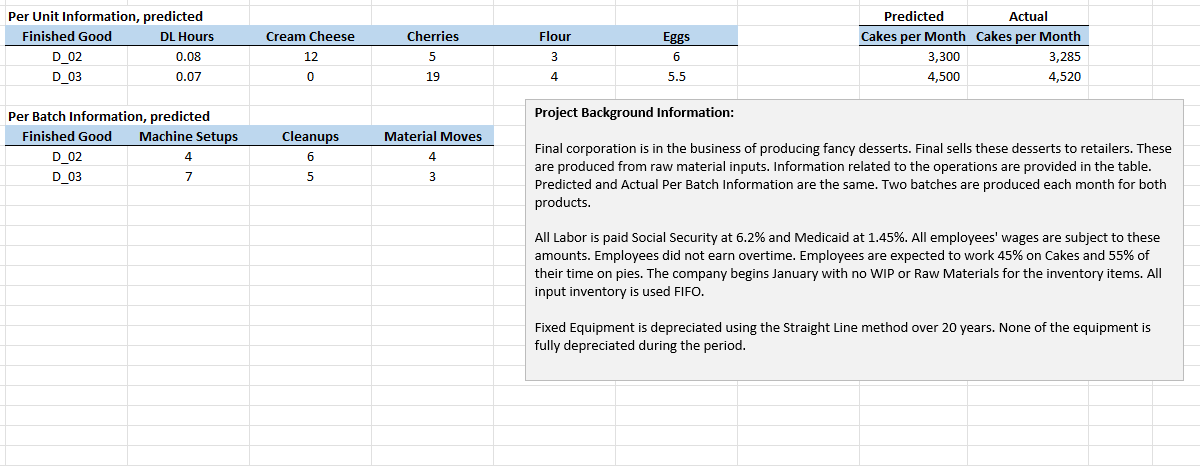

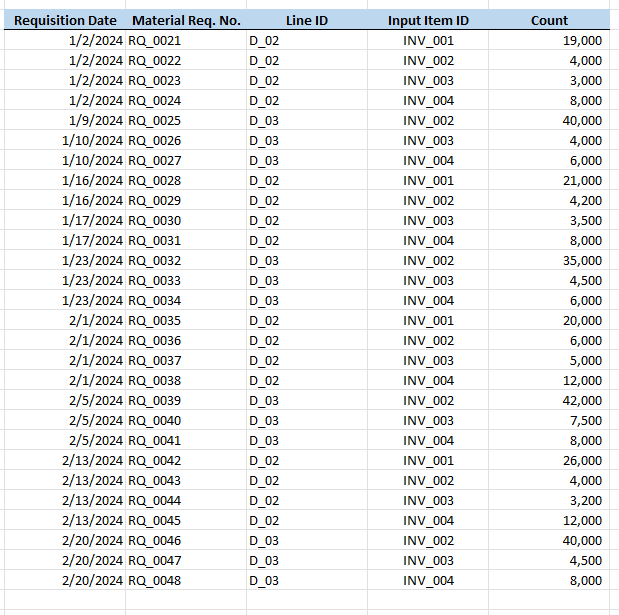

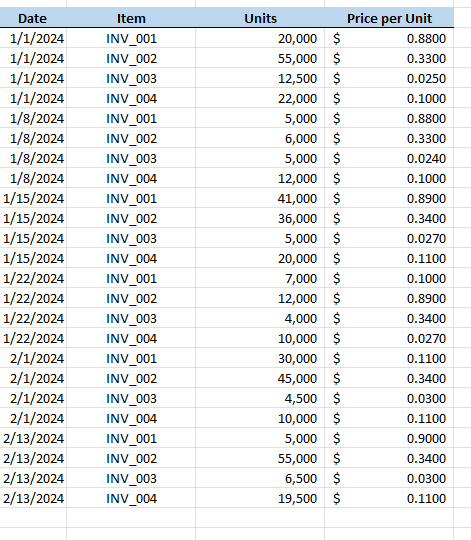

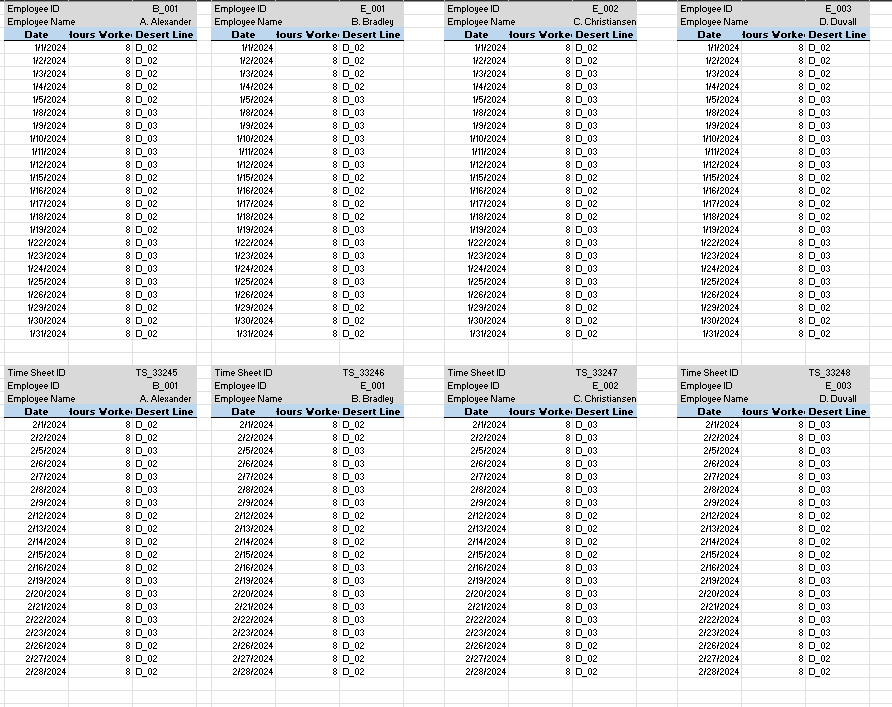

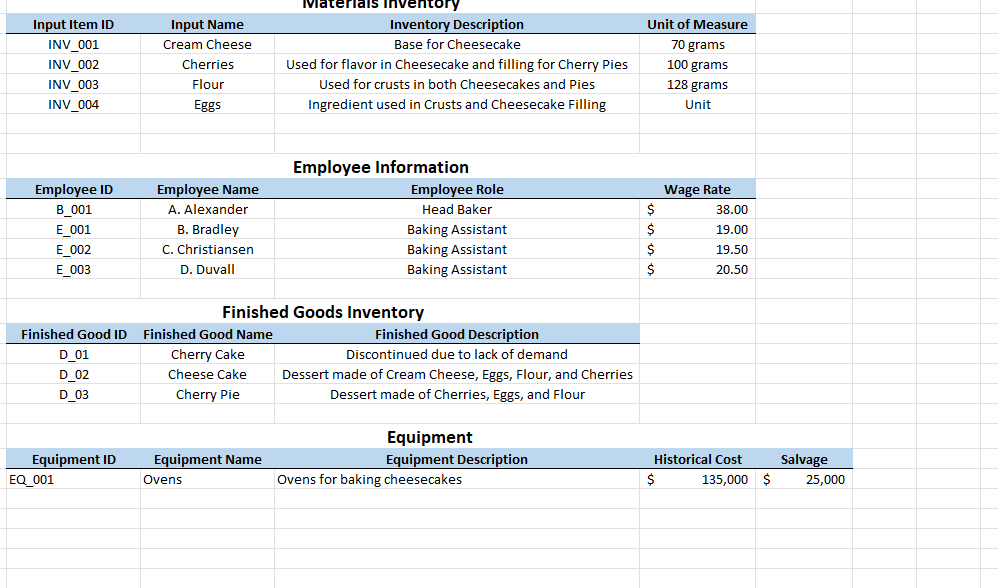

Project: Rollup 2 For the given products, complete the cost roll up for the two-month period and enter the required amounts in the 'Rollup' tab. All calculations needed to arrive at these results must be shown in the 'Calculations' tab to receive credit. All parts of the projects are to be worked individually. Deliverables: 1) Worked spreadsheet (50%) Complete and submit this worksheet file as directed. 2) Individual Writeup of steps and interpretations (50\%) 1-page (single spaced) writeup describing: a. The steps taken to make tables in the Calculations tab b. Interpretation of the results (actual vs. predicted) for each input category. Project Background Information: Final corporation is in the business of producing fancy desserts. Final sells these desserts to retailers. These are produced from raw material inputs. Information related to the operations are provided in the table. Predicted and Actual Per Batch Information are the same. Two batches are produced each month for both products. All Labor is paid Social Security at 6.2% and Medicaid at 1.45%. All employees' wages are subject to these amounts. Employees did not earn overtime. Employees are expected to work 45% on Cakes and 55% of their time on pies. The company begins January with no WIP or Raw Materials for the inventory items. All input inventory is used FIFO. Fixed Equipment is depreciated using the Straight Line method over 20 years. None of the equipment is fully depreciated during the period. \begin{tabular}{|c|c|c|c|} \hline Input Item ID & Input Name & Inventory Description & Unit of Measure \\ \hline INV_001 & Cream Cheese & Base for Cheesecake & 70 grams \\ \hline INV_002 & Cherries & Used for flavor in Cheesecake and filling for Cherry Pies & 100 grams \\ \hline INV_003 & Flour & Used for crusts in both Cheesecakes and Pies & 128 grams \\ \hline INV_004 & Eggs & Ingredient used in Crusts and Cheesecake Filling & Unit \\ \hline \end{tabular} Employee Information Finished Goods Inventory Project: Rollup 2 For the given products, complete the cost roll up for the two-month period and enter the required amounts in the 'Rollup' tab. All calculations needed to arrive at these results must be shown in the 'Calculations' tab to receive credit. All parts of the projects are to be worked individually. Deliverables: 1) Worked spreadsheet (50%) Complete and submit this worksheet file as directed. 2) Individual Writeup of steps and interpretations (50\%) 1-page (single spaced) writeup describing: a. The steps taken to make tables in the Calculations tab b. Interpretation of the results (actual vs. predicted) for each input category. Project Background Information: Final corporation is in the business of producing fancy desserts. Final sells these desserts to retailers. These are produced from raw material inputs. Information related to the operations are provided in the table. Predicted and Actual Per Batch Information are the same. Two batches are produced each month for both products. All Labor is paid Social Security at 6.2% and Medicaid at 1.45%. All employees' wages are subject to these amounts. Employees did not earn overtime. Employees are expected to work 45% on Cakes and 55% of their time on pies. The company begins January with no WIP or Raw Materials for the inventory items. All input inventory is used FIFO. Fixed Equipment is depreciated using the Straight Line method over 20 years. None of the equipment is fully depreciated during the period. \begin{tabular}{|c|c|c|c|} \hline Input Item ID & Input Name & Inventory Description & Unit of Measure \\ \hline INV_001 & Cream Cheese & Base for Cheesecake & 70 grams \\ \hline INV_002 & Cherries & Used for flavor in Cheesecake and filling for Cherry Pies & 100 grams \\ \hline INV_003 & Flour & Used for crusts in both Cheesecakes and Pies & 128 grams \\ \hline INV_004 & Eggs & Ingredient used in Crusts and Cheesecake Filling & Unit \\ \hline \end{tabular} Employee Information Finished Goods Inventory