Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the January 15 journal entry, the calculation of dividends in arrears would be based on 1 year or 2 years? Only need help with

For the January 15 journal entry, the calculation of dividends in arrears would be based on 1 year or 2 years?

Only need help with the Jan 15 entry, I've already done the rest of them. Does "No dividends have been declared since December 31, 2016" mean that only the dividends from 2017 are in arrears?

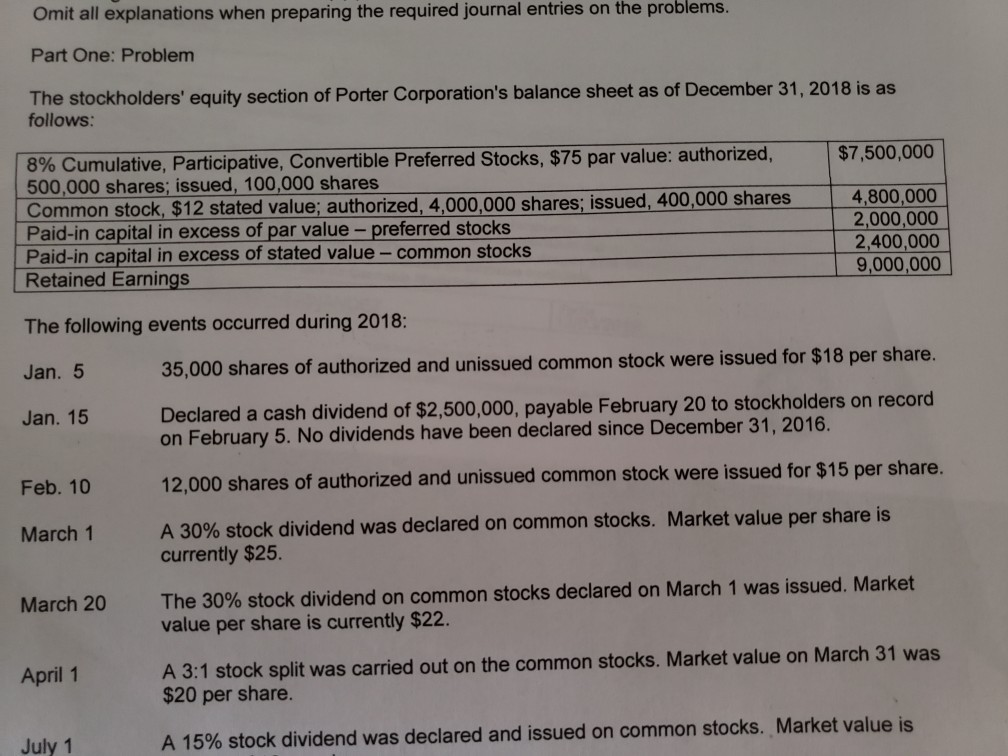

Omit all explanations when preparing the required journal entries on the problems. Part One: Problem The stockholders' equity section of Porter Corporation's balance sheet as of December 31, 2018 is as follows 8% Cumulative, Participative, Convertible Preferred Stocks, $75 par value: authorized, 500,000 shares; issued, 100,000 shares Common stock, $12 stated value; authorized, 4,000,000 shares: issued, 400,000 shares Paid-in capital in excess of par value - preferred stocks Paid-in capital in excess of stated value-common stocks Retained Earnings $7,500,000 4,8000 2,400,000 9,000,000 The following events occurred during 2018: Jan. 5 35,000 shares of authorized and unissued common stock were issued for $18 per sha Declared a cash dividend of $2,500,000, payable February 20 to stockholders on record on February 5. No dividends have been declared since December 31, 2016. Jan. 15 Feb. 10 000 shares of authorized and unissued common stock were issued for $15 per share. A 30% stock dividend was declared on common stocks. Market value per share is currently $25. March 1 The 30% stock dividend on common stocks declared on March 1 was issued. Market value per share is currently $22. March 20 A 3:1 stock split was carried out on the common stocks. Market value on March 31 was $20 per share. April 1 July 1 A 15% stock dividend was declared and issued on common stocks. Market value isStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started