Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the midterm paper, you are to assume the role of a personal financial planner. Your client has asked you to develop a holistic personal

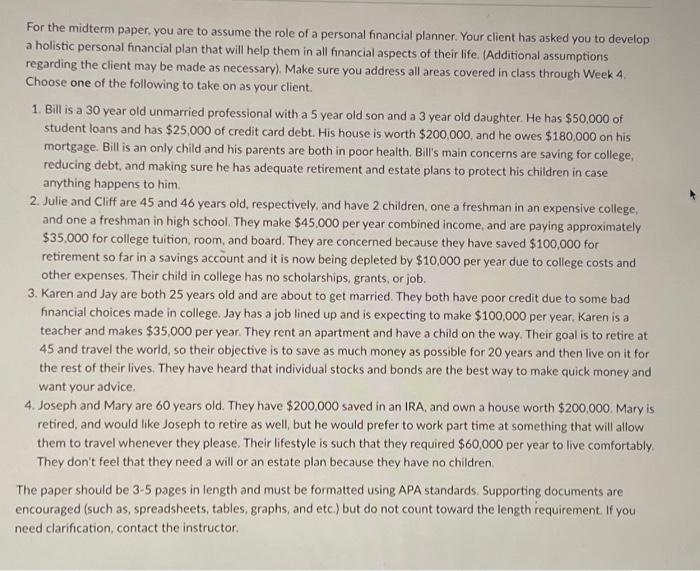

For the midterm paper, you are to assume the role of a personal financial planner. Your client has asked you to develop a holistic personal financial plan that will help them in all financial aspects of their life. (Additional assumptions regarding the client may be made as necessary). Make sure you address all areas covered in class through Week 4. Choose one of the following to take on as your client. 1. Bill is a 30 year old unmarried professional with a 5 year old son and a 3 year old daughter. He has $50,000 of student loans and has $25,000 of credit card debt. His house is worth $200,000, and he owes $180,000 on his mortgage. Bill is an only child and his parents are both in poor health. Bill's main concerns are saving for college, reducing debt, and making sure he has adequate retirement and estate plans to protect his children in case anything happens to him. 2. Julie and Cliff are 45 and 46 years old, respectively, and have 2 children, one a freshman in an expensive college, and one a freshman in high school. They make $45,000 per year combined income, and are paying approximately $35,000 for college tuition, room, and board. They are concerned because they have saved $100,000 for retirement so far in a savings account and it is now being depleted by $10,000 per year due to college costs and other expenses. Their child in college has no scholarships, grants, or job. 3. Karen and Jay are both 25 years old and are about to get married. They both have poor credit due to some bad financial choices made in college. Jay has a job lined up and is expecting to make $100,000 per year. Karen is a teacher and makes $35,000 per year. They rent an apartment and have a child on the way. Their goal is to retire at 45 and travel the world, so their objective is to save as much money as possible for 20 years and then live on it for the rest of their lives. They have heard that individual stocks and bonds are the best way to make quick money and want your advice. 4. Joseph and Mary are 60 years old. They have $200,000 saved in an IRA, and own a house worth $200,000. Mary is retired, and would like Joseph to retire as well, but he would prefer to work part time at something that will allow them to travel whenever they please. Their lifestyle is such that they required $60,000 per year to live comfortably. They don't feel that they need a will or an estate plan because they have no children. The paper should be 3-5 pages in length and must be formatted using APA standards. Supporting documents are encouraged (such as, spreadsheets, tables, graphs, and etc.) but do not count toward the length requirement. If you need clarification, contact the instructor.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started