Question

For the Month of November 2022 On November 1, Ping and Paka formed a corporation and started operating P&P Inc., a solar panel installation

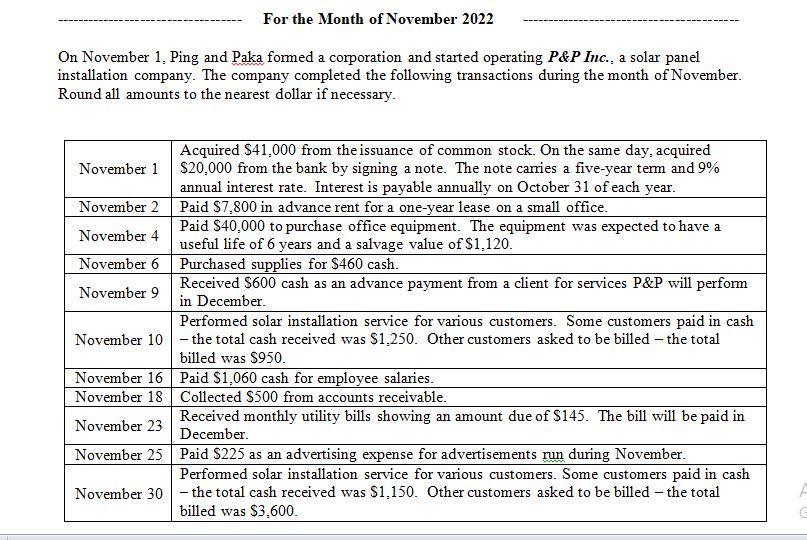

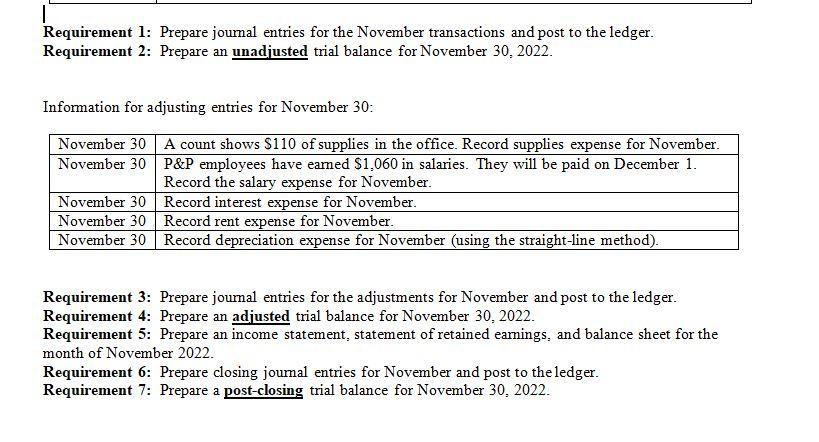

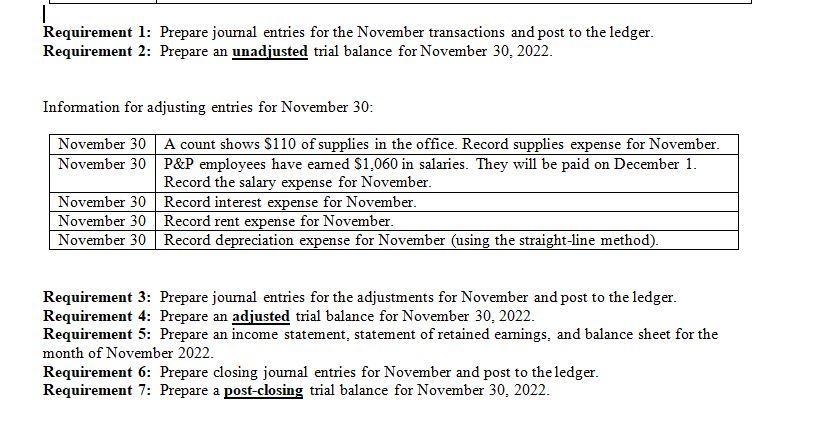

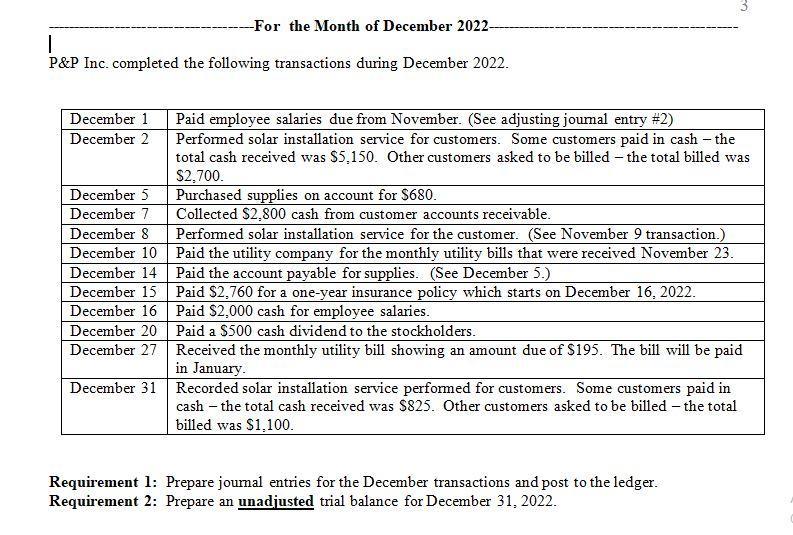

For the Month of November 2022 On November 1, Ping and Paka formed a corporation and started operating P&P Inc., a solar panel installation company. The company completed the following transactions during the month of November. Round all amounts to the nearest dollar if necessary. November 1 November 2 November 4 November 6 November 9 November 10 November 16 November 18 November 23 November 25 Acquired $41,000 from the issuance of common stock. On the same day, acquired $20,000 from the bank by signing a note. The note carries a five-year term and 9% annual interest rate. Interest is payable annually on October 31 of each year. Paid $7,800 in advance rent for a one-year lease on a small office. Paid $40,000 to purchase office equipment. The equipment was expected to have a useful life of 6 years and a salvage value of $1,120. Purchased supplies for $460 cash. Received $600 cash as an advance payment from a client for services P&P will perform in December. Performed solar installation service for various customers. Some customers paid in cash the total cash received was $1,250. Other customers asked to be billed - the total billed was $950. Paid $1,060 cash for employee salaries. Collected $500 from accounts receivable. Received monthly utility bills showing an amount due of $145. The bill will be paid in December. Paid $225 as an advertising expense for advertisements run during November. Performed solar installation service for various customers. Some customers paid in cash November 30- the total cash received was $1,150. Other customers asked to be billed - the total billed was $3,600. | Requirement 1: Prepare journal entries for the November transactions and post to the ledger. Requirement 2: Prepare an unadjusted trial balance for November 30, 2022. Information for adjusting entries for November 30: November 30 November 30 November 30 November 30 November 30 A count shows $110 of supplies in the office. Record supplies expense for November. P&P employees have earned $1,060 in salaries. They will be paid on December 1. Record the salary expense for November. Record interest expense for November. Record rent expense for November. Record depreciation expense for November (using the straight-line method). Requirement 3: Prepare journal entries for the adjustments for November and post to the ledger. Requirement 4: Prepare an adjusted trial balance for November 30, 2022. Requirement 5: Prepare an income statement, statement of retained earnings, and balance sheet for the month of November 2022. Requirement 6: Prepare closing journal entries for November and post to the ledger. Requirement 7: Prepare a post-closing trial balance for November 30, 2022. | Requirement 1: Prepare journal entries for the November transactions and post to the ledger. Requirement 2: Prepare an unadjusted trial balance for November 30, 2022. Information for adjusting entries for November 30: November 30 November 30 November 30 November 30 November 30 A count shows $110 of supplies in the office. Record supplies expense for November. P&P employees have earned $1,060 in salaries. They will be paid on December 1. Record the salary expense for November. Record interest expense for November. Record rent expense for November. Record depreciation expense for November (using the straight-line method). Requirement 3: Prepare journal entries for the adjustments for November and post to the ledger. Requirement 4: Prepare an adjusted trial balance for November 30, 2022. Requirement 5: Prepare an income statement, statement of retained earnings, and balance sheet for the month of November 2022. Requirement 6: Prepare closing journal entries for November and post to the ledger. Requirement 7: Prepare a post-closing trial balance for November 30, 2022. ---For the Month of December 2022- | P&P Inc. completed the following transactions during December 2022. December 1 December 2 December 5 December 7 December 8 December 10 December 14 December 15 December 16 December 20 December 27 December 31 Paid employee salaries due from November. (See adjusting journal entry #2) Performed solar installation service for customers. Some customers paid in cash - the total cash received was $5,150. Other customers asked to be billed - the total billed was $2,700. Purchased supplies on account for $680. Collected $2,800 cash from customer accounts receivable. mi Performed solar installation service for the customer. (See November 9 transaction.) Paid the utility company for the monthly utility bills that were received November 23. Paid the account payable for supplies. (See December 5.) Paid $2,760 for a one-year insurance policy which starts on December 16, 2022. Paid $2,000 cash for employee salaries. Paid a $500 cash dividend to the stockholders. Received the monthly utility bill showing an amount due of $195. The bill will be paid in January. Recorded solar installation service performed for customers. Some customers paid in cash - the total cash received was $825. Other customers asked to be billed - the total billed was $1,100. Requirement 1: Prepare journal entries for the December transactions and post to the ledger. Requirement 2: Prepare an unadjusted trial balance for December 31, 2022.

Step by Step Solution

5.00 Ratings (1 Votes)

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started