Answered step by step

Verified Expert Solution

Question

1 Approved Answer

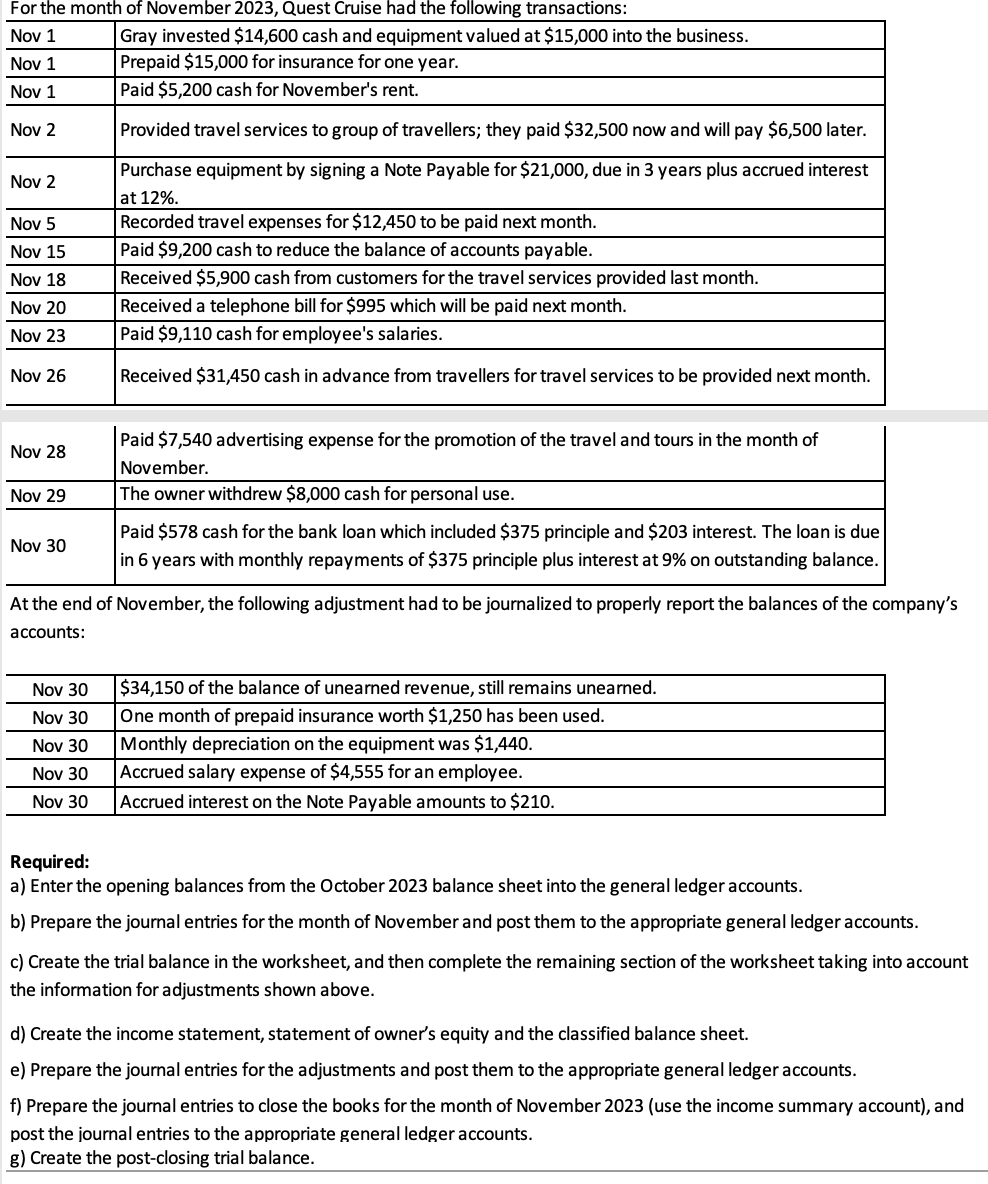

For the month of November 2023, Quest Cruise had the following transactions: Nov 1 Nov 1 Nov 1 Nov 2 Nov 2 Nov 5

For the month of November 2023, Quest Cruise had the following transactions: Nov 1 Nov 1 Nov 1 Nov 2 Nov 2 Nov 5 Nov 15 Nov 18 Nov 20 Nov 23 Nov 26 Nov 28 Nov 29 Nov 30 Gray invested $14,600 cash and equipment valued at $15,000 into the business. Prepaid $15,000 for insurance for one year. Paid $5,200 cash for November's rent. Nov 30 Nov 30 Nov 30 Nov 30 Nov 30 Provided travel services to group of travellers; they paid $32,500 now and will pay $6,500 later. Purchase equipment by signing a Note Payable for $21,000, due in 3 years plus accrued interest at 12%. Recorded travel expenses for $12,450 to be paid next month. Paid $9,200 cash to reduce the balance of accounts payable. Received $5,900 cash from customers for the travel services provided last month. Received a telephone bill for $995 which will be paid next month. Paid $9,110 cash for employee's salaries. Received $31,450 cash in advance from travellers for travel services to be provided next month. Paid $7,540 advertising expense for the promotion of the travel and tours in the month of November. The owner withdrew $8,000 cash for personal use. Paid $578 cash for the bank loan which included $375 principle and $203 interest. The loan is due in 6 years with monthly repayments of $375 principle plus interest at 9% on outstanding balance. At the end of November, the following adjustment had to be journalized to properly report the balances of the company's accounts: $34,150 of the balance of unearned revenue, still remains unearned. One month of prepaid insurance worth $1,250 has been used. Monthly depreciation on the equipment was $1,440. Accrued salary expense of $4,555 for an employee. Accrued interest on the Note Payable amounts to $210. Required: a) Enter the opening balances from the October 2023 balance sheet into the general ledger accounts. b) Prepare the journal entries for the month of November and post them to the appropriate general ledger accounts. c) Create the trial balance in the worksheet, and then complete the remaining section of the worksheet taking into account the information for adjustments shown above. d) Create the income statement, statement of owner's equity and the classified balance sheet. e) Prepare the journal entries for the adjustments and post them to the appropriate general ledger accounts. f) Prepare the journal entries to close the books for the month of November 2023 (use the income summary account), and post the journal entries to the appropriate general ledger accounts. g) Create the post-closing trial balance.

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Quest Cruise November 2023 Transactions a Opening Balances Assuming no balances are provided There are no opening balances mentioned in the problem so ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started