Question

For the MYOB Group Limited. 1. Why do you think it is important for a company to prepare a statement of cash flows? What information

For the MYOB Group Limited.

For the MYOB Group Limited.

1. Why do you think it is important for a company to prepare a statement of cash flows? What information does this provide the user? Using information from the statement of cash flows and the notes to the statement:

2. Compare the cash from operating activities with operating profit after tax for the latest financial year. Are they similar? Why are they similar? If they are different, look for reasons for the differences. Do you think that cash from operations or operating profit is a better predictor of future profitability of the firm? Use references from magazines, academic papers or the press in answering this. (You should cite at least two references). What do you think investors might prefer? 3. Compare cash from operating activities with past years. Comment on any changes and reasons for the change. 4. Analysis of the statement of cash flows: Compare cash flows from operating, investing and financing activities for the last two financial years using cash flow ratios where possible. Note any changes in these and give reasons for the changes. For example: Has there been an increase or decrease? What explains these changes? Have they taken on more debt, repaid debt, heavily invested in non-current assets etc Is operating cash sufficient to pay dividends?

about 1200 words.

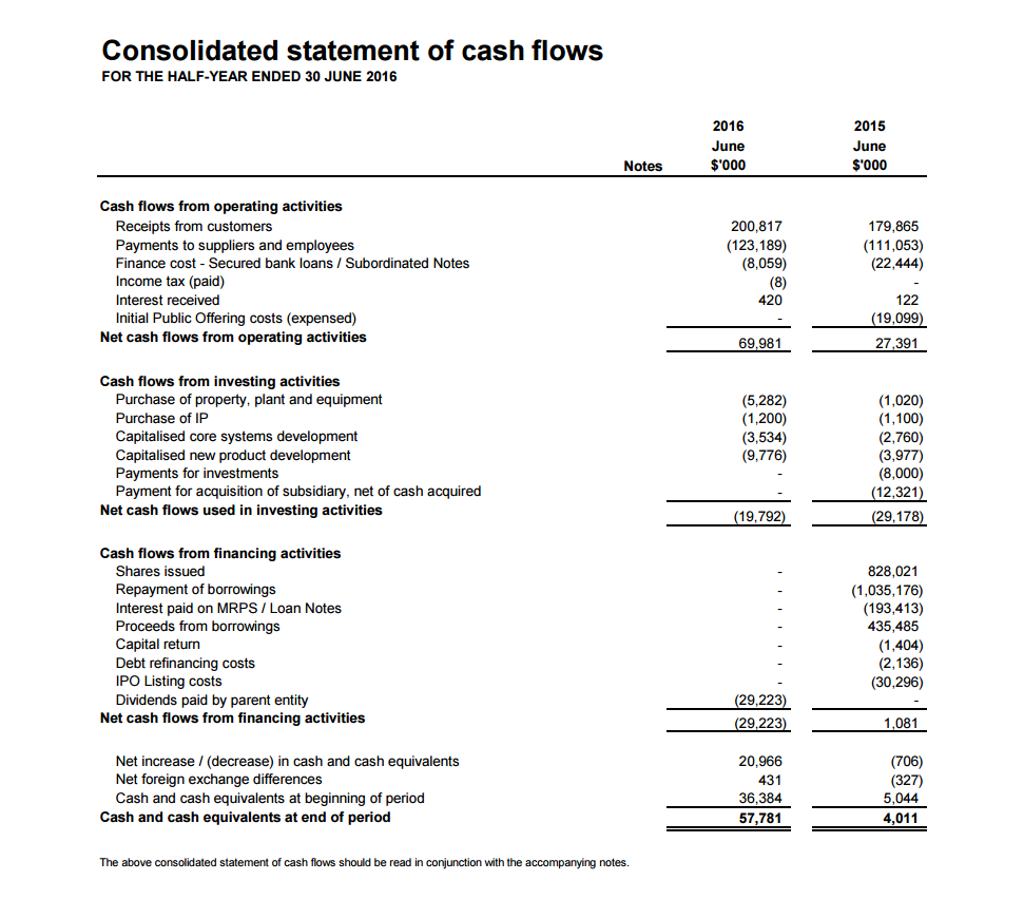

Consolidated statement of cash flows FOR THE HALF-YEAR ENDED 30 JUNE 2016 2016 June $'000 2015 June S000 Notes Cash flows from operating activities 200,817 (123,189) (8,059) Receipts from customers Payments to suppliers and employees Finance cost Secured bank loans/Subordinated Notes Income tax (paid) Interest Initial Public Offering costs (expensed) 179,865 (111,053) (22,444) 420 122 19,099 Net cash flows from operating activities 29.981 2.391 Cash flows from investing activities Purchase of property, plant and equipment Purchase of IP Capitalised core systems development Capitalised new product development Payments for investments Payment for acquisition of subsidiary, net of cash acquired (5,282) (1,200) (3,534) (9,776) (1,020) (1,100) (2,760) (3,977) (8,000) 12,321 29,178 Net cash flows used in investing activities 19,792 Cash flows from financing activities Shares issued Repayment of borrowings Interest paid on MRPS/Loan Notes Proceeds from borrowings Capital return Debt refinancing costs IPO Listing costs Dividends paid by parent entity 828,021 (1,035,176) (193,413) 435,485 (1,404) (2,136) (30,296) 29,223 Net cash flows from financing activities 29,223 1,081 Net increase / (decrease) in cash and cash equivalents Net foreign exchange differences Cash and cash equivalents at beginning of period 20,966 431 36.384 57,781 (706) (327) 5,044 4,011 Cash and cash equivalents at end of period The above consolidated statement of cash flows should be read in conjunction with the accompanying notesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started