Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the next question, a sign is optional for any answer that is a net cash inflow, but a sign is mandatory for any answer

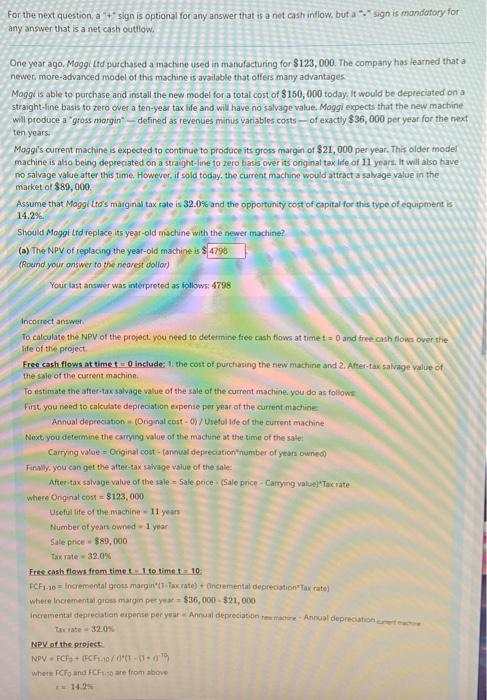

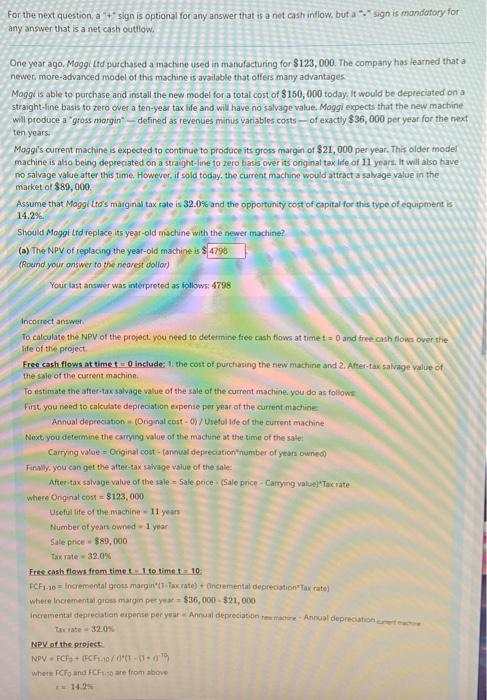

For the next question, a sign is optional for any answer that is a net cash inflow, but a sign is mandatory for any answer that is a net cash outflow. One year ago, Maggi ltd purchased a machine used in manufacturing for $123,000. The company has learned that a newer more advanced model of this machine is available that offers many advantages Maggis able to purchase and install the new model for a total cost of $150,000 today. It would be deprecated on a straight-line basis to zero over a ten-year tax life and will have no salvage value. Maggi expects that the new machine will produce a "gross margin" - defined as revenues minus variables.costs - of exactly $36,000 per year for the next ten years. Maggi's current machine is expected to continue to produce its gross margin of $21,000 per year. This older model machine is also being depreciated on a straight-line to zero basis over its original tax life of 11 years. It will also have no salvage value after this time. However, it sold today, the current machine would attract a salvage value in the market of $89,000 Assume that Maggi Ltd's marginal tax rate is 32.0% and the opportunity cost of capital for this type of equipment is 14.2% Should Moggi Ltd replace its year-old machine with the newer machine? (a) The NPV of replacing the year-old machine is $4798 (Round your answer to the nearest dolor) Your tast answer was interpreted as follows: 4798 Incorrect answer To calculate the NPV of the project, you need to determine free cash flow at time to and free cash flows over the life of the project Free cash flows at time to include the cost of purchasing the new machine and 2. After-tax salvage value of the sale of the current machine To estimate the after-tax salvage value of the sale of the current machine, you do as follow First you need to calculate depreciation expense per year of the current machine Annual depreciation (Original cost - 0)/Useful ide of the current machine Next you determine the carrying value of the machine at the time of the sale Carrying value = Original cost-annual depreciation number of years owned Finally, you can get the after-tax savage value of the sale After-tax salvage value of the sale - Sale price (Sale price - Carrying value)Taevate where Onginal cost $123,000 Useful life of the machine - 11 years Number of years owned - 1 year sale price $80,000 Tax rate-32.0% Free cash flows from time to time 10 CF-10-incremental grous margin"1 Tax rate) Oncemental depreciation Tax rate) where Incremental gross margin per year = $36,000 - $21,000 incremental depreciation expense per year. Annual depreciation mature-Annual depreciation atate 32.0% NPV of the project NPV - FCFS (FCF1.20/01-11- whore Co and Care from above 14

For the next question, a sign is optional for any answer that is a net cash inflow, but a sign is mandatory for any answer that is a net cash outflow. One year ago, Maggi ltd purchased a machine used in manufacturing for $123,000. The company has learned that a newer more advanced model of this machine is available that offers many advantages Maggis able to purchase and install the new model for a total cost of $150,000 today. It would be deprecated on a straight-line basis to zero over a ten-year tax life and will have no salvage value. Maggi expects that the new machine will produce a "gross margin" - defined as revenues minus variables.costs - of exactly $36,000 per year for the next ten years. Maggi's current machine is expected to continue to produce its gross margin of $21,000 per year. This older model machine is also being depreciated on a straight-line to zero basis over its original tax life of 11 years. It will also have no salvage value after this time. However, it sold today, the current machine would attract a salvage value in the market of $89,000 Assume that Maggi Ltd's marginal tax rate is 32.0% and the opportunity cost of capital for this type of equipment is 14.2% Should Moggi Ltd replace its year-old machine with the newer machine? (a) The NPV of replacing the year-old machine is $4798 (Round your answer to the nearest dolor) Your tast answer was interpreted as follows: 4798 Incorrect answer To calculate the NPV of the project, you need to determine free cash flow at time to and free cash flows over the life of the project Free cash flows at time to include the cost of purchasing the new machine and 2. After-tax salvage value of the sale of the current machine To estimate the after-tax salvage value of the sale of the current machine, you do as follow First you need to calculate depreciation expense per year of the current machine Annual depreciation (Original cost - 0)/Useful ide of the current machine Next you determine the carrying value of the machine at the time of the sale Carrying value = Original cost-annual depreciation number of years owned Finally, you can get the after-tax savage value of the sale After-tax salvage value of the sale - Sale price (Sale price - Carrying value)Taevate where Onginal cost $123,000 Useful life of the machine - 11 years Number of years owned - 1 year sale price $80,000 Tax rate-32.0% Free cash flows from time to time 10 CF-10-incremental grous margin"1 Tax rate) Oncemental depreciation Tax rate) where Incremental gross margin per year = $36,000 - $21,000 incremental depreciation expense per year. Annual depreciation mature-Annual depreciation atate 32.0% NPV of the project NPV - FCFS (FCF1.20/01-11- whore Co and Care from above 14

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started