Answered step by step

Verified Expert Solution

Question

1 Approved Answer

? ? ? ? ? ? ?? consider an economy with only two non-identical banks, called Bank One and Bank Two. In addition to this

? ?

? ? ?

? ?

? ?

? ?

? ??

??

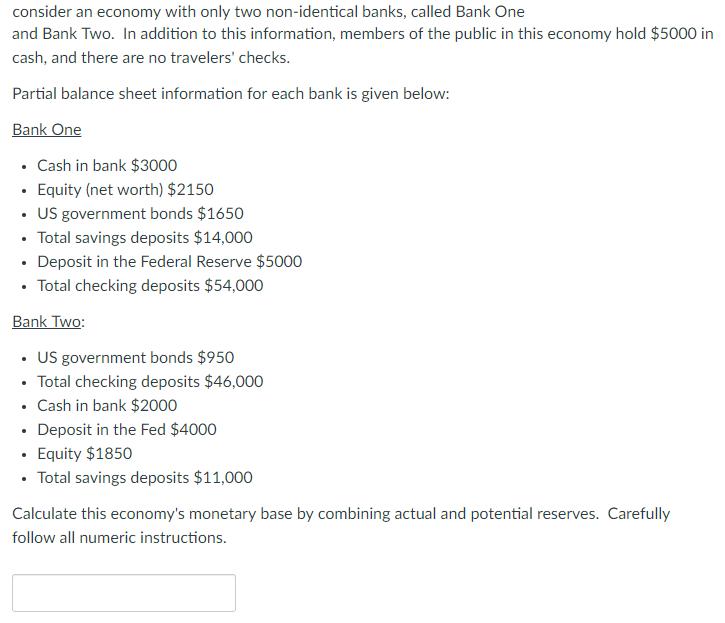

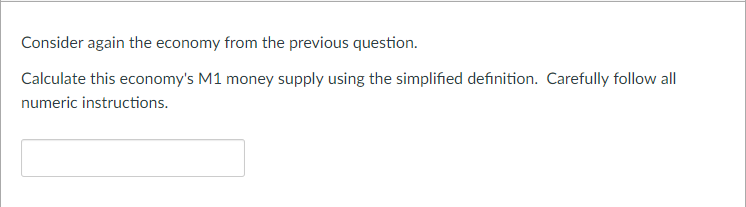

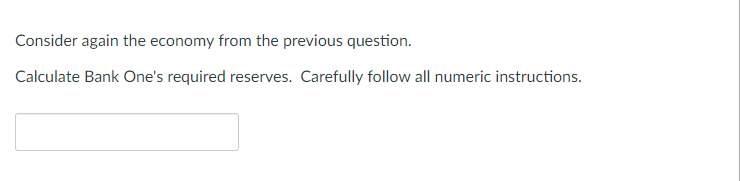

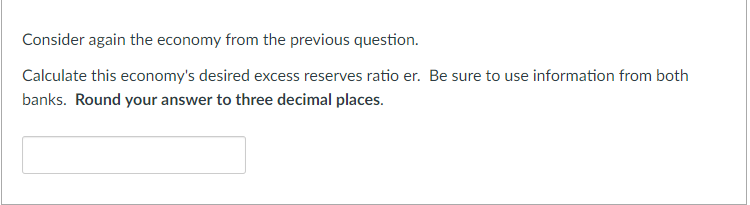

consider an economy with only two non-identical banks, called Bank One and Bank Two. In addition to this information, members of the public in this economy hold $5000 in cash, and there are no travelers' checks. Partial balance sheet information for each bank is given below: Bank One Cash in bank $3000 Equity (net worth) $2150 US government bonds $1650 Total savings deposits $14,000 Deposit in the Federal Reserve $5000 Total checking deposits $54,000 Bank Two: US government bonds $950 Total checking deposits $46,000 Cash in bank $2000 Deposit in the Fed $4000 Equity $1850 Total savings deposits $11,000 Calculate this economy's monetary base by combining actual and potential reserves. Carefully follow all numeric instructions. Consider again the economy from the previous question. Calculate this economy's M1 money supply using the simplified definition. Carefully follow all numeric instructions. Consider again the economy from the previous question. Calculate Bank One's required reserves. Carefully follow all numeric instructions. Consider again the economy from the previous question. Calculate this economy's desired excess reserves ratio er. Be sure to use information from both banks. Round your answer to three decimal places. Consider again the economy from the previous question. Now let's say the Fed does easy (expansionary) monetary policy via OMOs with Bank One only in the amount of $1000. As a result of this transaction, calculate the economy's new monetary base by combining actual and potential reserves. Consider one last time the economy from the previous question. After this open market operation takes place, what will be Bank One's new excess reserves? Carefully follow all numeric instructions.

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Monetary Base RRR D ER C where C is the currency in circulation the checkable depocash with public C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started