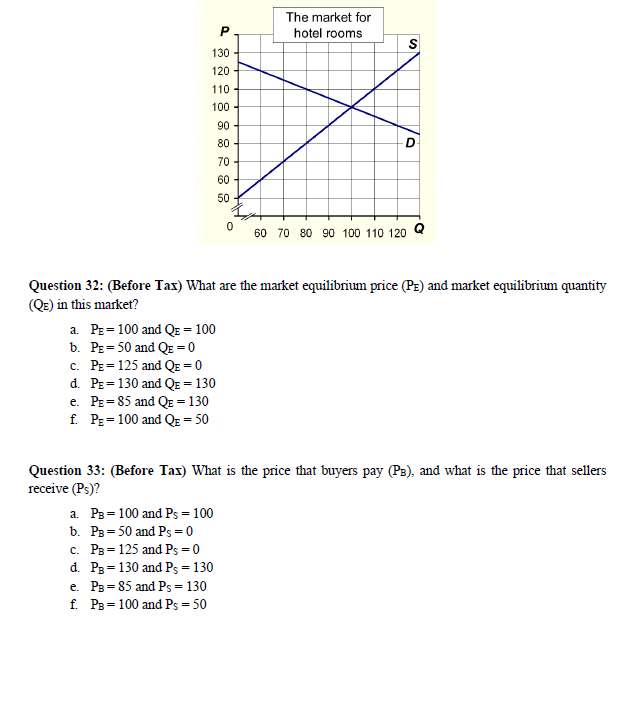

For the next six questions, use the following context.

The following diagram depicts the market for hotel rooms in Big Little Town, USA.

The market for P hotel rooms 130 S 120 110 100 90 80 70 60 50 0 60 70 80 90 100 110 120 Q Question 32: (Before Tax) What are the market equilibrium price (PE) and market equilibrium quantity (QE) in this market? a. PE = 100 and QE = 100 b. PE = 50 and QE = 0 C. PE = 125 and QE = 0 d. PE = 130 and QE = 130 e. PE = 85 and QE = 130 f. PE = 100 and QE = 50 Question 33: (Before Tax) What is the price that buyers pay (PB), and what is the price that sellers receive (Ps)? a. PB = 100 and Ps = 100 b. PB = 50 and Ps = 0 C. PB = 125 and Ps = 0 d. P= = 130 and Ps = 130 e. PB = 85 and Ps = 130 f. PB = 100 and Ps = 50Question 34: (After Tax) Suppose the government imposes a tax on buyers of $60 per room. Find the new Q, PE, and Ps- a. Q = 100, P= = 100, and Ps = 100 b. Q = 60, PB = 160, and Ps = 100 c. Q = 60, PB = 60, and Ps = 60 d. Q = 60, PB = 120, and Ps = 60 e. Q = 100, P= = 85, and Ps = 130 f. Q = 40, PB = 100, and Ps = 40 Question 35: (After Tax) Suppose the government imposes a tax on buyers of $60 per room. Find the incidence of the tax (the buyers' share of the tax and that of the sellers"). a. Buyers' share= 20 and Sellers' share = 40 b. Buyers' share= 40 and Sellers' share = 20 c. Buyers' share = 60 and Sellers' share = 0 d. Buyers' share = 0 and Sellers' share = 60 e. Buyers' share= 30 and Sellers' share = 30 f. Buyers' share= 20 and Sellers' share = 20 Question 36: What would have happened to the markets outcomes (i.e. prices and quantities) and the economic incidence of the tax if the tax had been imposed on sellers instead of buyers? a. 50% of the tax would have been paid by the sellers. b. All of the tax would have been paid by the sellers. c. Nothing of the tax would have been paid by the sellers. d. All of the tax would have been paid by the buyers. e. All of the markets outcomes (i.e. prices and quantities) and the economic incidence of the tax would have changed. f. Nothing would have changed and the markets outcomes (i.e. prices and quantities) and the economic incidence of the tax would have remained unchanged. Question 37: Generally speaking, what is the main determinant of the incidence of a tax? a. Price elasticity of supply b. Price elasticity of demand c. Both "a" and "b" d. What the tax law says e. Income elasticity of supply f. Cross-price elasticity of demand