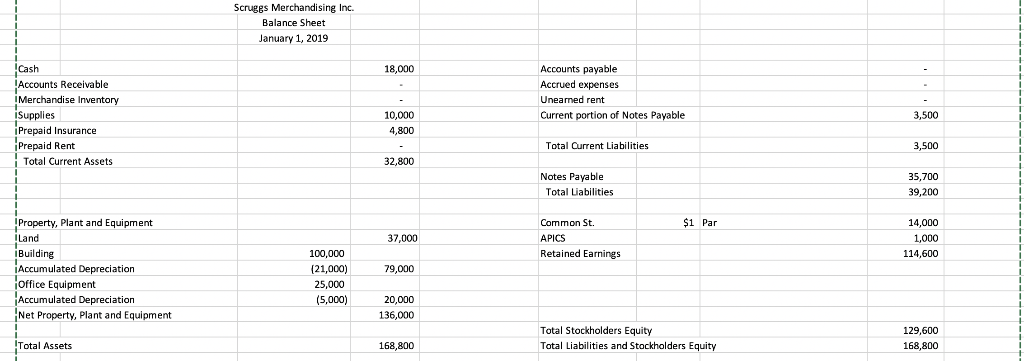

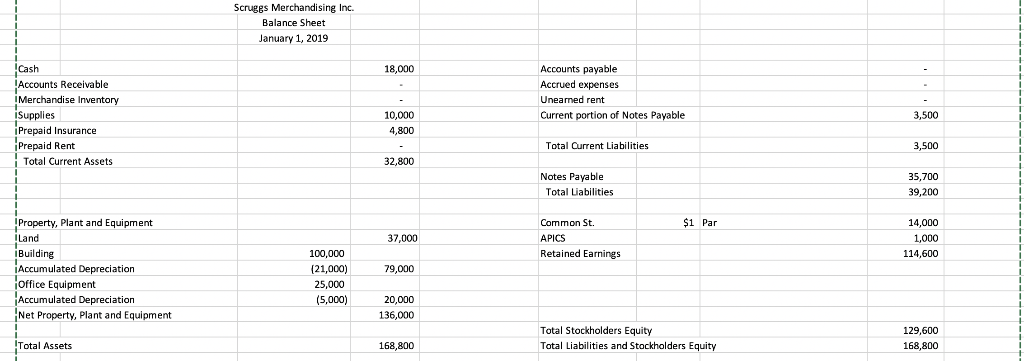

| For the past several years, Cletus Scruggs has operated a part-time merchandising company from his garage. Cletus decided to buy Fixed Assets | |

| and to operate the business, which is known as Scruggs Merchandising Inc. on a full-time basis. Scruggs Merchandising opening balance sheet is shown below: |

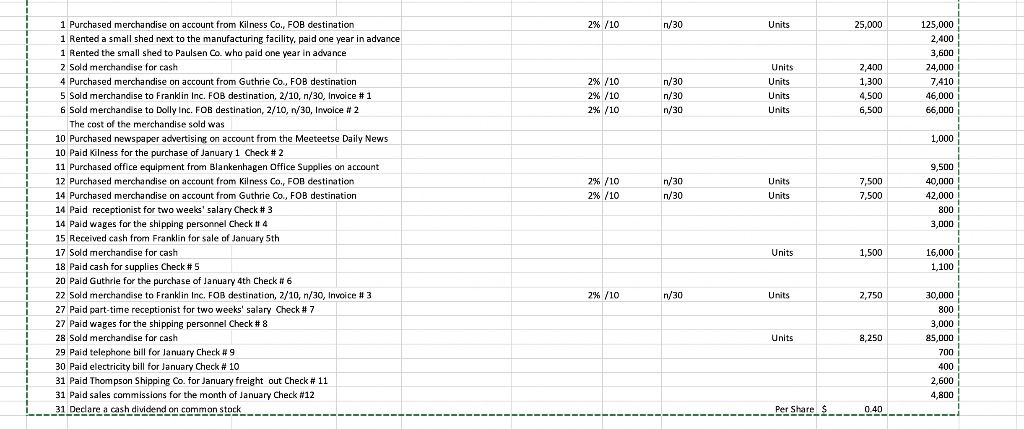

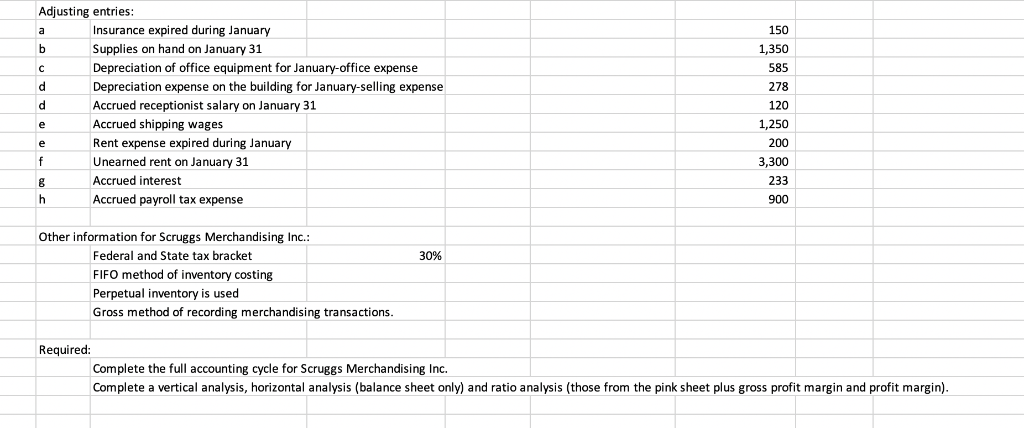

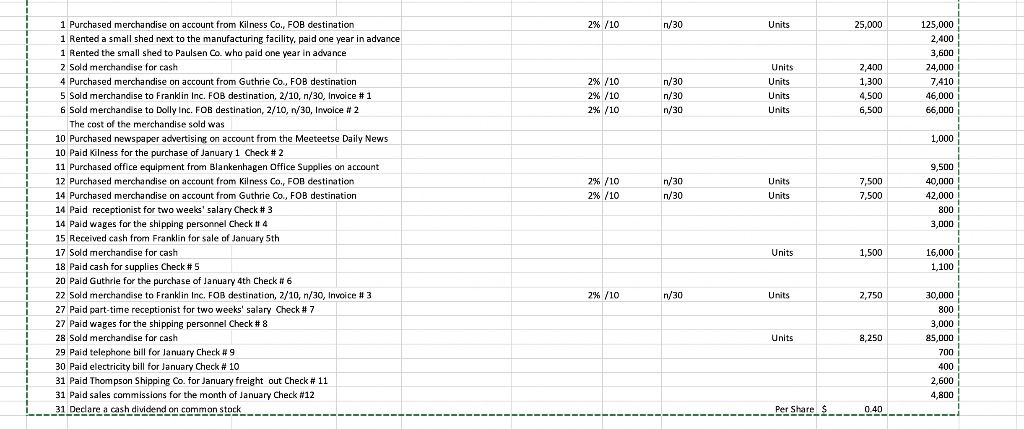

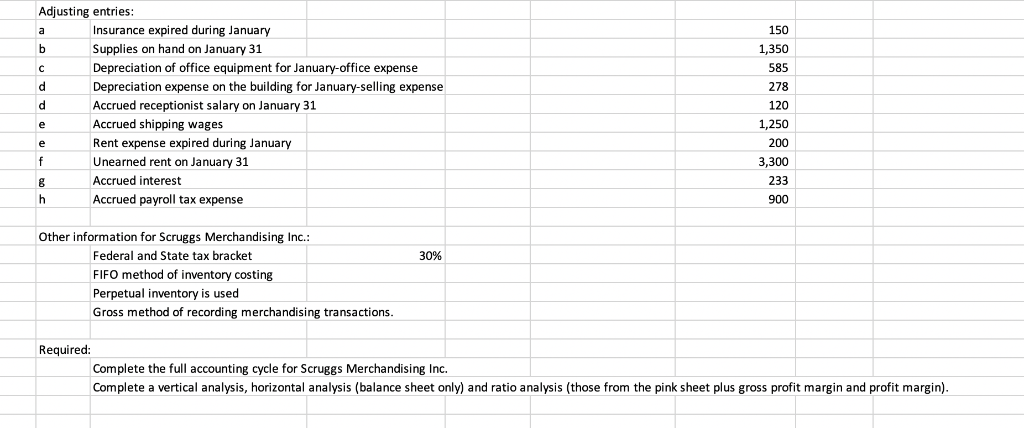

Scruggs Merchandising Inc. Balance Sheet January 1, 2019 Cash Accounts Receivable IMerchandise Inventory Supplies Prepaid Insurance Prepaid Rent 18,000 Accounts payable Accrued expenses Unearned rent Current portion of Notes Payable 10,000 4,800 3,500 Total Current Liabilities 3,500 Total Current Assets 32,800 Notes Payable 35,700 39,200 Total Liabilities Property, Plant and Equipment Land Building Accumulated Depreciation Office Equipment Accumulated Depreciation Net Property, Plant and Equipment $1 Par Common St. APICS Retained Earnings 14,000 1,000 114,600 37,000 100,000 (21,000) 25,000 5,000) 79,000 20,000 136,000 Total Stockholders Equity Total Liabilities and Stockholders Equity 129,600 168,800 Total Assets 168,800 Adjusting entries 150 1,350 585 278 120 1,250 200 3,300 233 900 Insurance expired during January Supplies on hand on January 31 Depreciation of office equipment for January-office expense Depreciation expense on the building for January-selling expense Accrued receptionist salary on January 31 Accrued shipping wages Rent expense expired during January Unearned rent on January 31 Accrued interest Accrued payroll tax expense Other information for Scruggs Merchandising Inc. Federal and State tax bracket FIFO method of inventory costing Perpetual inventory is used Gross method of recording merchandising transactions 30% Required Complete the full accounting cycle for Scruggs Merchandising Inc. Complete a vertical analysis, horizontal analysis (balance sheet only) and ratio analysis (those from the pink sheet plus gross profit margin and profit margin) Scruggs Merchandising Inc. Balance Sheet January 1, 2019 Cash Accounts Receivable IMerchandise Inventory Supplies Prepaid Insurance Prepaid Rent 18,000 Accounts payable Accrued expenses Unearned rent Current portion of Notes Payable 10,000 4,800 3,500 Total Current Liabilities 3,500 Total Current Assets 32,800 Notes Payable 35,700 39,200 Total Liabilities Property, Plant and Equipment Land Building Accumulated Depreciation Office Equipment Accumulated Depreciation Net Property, Plant and Equipment $1 Par Common St. APICS Retained Earnings 14,000 1,000 114,600 37,000 100,000 (21,000) 25,000 5,000) 79,000 20,000 136,000 Total Stockholders Equity Total Liabilities and Stockholders Equity 129,600 168,800 Total Assets 168,800 Adjusting entries 150 1,350 585 278 120 1,250 200 3,300 233 900 Insurance expired during January Supplies on hand on January 31 Depreciation of office equipment for January-office expense Depreciation expense on the building for January-selling expense Accrued receptionist salary on January 31 Accrued shipping wages Rent expense expired during January Unearned rent on January 31 Accrued interest Accrued payroll tax expense Other information for Scruggs Merchandising Inc. Federal and State tax bracket FIFO method of inventory costing Perpetual inventory is used Gross method of recording merchandising transactions 30% Required Complete the full accounting cycle for Scruggs Merchandising Inc. Complete a vertical analysis, horizontal analysis (balance sheet only) and ratio analysis (those from the pink sheet plus gross profit margin and profit margin)