Answered step by step

Verified Expert Solution

Question

1 Approved Answer

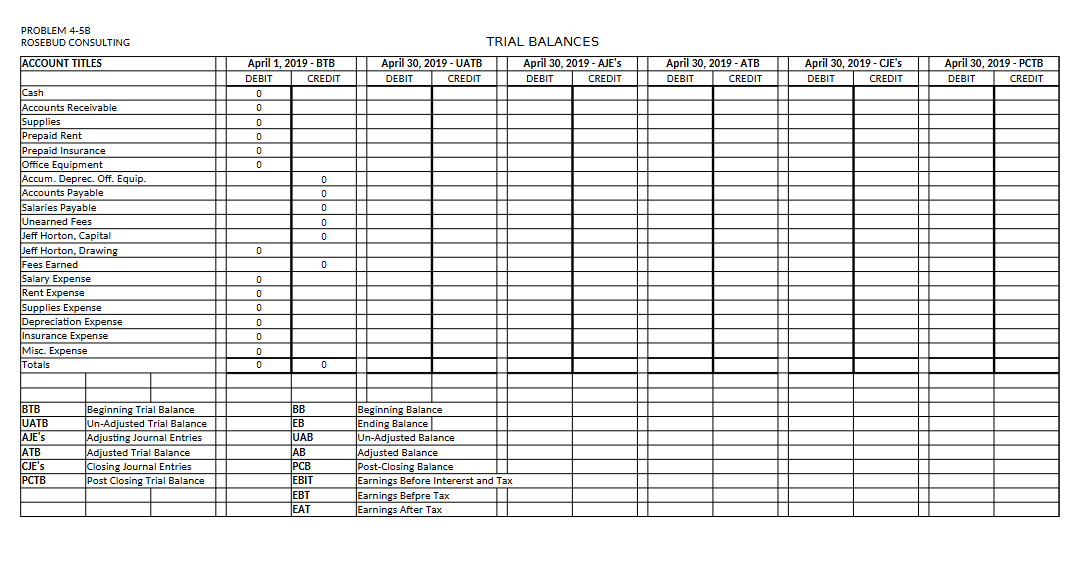

For the past several years, Jeff Horton has operated a part - time consulting business from his home. As of April 1 , 2 0

For the past several years, Jeff Horton has operated a parttime consulting business from his home. As of April Jeff decided to move to rented quarters and to operate the business on a fulltime basis. The business was named Rosebud Consulting. Rosebud Consulting incurred the following transactions during April. PART

Go to the General Ledger and input the April Beginning Balance BB for each account. PART Use the TRANSACTION DESCRIPTIONS below to prepare the April General Journal Entries GJEs

APRIL TRANSACTION DESCRIPTIONS

April : The following assets were received from Jeff Horton: Cash, $; Accounts Receivable, $; Supplies, $; Office Equipment, $ There were no liabilities received. April : Prepaid $ for three months rent. April : Prepaid $ for insurance policies. April : Receive $ of Cash advances from clients for services to be provided in the future. April : Purchased additional office equipment on account, $ April : Received Cash of $ from clients in settlement of Accounts Receivable. April : Paid Cash for newspaper advertisement that was printed on April $ April : Paid $ to partly settle the debt incurred on April April : Provided services on account for work performed April $ April : Paid receptionist for two weeks salary, $ April : Received $ Cash from clients upon delivery of services performed April April : Paid Cash for Supplies, $ April : Provided services on account for work performed April $ April : Received $ Cash from clients upon delivery of services performed April April : Received $ Cash from clients in settlement of Accounts Receivable. April : Paid receptionist for two weeks salary, $ April : Paid bill for April telephone service, $ April : Paid bill for electricity consumed during April, $ April : Received $ Cash from clients upon delivery of services performed April April : Provided services on account for the remainder of April, $ April : Jeff Horton withdrew $ Cash for personal use. PART Post the General Journal Entries to the General Ledger accounts. PART Calculate the April Unadjusted Balance UAB for each ledger account. PART : Prepare an Unadjusted Trial Balance UATB for April PART : Use the information below to prepare the Adjusted Journal Entries AJEs for April DATA FOR ADJUSTING ENTRIES a Prepaid Insurance that expired during April is $ b Supplies on hand April are $ c Depreciation of Office Equipment for April is $ d Accrued receptionist salary on April is $ e Prepaid Rent that expired during April is $ f Unearned Fees on April are $ PART Post the Adjusting Journal Entries to the General Ledger accounts. PART Calculate the April Adjusted Balance AB for each ledger account. PART Prepare an Adjusted Trial Balance ATB for April PART Use the Adjusted Trial Balance to prepare an Income Statement for the month ending April PART

Prepare the CLOSING JOURNAL ENTRIES CJEs for April PART

Post the Closing Journal Entries to the General Ledger accounts. PART Calculate the Post Closing Balance PCB for each General Ledger account. PART Prepare a PostClosing Trial Balance PCTB for April PART Prepare a Statement of Shareholders Equity for the month ending April PART Prepare a Statement of Cash Flows for the month ending April Use the direct method. Part Prepare a balance sheet for April PROBLEM B ROSEBUD CONSULTING

GENERAL JOURNAL

begintabularcccccc

hline DATE & TRANSACTION DESCRIPTION & ACCOUNTS AFFECTED & DEBIT & CREDIT & CASH FLOW EFFECT

hline GJE's & & & & &

hline April & Jeff Horton invested capital into the business. & & & &

hline & & & & &

hline & & & & &

hline & & & & &

hline & & & & &

hline & & & & &

hline April & Paid three monts' rent in advance. & & & &

hline & & & & &

hline & & & & &

hline April & Purchased insurance policies. & & & &

hline & & & & &

hline & & & & &

hline April & Received cash advance from clients. & & & &

hline & & & & &

hline & & & & &

hline April & Purchase office equipment on account. & & & &

hline & & & & &

hline & & & & &

hline April & Received payment from clients on account. & & & &

hline & & & & &

hline & & & & &

hline April & Paid advertising for ad's that were printed. & & & &

hline & & & & &

hline & & & & &

hline April & Made payment on off. Equip. Accts Payable & & & &

hline & & & & &

hline & & & & &

hline April & Provided services on account April & & & &

hline & & & & &

hline & & & & &

hline DATE & TRANSACTION DESCRIPTION & ACCOUN PROBLEM B

ROSEBUD CONSULTING

GENERAL JOURNAL PROBLEM B

ROSEBUD CONSULTING

GENERAL JOURNAL

begintabularcccccccc

hline April & Jeff Horton withdrew for personal use. & & & & & &

hline & & & & & & &

hline & & & & & & &

hline April & ADJUSTING JOURNAL ENTRY a & & & & & &

hline & & & & & & &

hline & & & & & & &

hline & ADJUSTING JOURNAL ENTRY b & & & & & &

hline & & & & & & &

hline & & & & & & &

hline & ADJUSTING JOURNAL ENTRY c & & & & & &

hline & & & & & & &

hline & & & & & & &

hline & ADJUSTING JOURNAL ENTRY d & & & & & &

hline & & & & PROBLEM B

ROSEBUD CONSULTING

GENERAL LEDGER ACCOUNTS

begintabularcccccccccccccccc

hline & CASH & multicolumnlACCOUNTS RECEIVABLE & multicolumnlSUPPLES & multicolumnlPREPAID RENT & multicolumnlPREPAID INSURANCE & multicolumn

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started