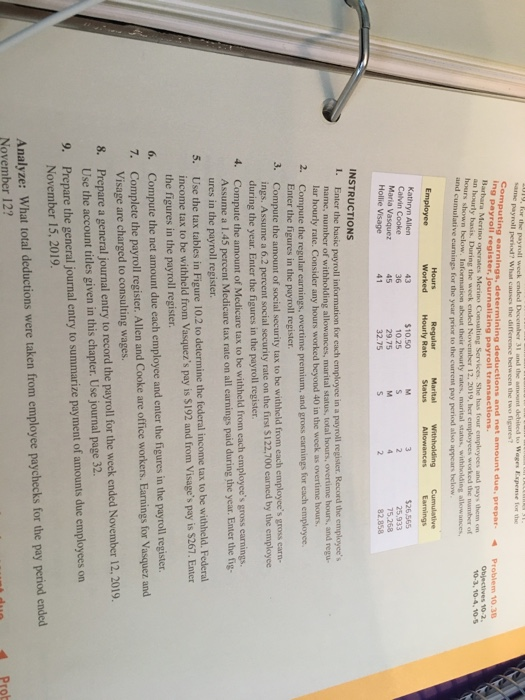

for the payroll week ended December 31 and the match Wax Expense to the same payroll perd? What causes the difference between computing earnings, determining deductions and net amount due, prepare Payroll register, Journalaing payroll transactions. Barbara Merino operates Mering Consulting Services. She has four employees and pay then om curly basis. During the week ended November 12, 2019, her employees worked the bar of shown below. Information about their hourly rates, marital status, withholding allowances, cumulative carnings for the year prior to the current pay period appears blow Problem 10.30 Objectives 10-2 VO-3, 104, 10-5 Employee Hours Worked Regular Hourly Rate Marital Status Withholding Allowances Cumulative Earnings Kathryn Allen Calvin Cooke Maria Vasquez Hollie Visage $10.50 10.25 29.75 32.75 $25,565 25,933 75.268 82858 INSTRUCTIONS 1. Enter the basic payroll information for each employee in a payroll register Record the employee's name, number of withholding allowances, marital status, total lours, overtime hours, and regu lar hourly rate. Consider any hours worked beyond 40 in the week as overtime lours 2. Compute the regular earnings, overtime premium, and gross earnings for each employee Enter the figures in the payroll register. 3. Compute the amount of social security tax to be withheld from each employee's rosa carne ings. Assume a 6.2 percent social security rate on the first $122,700 earned by the employee during the year. Enter the figures in the payroll register. 4. Compute the amount of Medicare tax to be withheld from each employee's gross earnings. Assume a 1.45 percent Medicare tax rate on all earnings paid during the year. Enter the lige ures in the payroll register. 5. Use the tax tables in Figure 10.2 to determine the federal income tax to be withheld. Federal income tax to be withheld from Vasquez's pay is $192 and from Visage's pay is $267. Enter the figures in the payroll register. 6. Compute the net amount due each employee and enter the figures in the payroll register. 7. Complete the payroll register. Allen and Cooke are office workers. Earnings for Vasquez and Visage are charged to consulting wages. 8. Prepare a general journal entry to record the payroll for the week ended November 12, 2019. Use the account titles given in this chapter. Use journal page 32. 9. Prepare the general journal entry to summarize payment of amounts due employees on November 15, 2019. Analyze: What total deductions were taken from employee paychecks for the pay period ended November 12? dun Pro