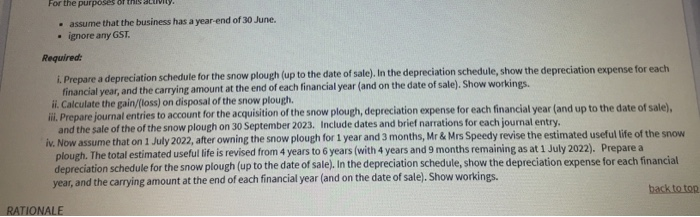

For the purposes of this all - assume that the business has a year-end of 30 June. ignore any GST Required: i. Prepare a depreciation schedule for the snow plough (up to the date of sale). In the depreciation schedule, show the depreciation expense for each financial year, and the carrying amount at the end of each financial year (and on the date of sale). Show workings. ii. Calculate the pain/(loss) on disposal of the snow plough. ili. Prepare journal entries to account for the acquisition of the snow plough, depreciation expense for each financial year (and up to the date of sale), and the sale of the of the snow plough on 30 September 2023. Include dates and brief narrations for each journal entry, iv. Now assume that on 1 July 2022, after owning the snow plough for 1 year and 3 months, Mr & Mrs Speedy revise the estimated useful life of the snow plough. The total estimated useful life is revised from 4 years to 6 years (with 4 years and 9 months remaining as at 1 July 2022). Prepare a depreciation schedule for the snow plough (up to the date of sale). In the depreciation schedule, show the depreciation expense for each financial year, and the carrying amount at the end of each financial year (and on the date of sale). Show workings. back to top RATIONALE For the purposes of this all - assume that the business has a year-end of 30 June. ignore any GST Required: i. Prepare a depreciation schedule for the snow plough (up to the date of sale). In the depreciation schedule, show the depreciation expense for each financial year, and the carrying amount at the end of each financial year (and on the date of sale). Show workings. ii. Calculate the pain/(loss) on disposal of the snow plough. ili. Prepare journal entries to account for the acquisition of the snow plough, depreciation expense for each financial year (and up to the date of sale), and the sale of the of the snow plough on 30 September 2023. Include dates and brief narrations for each journal entry, iv. Now assume that on 1 July 2022, after owning the snow plough for 1 year and 3 months, Mr & Mrs Speedy revise the estimated useful life of the snow plough. The total estimated useful life is revised from 4 years to 6 years (with 4 years and 9 months remaining as at 1 July 2022). Prepare a depreciation schedule for the snow plough (up to the date of sale). In the depreciation schedule, show the depreciation expense for each financial year, and the carrying amount at the end of each financial year (and on the date of sale). Show workings. back to top RATIONALE