Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the question, Yellow is the core information of the question, blue is the Project Details, green is at the start of the Problem Section,

For the question, Yellow is the core information of the question, blue is the Project Details, green is at the start of the Problem Section, and I included just incase it was necessary. The two parts of the question are at the bottom. Please show all work in an excel spreadsheet and label Part A and B. Thank you very much!

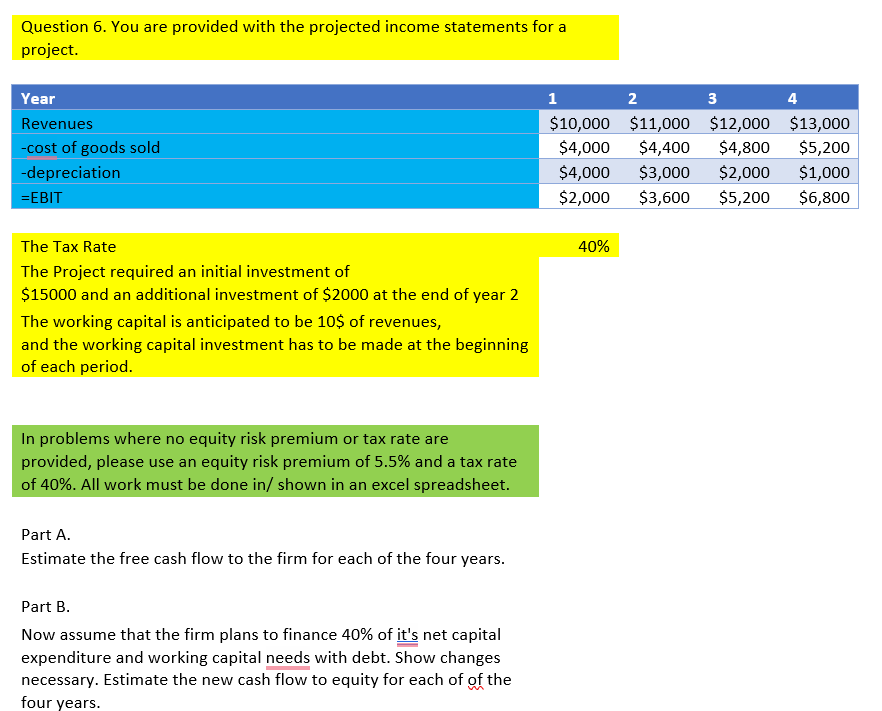

Question 6. You are provided with the projected income statements for a project. In problems where no equity risk premium or tax rate are provided, please use an equity risk premium of 5.5% and a tax rate of 40%. All work must be done in/ shown in an excel spreadsheet. Part A. Estimate the free cash flow to the firm for each of the four years. Part B. Now assume that the firm plans to finance 40% of it's net capital expenditure and working capital needs with debt. Show changes necessary. Estimate the new cash flow to equity for each of of the four yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started