Question

2. (30) For the sake of simplicity, assume that in each year, each company reinvests all of its retained earnings into a single investment

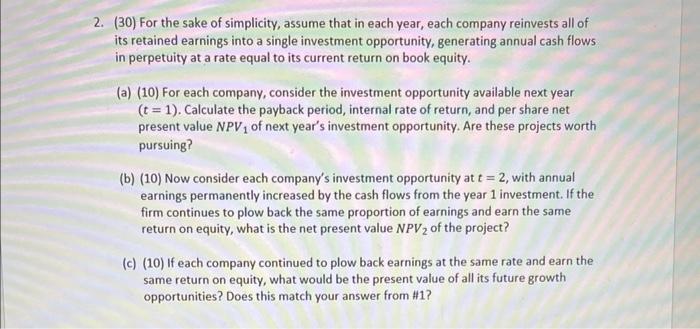

2. (30) For the sake of simplicity, assume that in each year, each company reinvests all of its retained earnings into a single investment opportunity, generating annual cash flows in perpetuity at a rate equal to its current return on book equity. (a) (10) For each company, consider the investment opportunity available next year (t = 1). Calculate the payback period, internal rate of return, and per share net present value NPV1 of next year's investment opportunity. Are these projects worth pursuing? (b) (10) Now consider each company's investment opportunity at t = 2, with annual earnings permanently increased by the cash flows from the year 1 investment. If the firm continues to plow back the same proportion of earnings and earn the same return on equity, what is the net present value NPV2 of the project? (c) (10) If each company continued to plow back earnings at the same rate and earn the same return on equity, what would be the present value of all its future growth opportunities? Does this match your answer from #1?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started