Answered step by step

Verified Expert Solution

Question

1 Approved Answer

for the second part i want to know how it is capitalized and amortized the 6,000 using cash and accrual method. economic performance has occurred.

for the second part i want to know how it is capitalized and amortized the 6,000 using cash and accrual method.

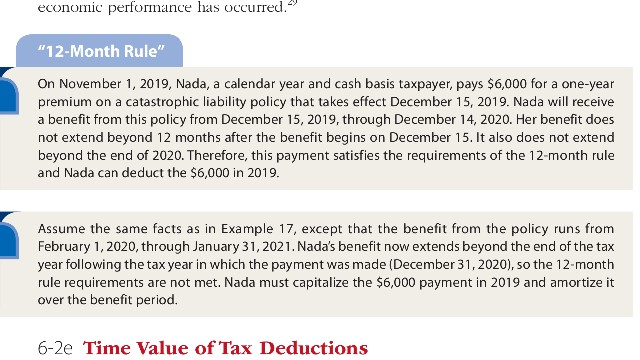

economic performance has occurred. "12-Month Rule" On November 1, 2019, Nada, a calendar year and cash basis taxpayer, pays $6,000 for a one-year premium on a catastrophic liability policy that takes effect December 15, 2019. Nada will receive a benefit from this policy from December 15, 2019, through December 14, 2020. Her benefit does not extend beyond 12 months after the benefit begins on December 15. It also does not extend beyond the end of 2020. Therefore, this payment satisfies the requirements of the 12-month rule and Nada can deduct the $6,000 in 2019. Assume the same facts as in Example 17, except that the benefit from the policy runs from February 1, 2020, through January 31, 2021. Nada's benefit now extends beyond the end of the tax year following the tax year in which the payment was made (December 31,2020), so the 12-month rule requirements are not met. Nada must capitalize the $6,000 payment in 2019 and amortize it over the benefit period. 6-2e Time Value of Tax Deductions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started