Question

For the transactions from 1 January 2021 until March 2021, prepare journal entries assuming all the transactions are paid in cash. Show all the relevant

For the transactions from 1 January 2021 until March 2021, prepare journal entries assuming all the transactions are paid in cash. Show all the relevant workings, ignore narrations for journal entries.

b) For the 31 July 2021 transaction, calculate how much gains/losses on exchange and prepare entries for Medi-care to record the trade following two circumstances as belowe The exchange has commercial substance and the old equipment has trade-in allowances of RM3,000

The exchange has commercial substance and the old equipment has trade-in allowances of RM7000

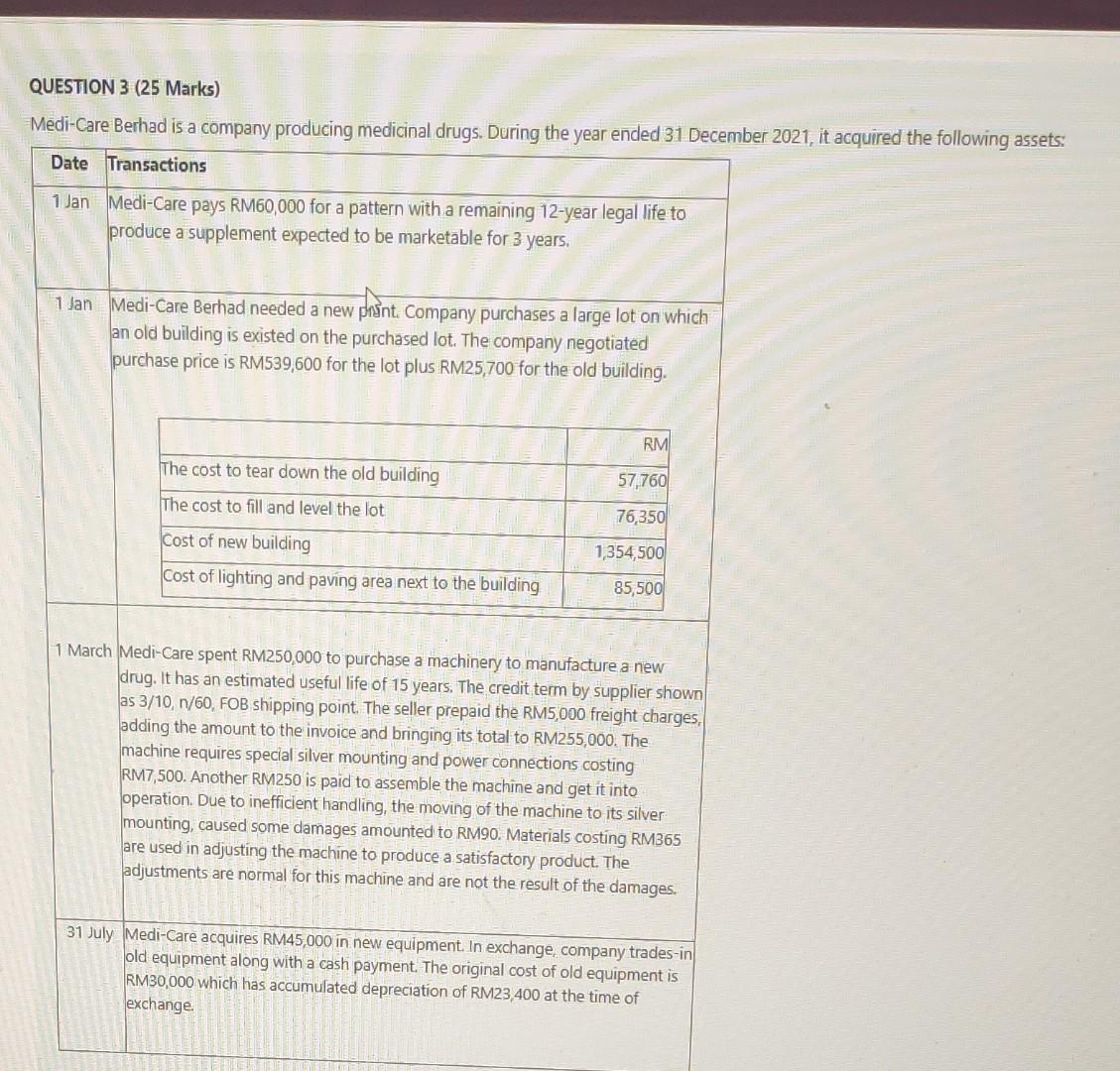

QUESTION 3 (25 Marks) Medi-Care Berhad is a company producing medicinal drugs. During the year ended 31 December 2021, it acquired the following assets: Date Transactions 1 Jan Medi-Care pays RM60,000 for a pattern with a remaining 12-year legal life to produce a supplement expected to be marketable for 3 years. 1 Jan Medi-Care Berhad needed a new prant. Company purchases a large lot on which an old building is existed on the purchased lot. The company negotiated purchase price is RM539,600 for the lot plus RM25,700 for the old building. The cost to tear down the old building The cost to fill and level the lot Cost of new building Cost of lighting and paving area next to the building RM 57,760 76,350 1,354,500 85,500 1 March Medi-Care spent RM250,000 to purchase a machinery to manufacture a new drug. It has an estimated useful life of 15 years. The credit term by supplier shown as 3/10, n/60, FOB shipping point. The seller prepaid the RM5,000 freight charges, adding the amount to the invoice and bringing its total to RM255,000. The machine requires special silver mounting and power connections costing RM7,500. Another RM250 is paid to assemble the machine and get it into operation. Due to inefficient handling, the moving of the machine to its silver mounting, caused some damages amounted to RM90. Materials costing RM365 are used in adjusting the machine to produce a satisfactory product. The adjustments are normal for this machine and are not the result of the damages. 31 July Medi-Care acquires RM45,000 in new equipment. In exchange, company trades-in old equipment along with a cash payment. The original cost of old equipment is RM30,000 which has accumulated depreciation of RM23,400 at the time of exchangeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started