Answered step by step

Verified Expert Solution

Question

1 Approved Answer

for the year 1 and 2 please x P 9-5 (similar to) Kokomochi is considering the launch of an advertising campaign for its latest dessert

for the year 1 and 2 please

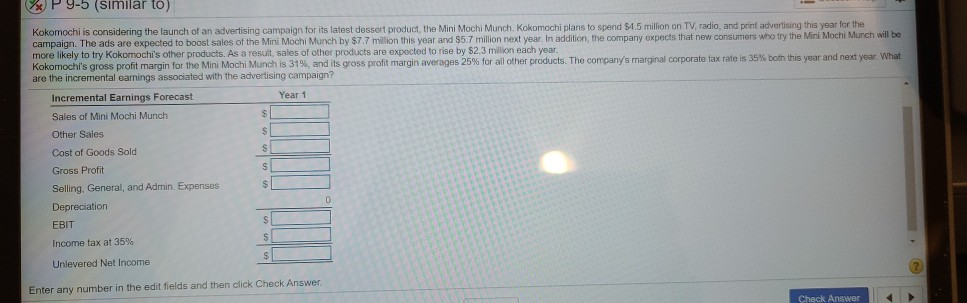

x P 9-5 (similar to) Kokomochi is considering the launch of an advertising campaign for its latest dessert product the Mini Mochi Munch. Kokomochi plans to spend 51.5 million on TV, radio, and print advertising this year for the campaign. The ads are expected to boost sales of the Mini Mochi Munch by $7.7 million this year and $5.7 million next year. In addition, the company expects that new consumers who try the Mini Mochi Munch will be more likely to try Kokomochi's other products. As a result, sales of other products are expected to rise by $2.3 million each year. Kokomochi's gross profit margin for the Mini Mochi Munch is 31%, and its gross profit margin averages 25% for all other products. The company's marginal corporate tax rate is 35% both this year and next year. What are the incremental earnings associated with the advertising campaign? Incremental Earnings Forecast Year 1 Sales of Mini Mochi Munch Other Sales $ Cost of Goods Sold $ Gross Profit s Selling, General, and Admin Expenses $ Depreciation EBIT $ Income tax at 35% 5 Unlevered Net Income 0 ? Enter any number in the edit fields and then click Check Answer CheckStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started