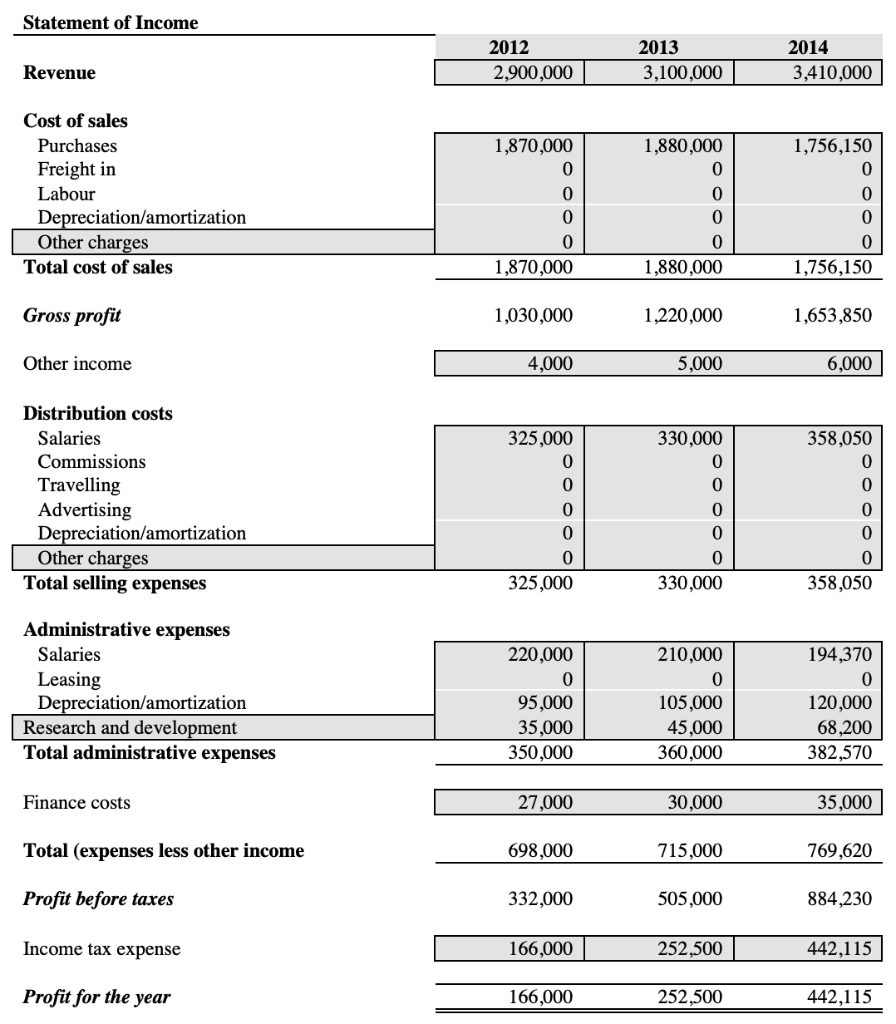

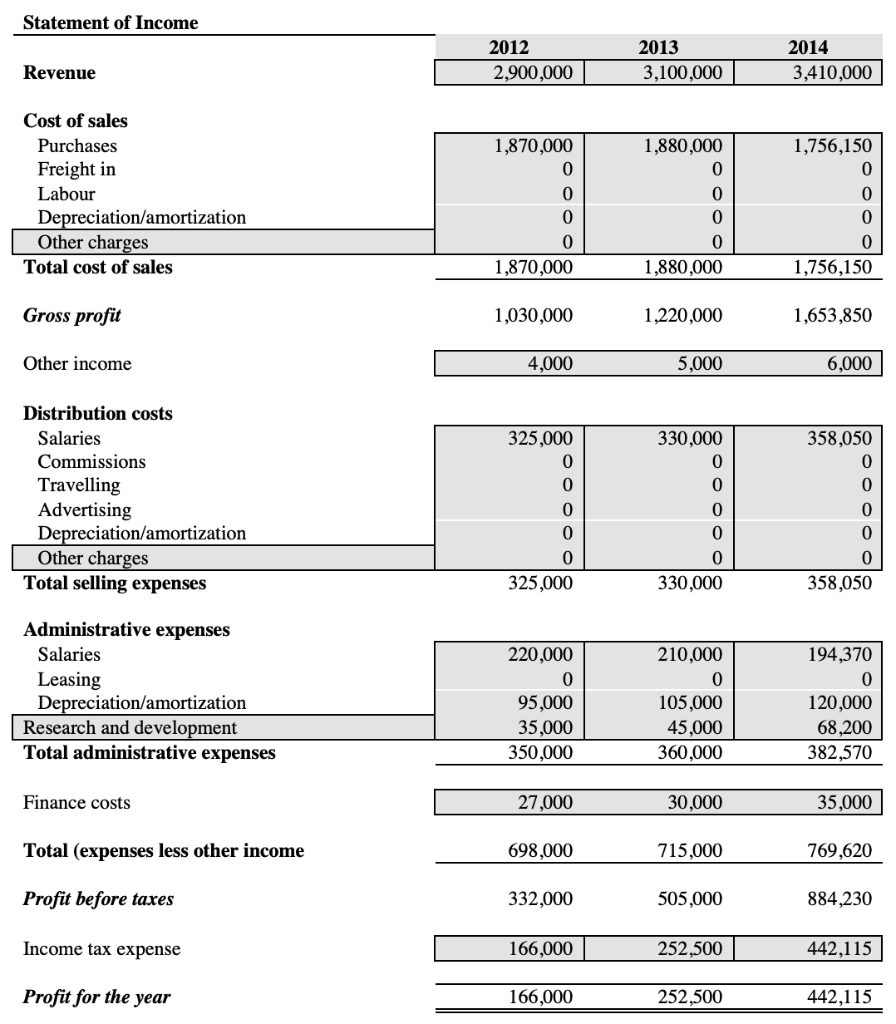

For the year 2013 and also 2014 find the profitability ratio

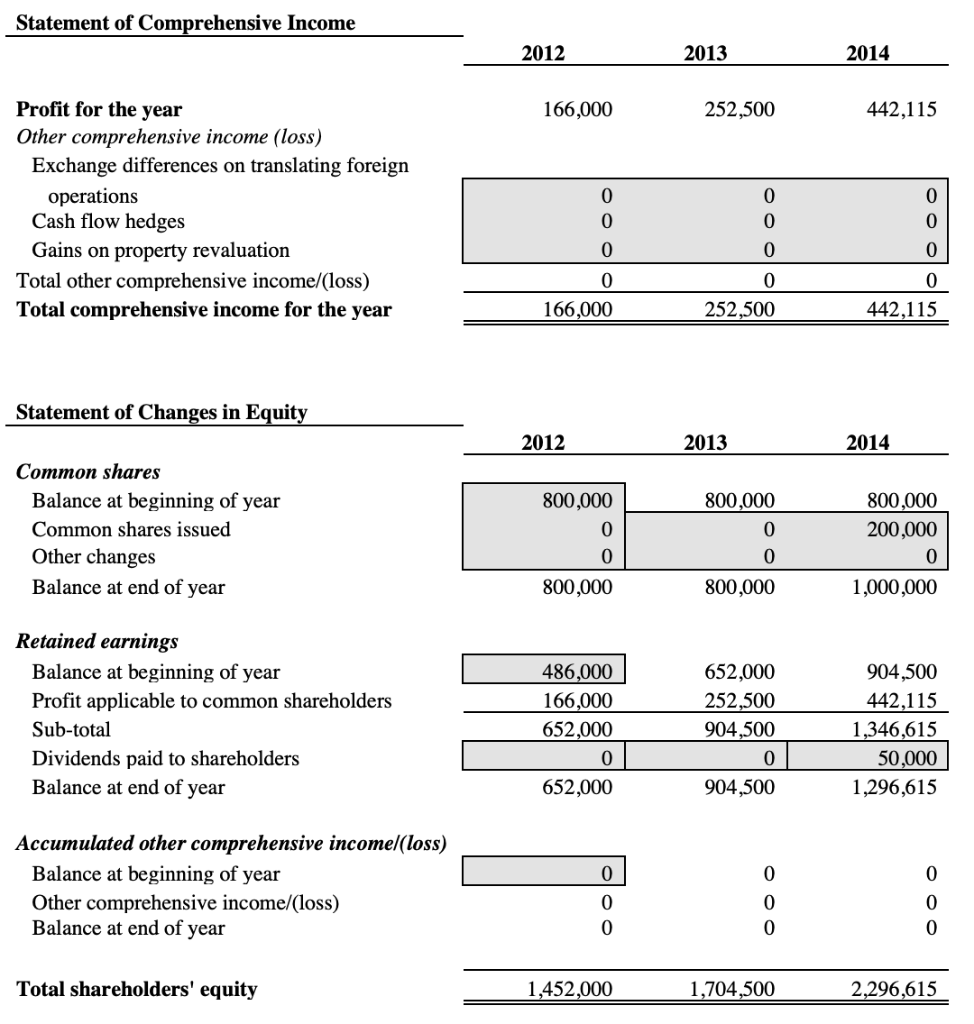

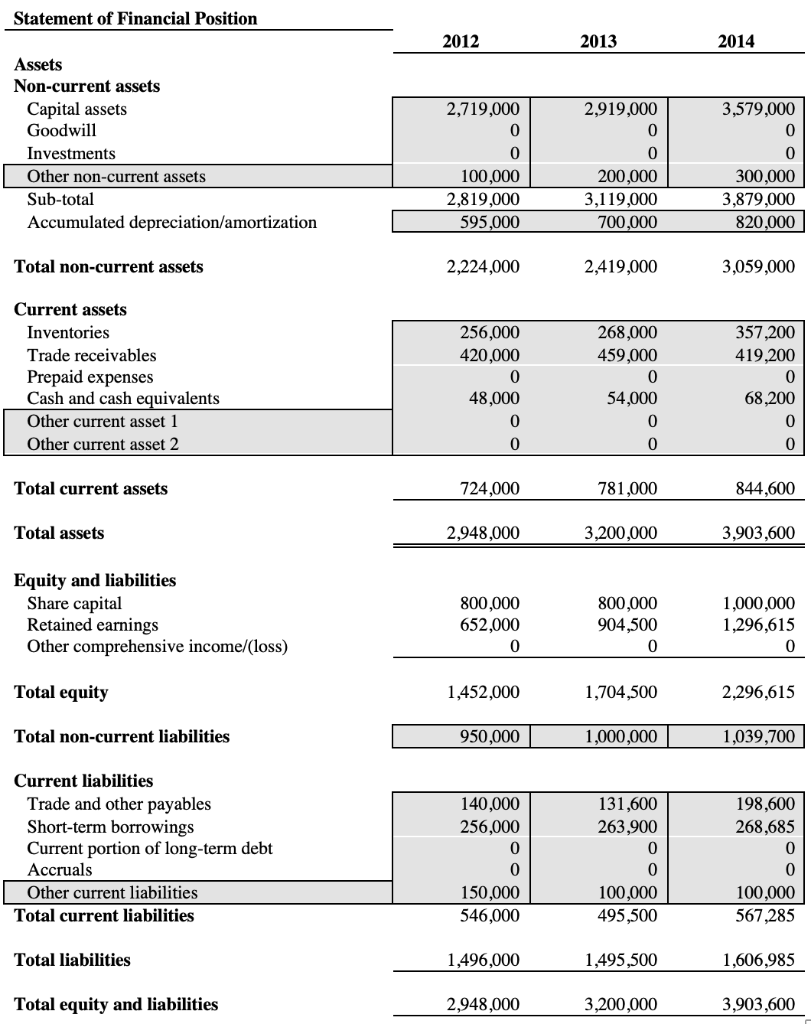

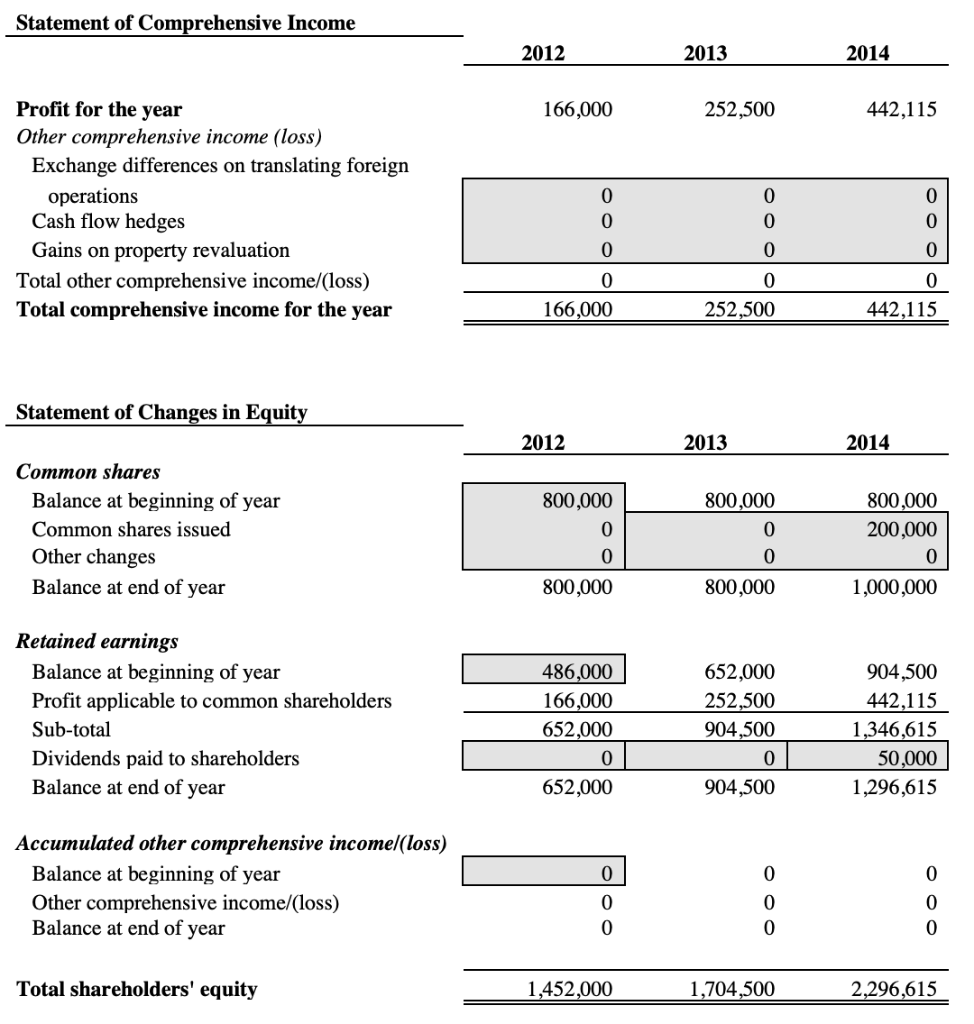

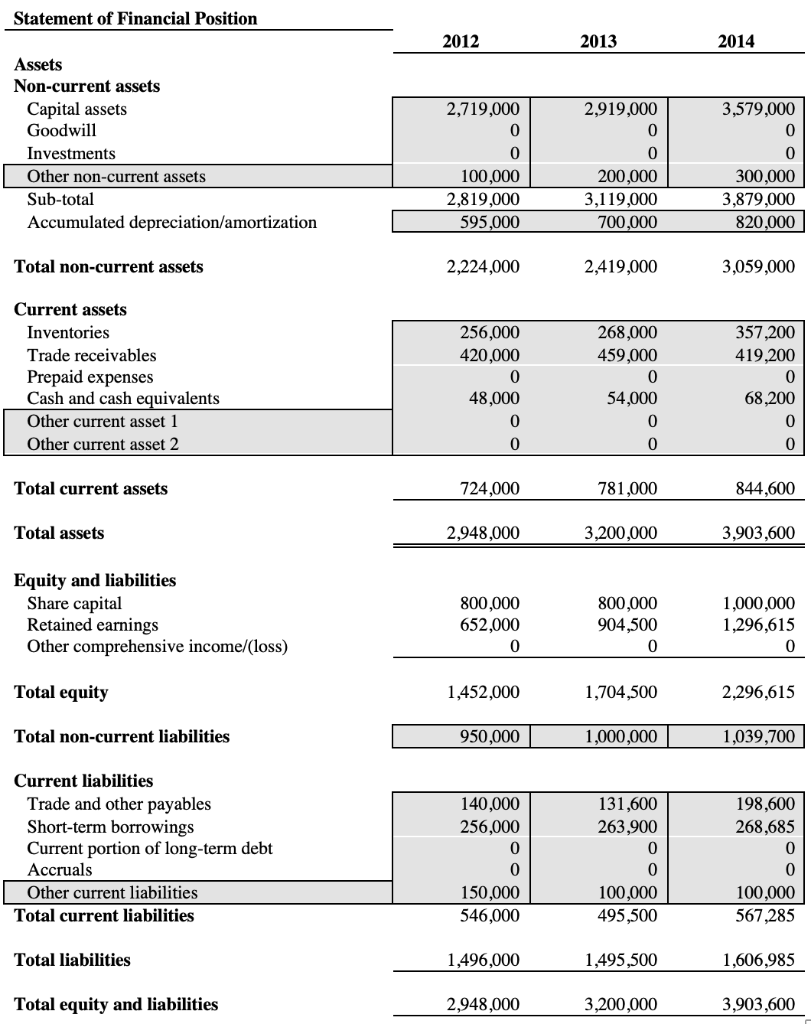

Statement of Income 2012 2,900,000 2013 3,100,000 2014 3,410,000 Revenue 1,880,000 1,756,150 0 Cost of sales Purchases Freight in Labour Depreciation/amortization Other charges Total cost of sales 1,870,000 0 0 0 0 1,870,000 0 0 0 1,880,000 0 0 0 1,756,150 Gross profit 1,030,000 1,220,000 1,653,850 Other income 4,000 5,000 6,000 325,000 Distribution costs Salaries Commissions Travelling Advertising Depreciation/amortization Other charges Total selling expenses 0 0 0 0 325,000 330,000 0 0 0 0 0 330,000 358,050 0 0 0 0 0 358,050 Administrative expenses Salaries Leasing Depreciation/amortization Research and development Total administrative expenses 220,000 0 95,000 35,000 350,000 210,000 0 105,000 45,000 360,000 194,370 0 120,000 68,200 382,570 Finance costs 27,000 30,000 35,000 Total (expenses less other income 698,000 715,000 769,620 Profit before taxes 332,000 505,000 884,230 Income tax expense 166,000 252,500 442,115 Profit for the year 166,000 252,500 442,115 Statement of Comprehensive Income 2012 2013 2014 166,000 252,500 442,115 0 0 Profit for the year Other comprehensive income (loss) Exchange differences on translating foreign operations Cash flow hedges Gains on property revaluation Total other comprehensive income/(loss) Total comprehensive income for the year 0 0 0 0 0 0 0 0 0 252,500 0 442,115 166,000 Statement of Changes in Equity 2012 2013 2014 800,000 Common shares Balance at beginning of year Common shares issued Other changes Balance at end of year 800,000 0 0 0 800,000 200,000 0 1,000,000 0 800,000 800,000 Retained earnings Balance at beginning of year Profit applicable to common shareholders Sub-total Dividends paid to shareholders Balance at end of year 486,000 166,000 652,000 652,000 252,500 904,500 0 904,500 904,500 442,115 1,346,615 50,000 1,296,615 0 652,000 0 0 0 Accumulated other comprehensive income (loss) Balance at beginning of year Other comprehensive income/(loss) Balance at end of year 0 0 0 0 0 0 Total shareholders' equity 1,452,000 1,704,500 2,296,615 Statement of Financial Position 2012 2013 2014 2,919,000 0 Assets Non-current assets Capital assets Goodwill Investments Other non-current assets Sub-total Accumulated depreciation/amortization 2,719,000 0 0 100,000 2,819,000 595,000 3,579,000 0 0 300,000 3,879,000 820,000 200,000 3,119,000 700,000 Total non-current assets 2,224,000 2,419,000 3,059,000 Current assets Inventories Trade receivables Prepaid expenses Cash and cash equivalents Other current asset 1 Other current asset 2 256,000 420,000 0 48,000 0 268,000 459,000 0 54,000 0 0 357,200 419,200 0 68,200 0 0 0 Total current assets 724,000 781,000 844,600 Total assets 2,948,000 3,200,000 3,903,600 Equity and liabilities Share capital Retained earnings Other comprehensive income/loss) 800,000 652,000 0 800,000 904,500 0 1,000,000 1,296,615 0 Total equity 1,452,000 1,704,500 2,296,615 Total non-current liabilities 950,000 1,000,000 1,039,700 Current liabilities Trade and other payables Short-term borrowings Current portion of long-term debt Accruals Other current liabilities Total current liabilities 140,000 256,000 0 0 150,000 546,000 131,600 263,900 0 0 100,000 495,500 198,600 268,685 0 0 100,000 567,285 Total liabilities 1,496,000 1,495,500 1,606,985 Total equity and liabilities 2,948,000 3,200,000 3,903,600