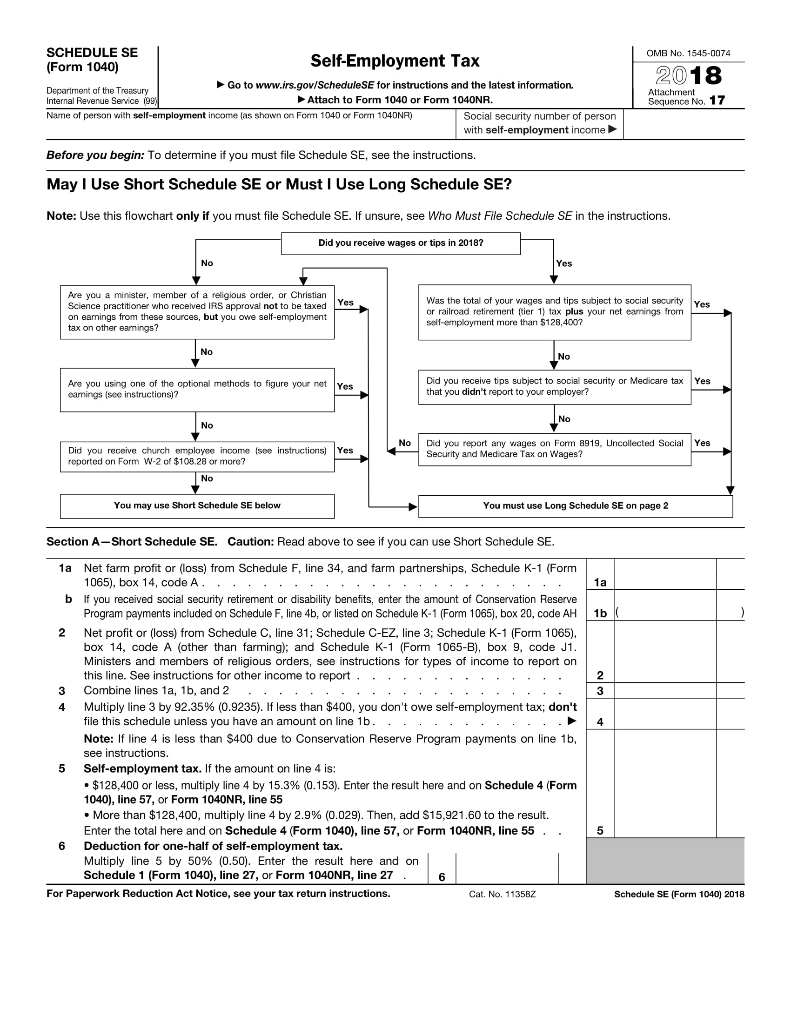

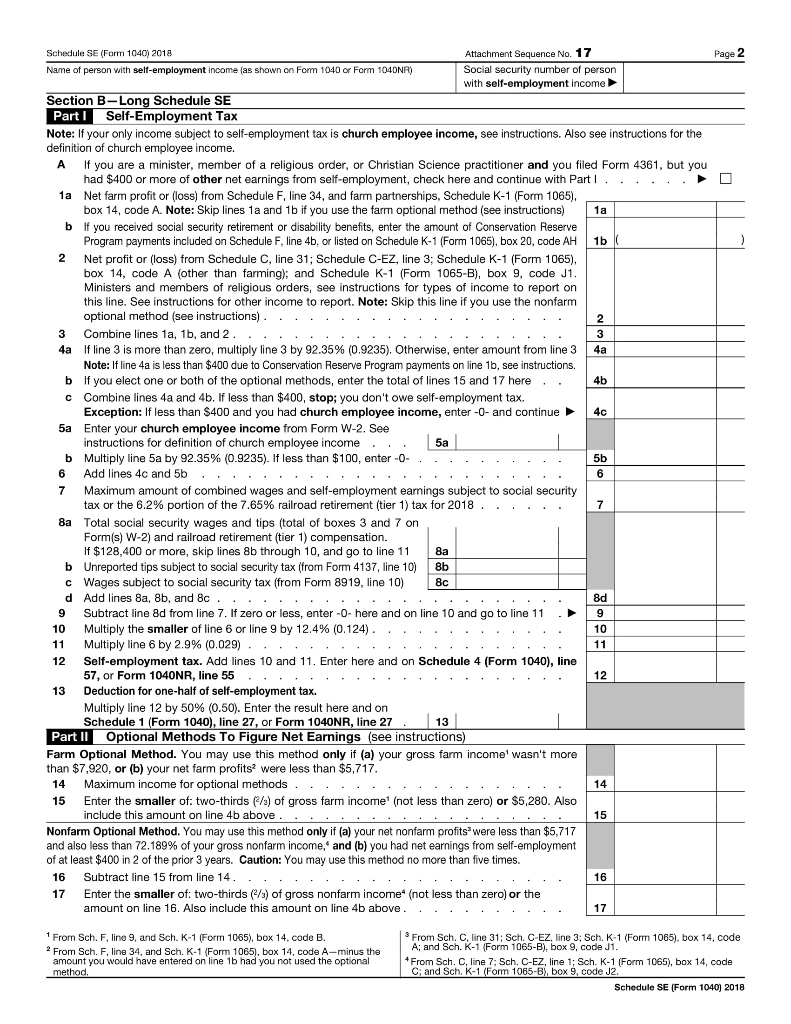

For the year 2018 i need Marias: -1040 -Schedule 1 -Schedule 4 -Schedule 5 -Schedule C -Schedule SE Please provide the correct numbers and properly written for the above forms. All the information is provided-

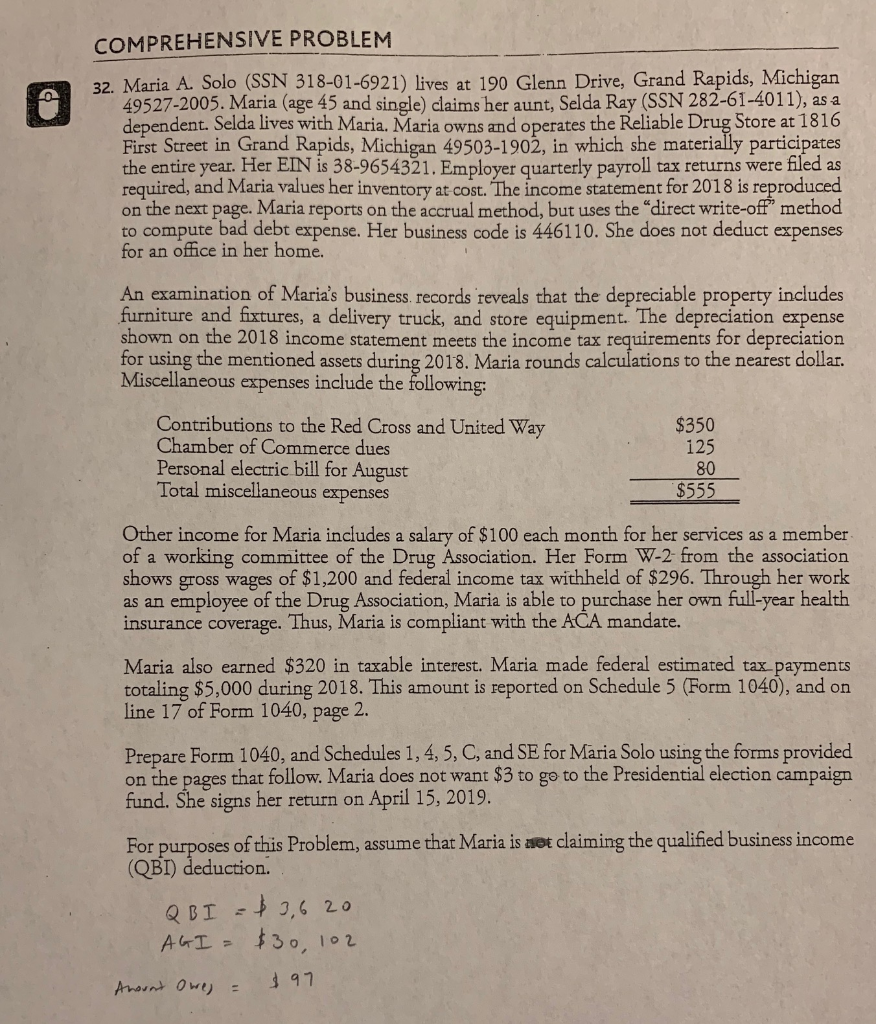

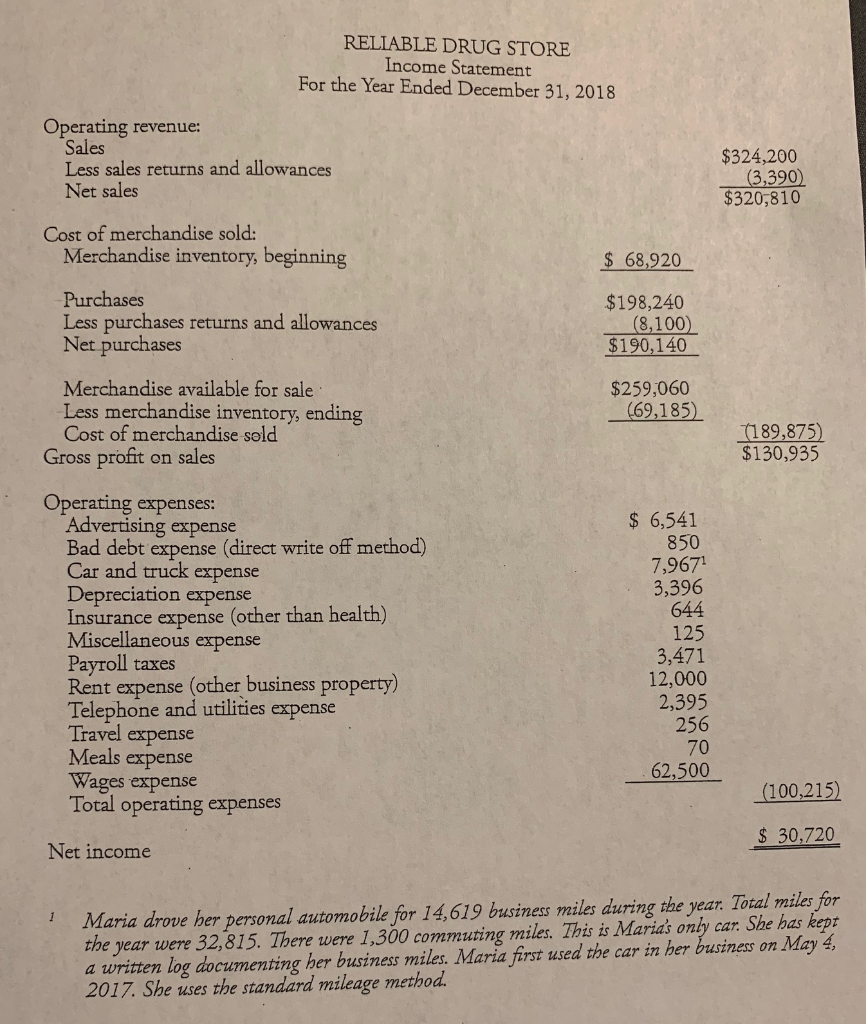

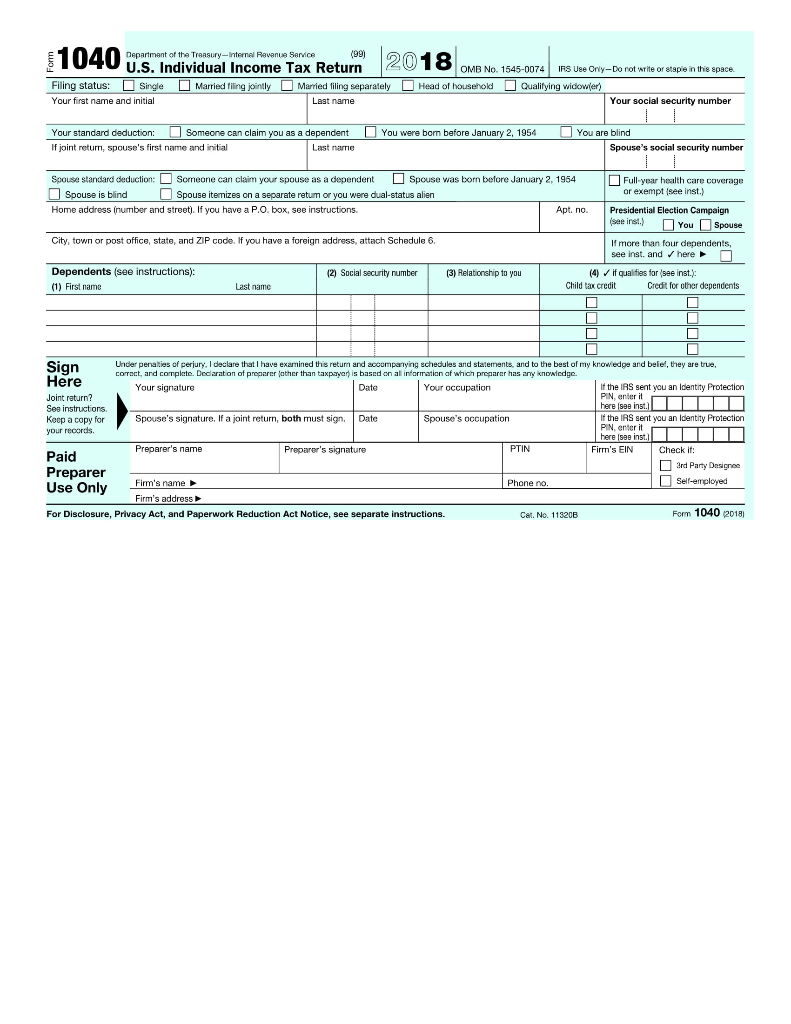

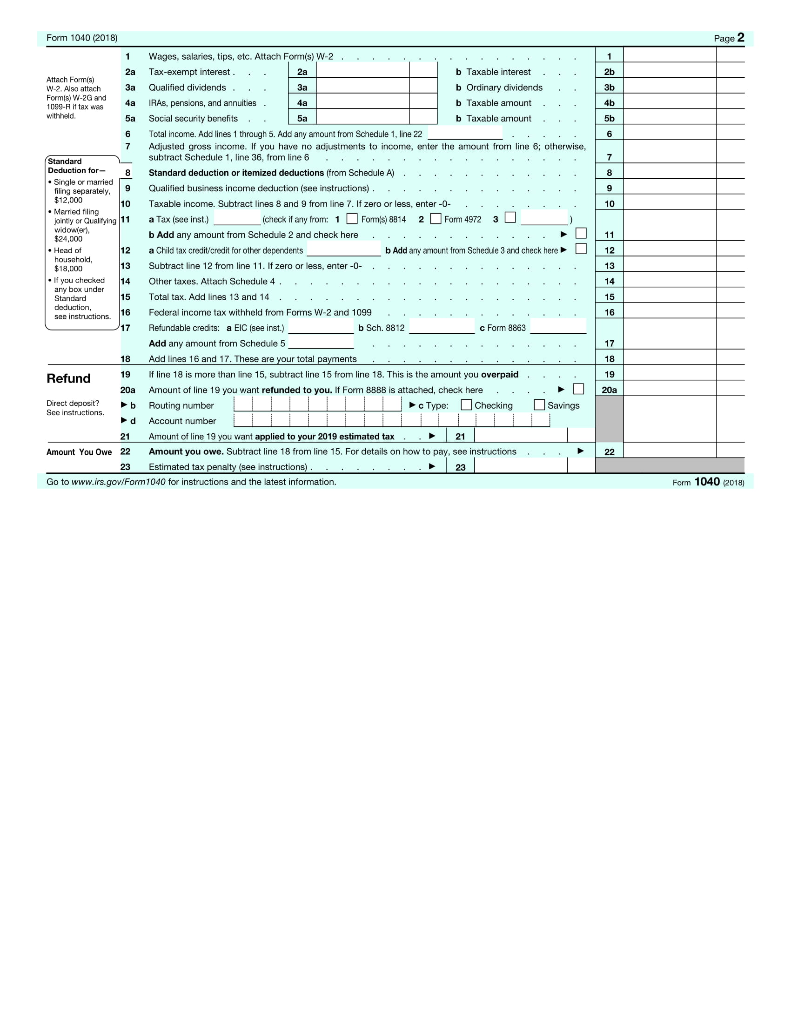

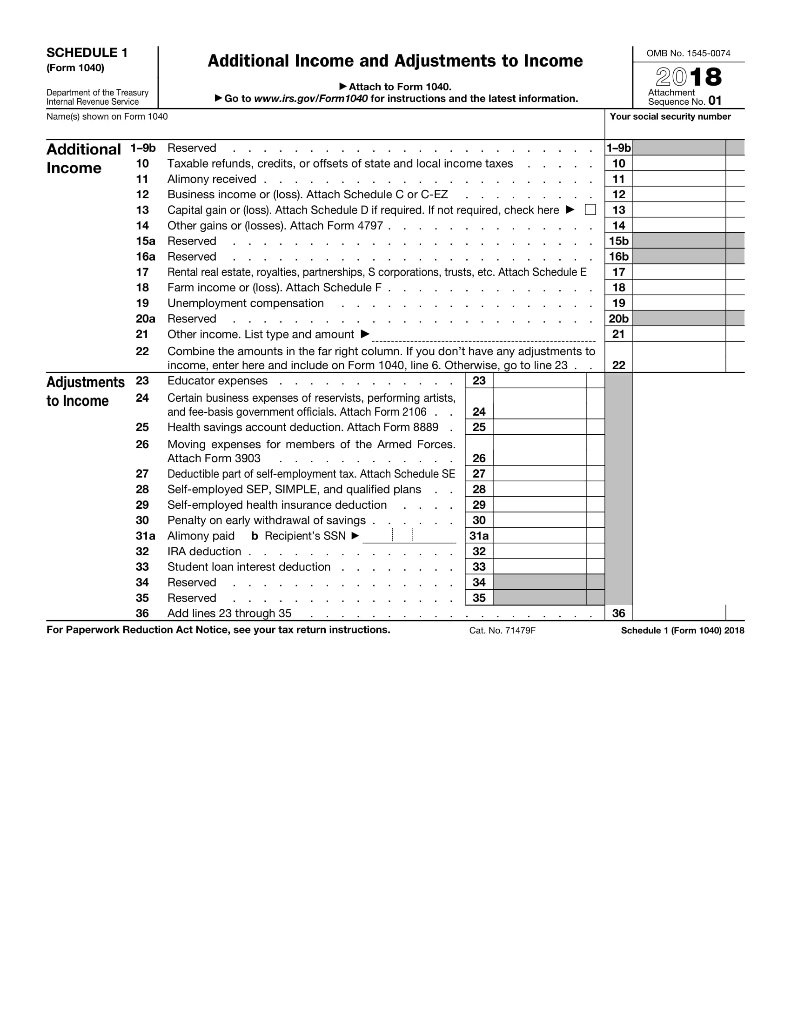

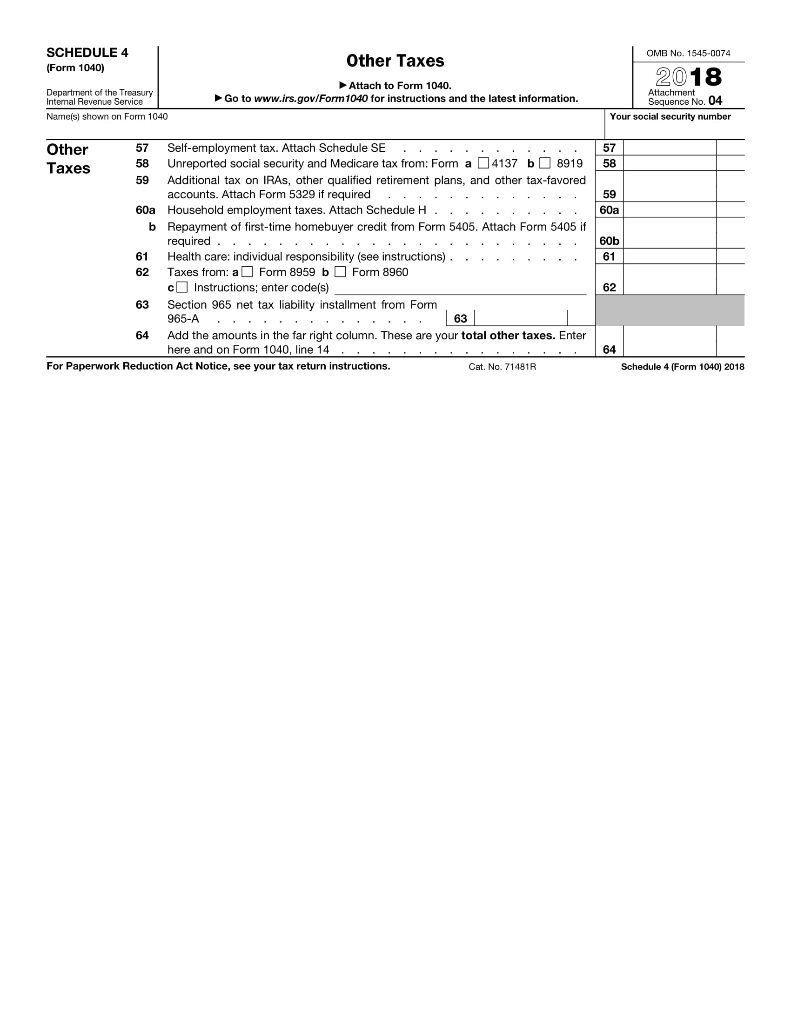

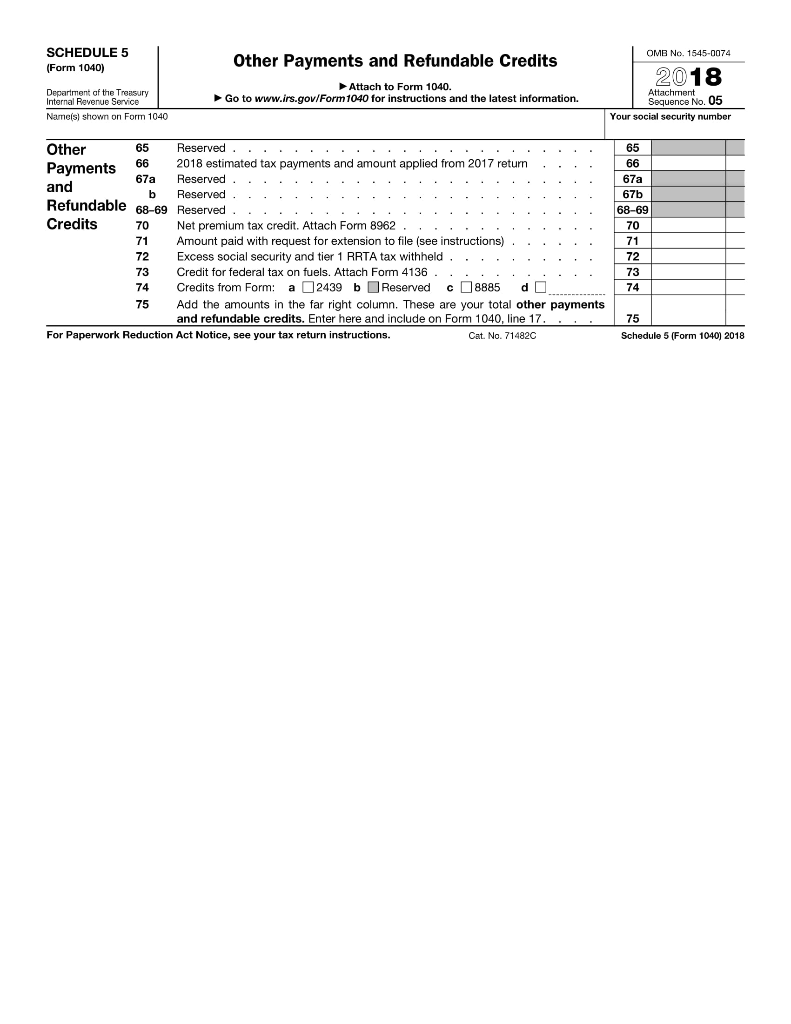

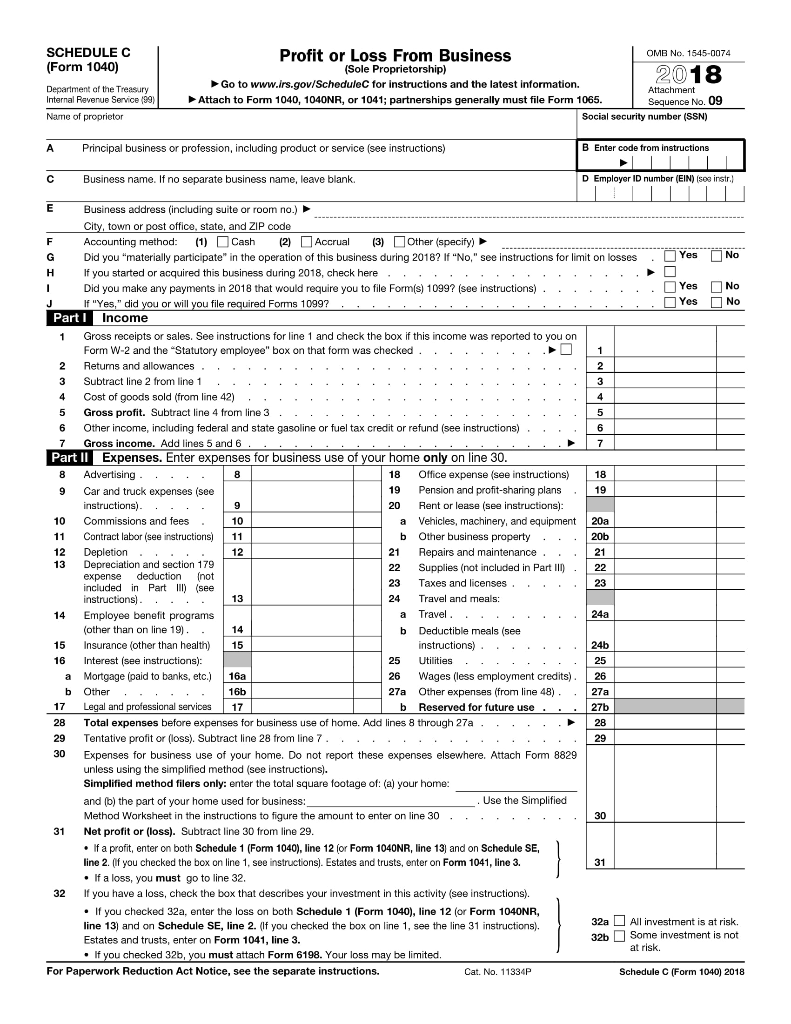

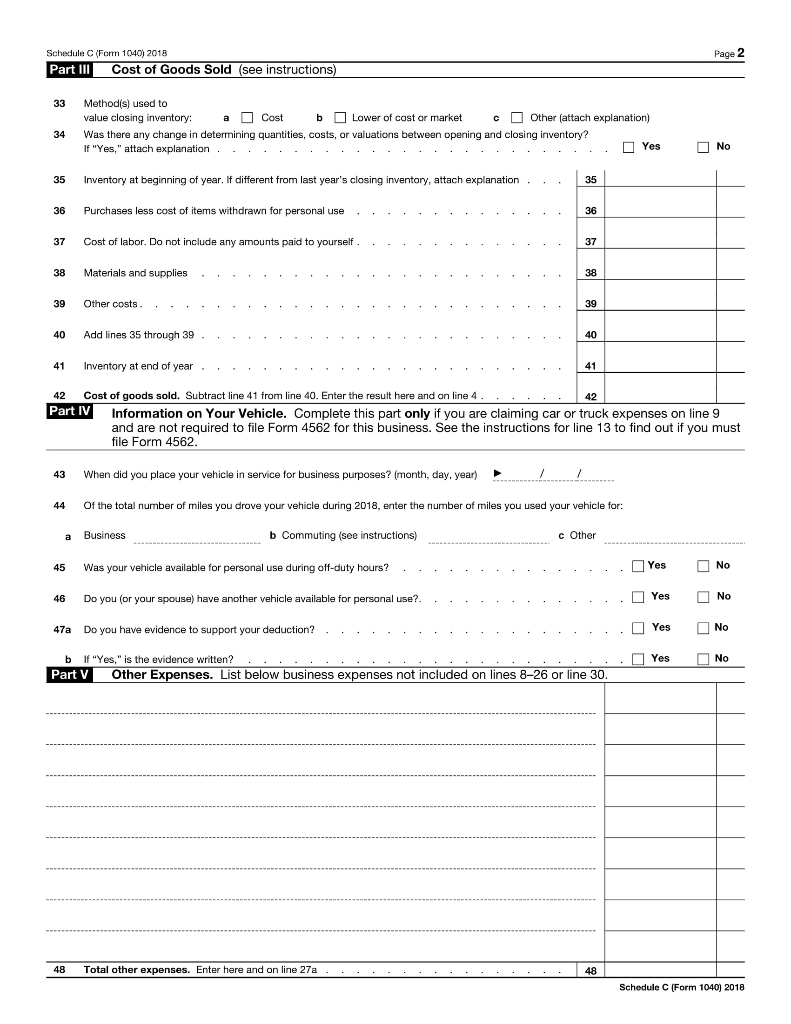

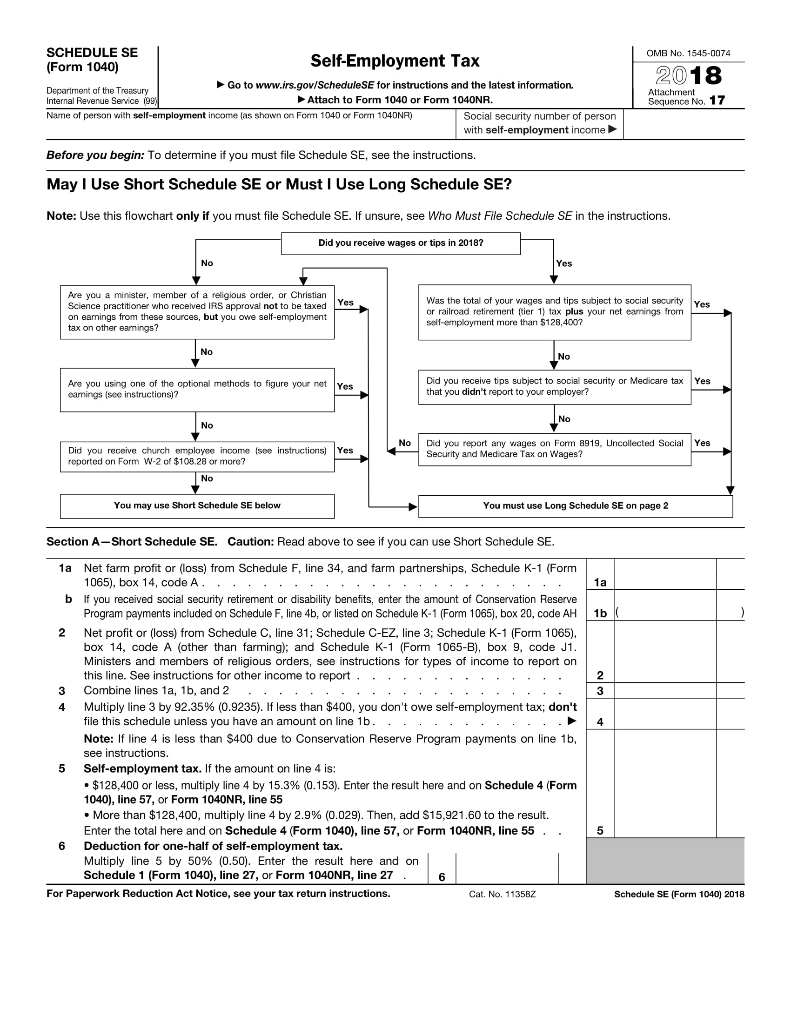

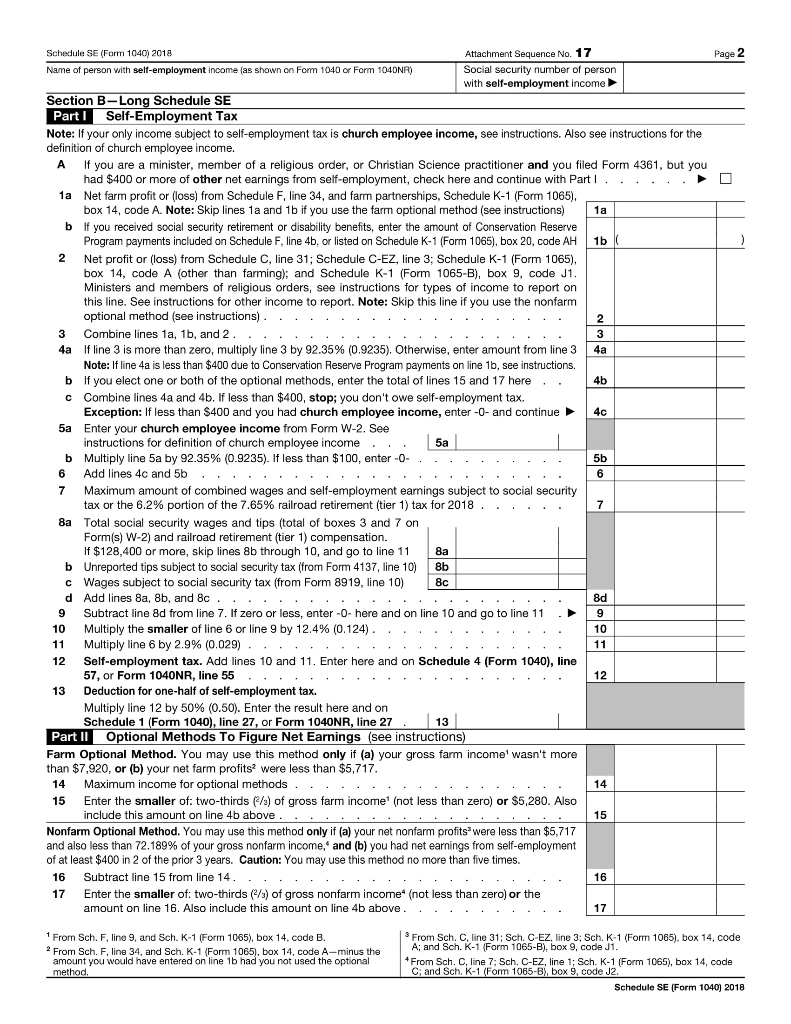

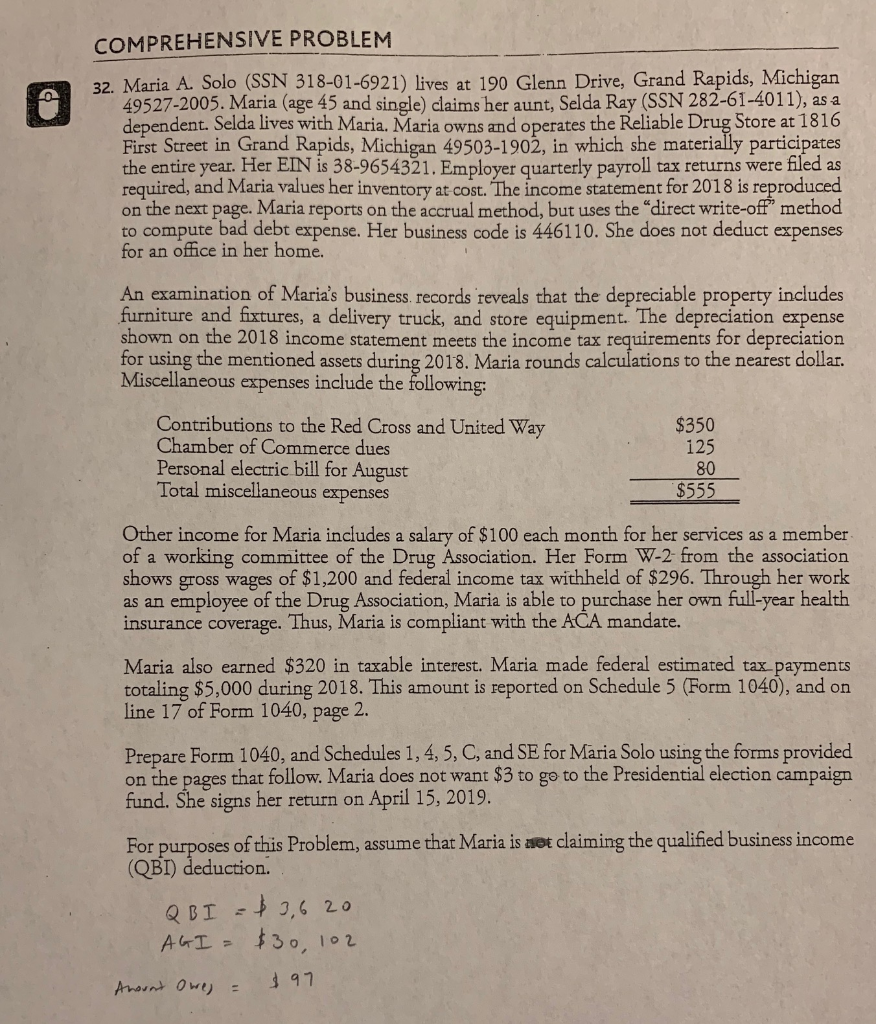

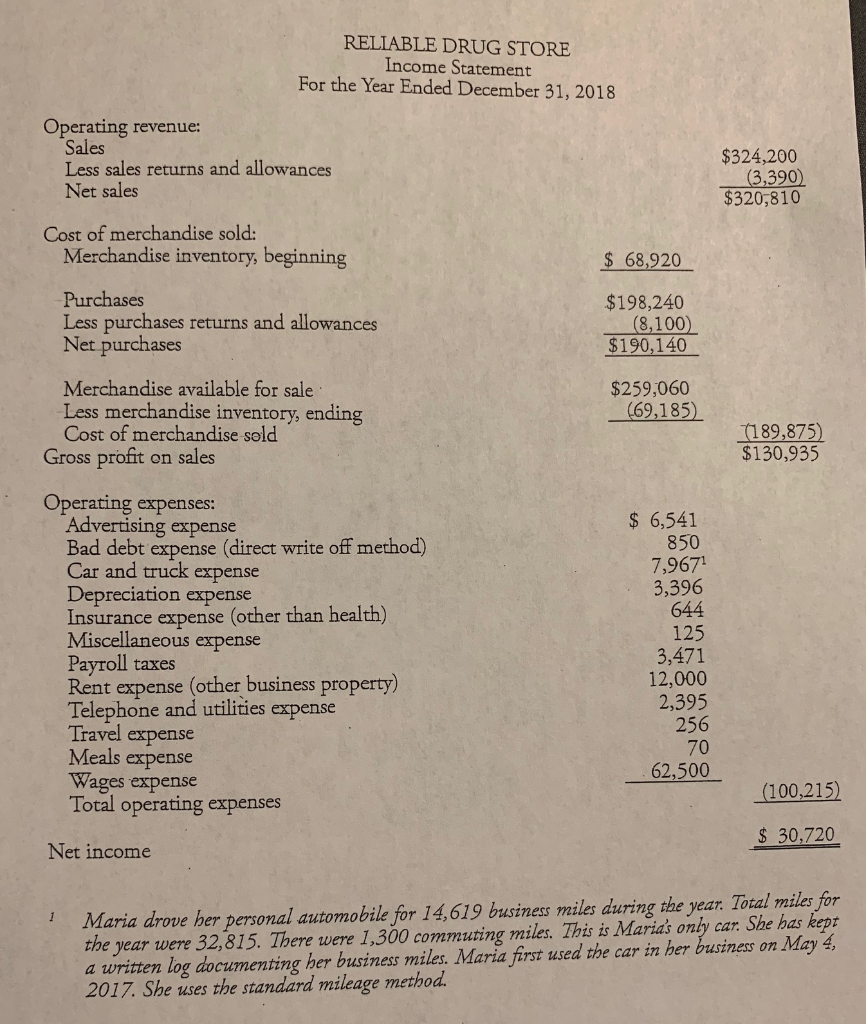

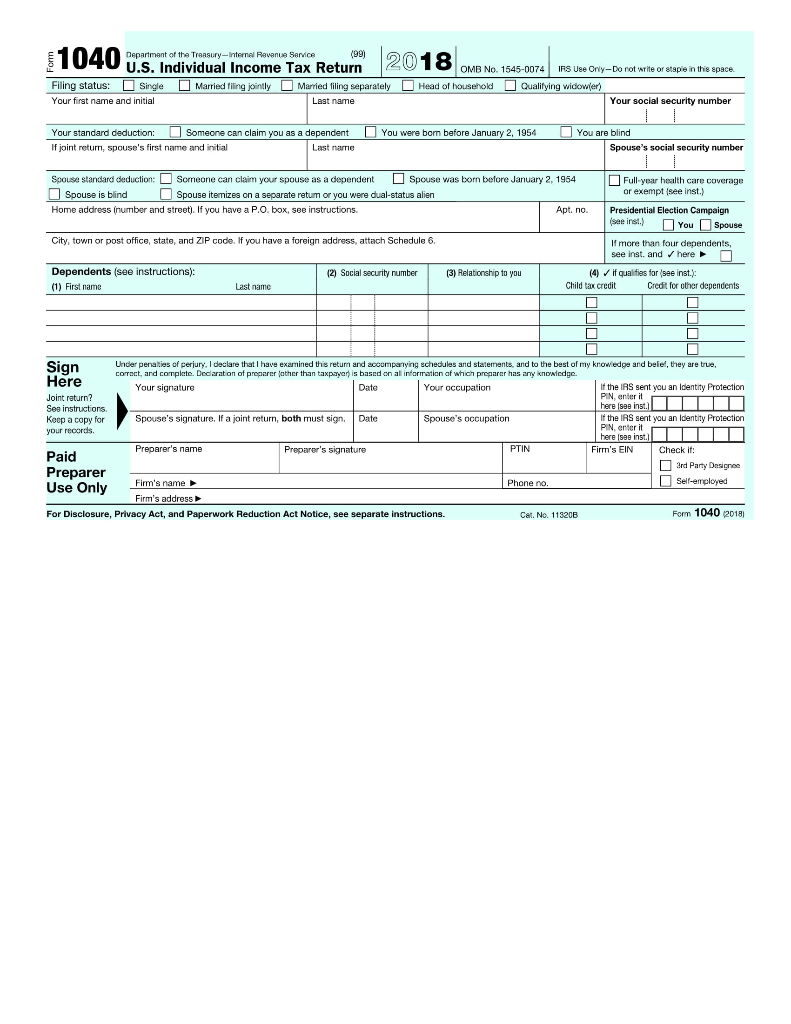

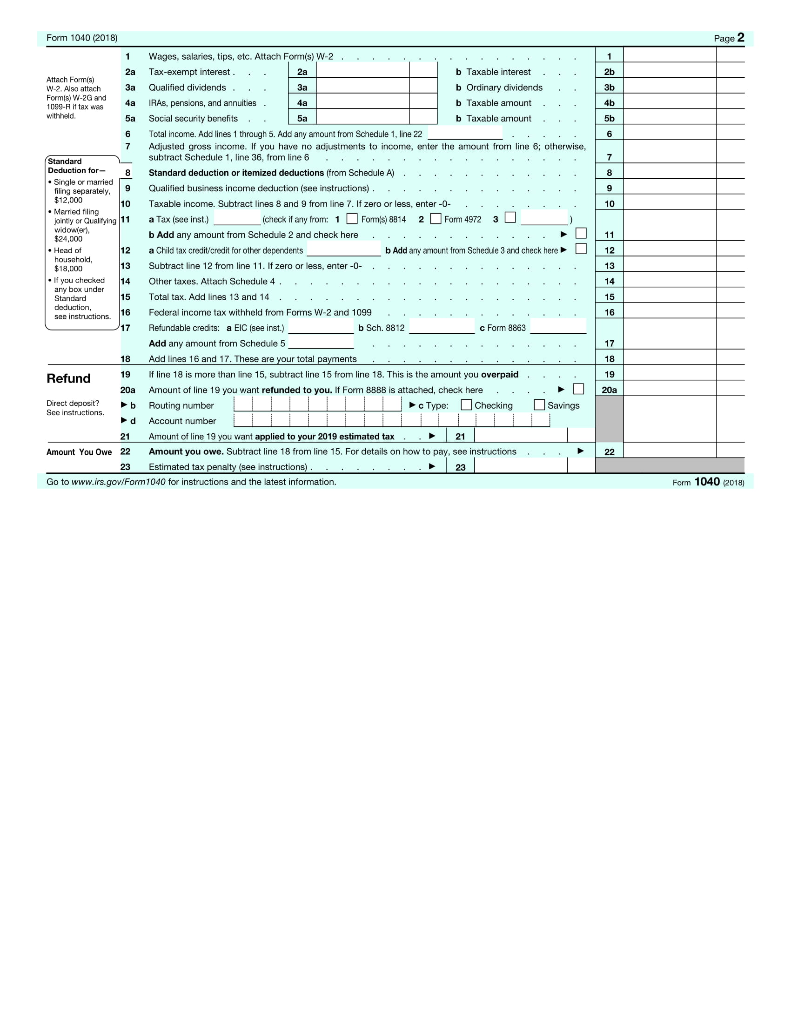

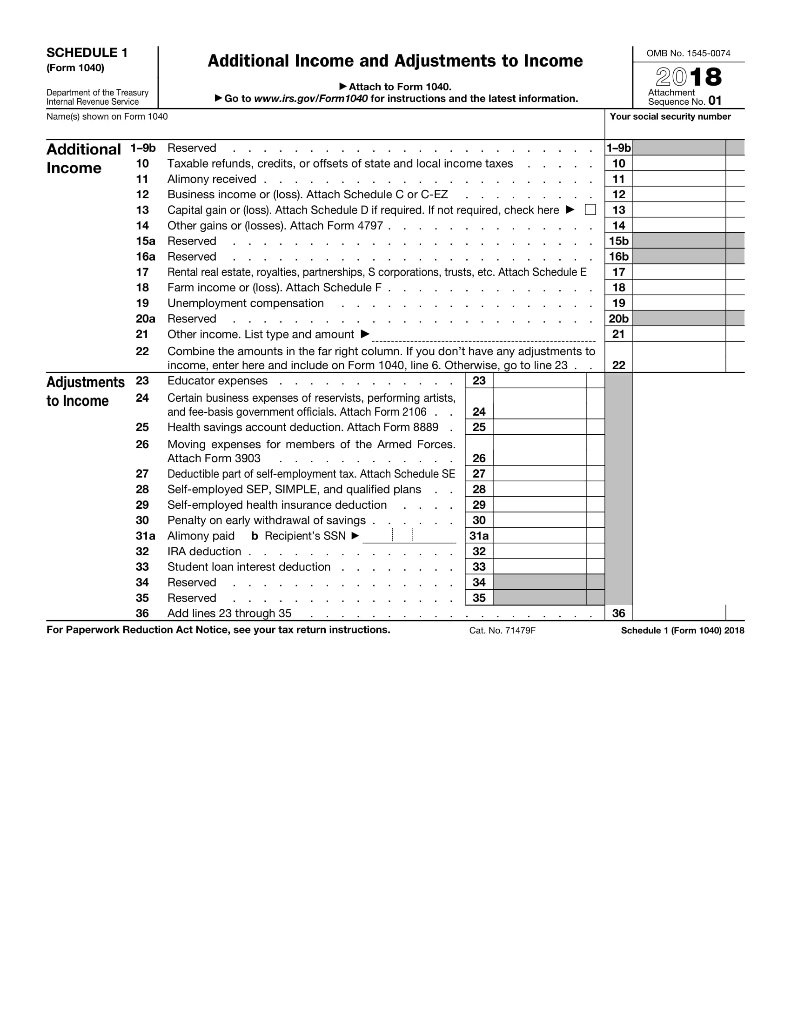

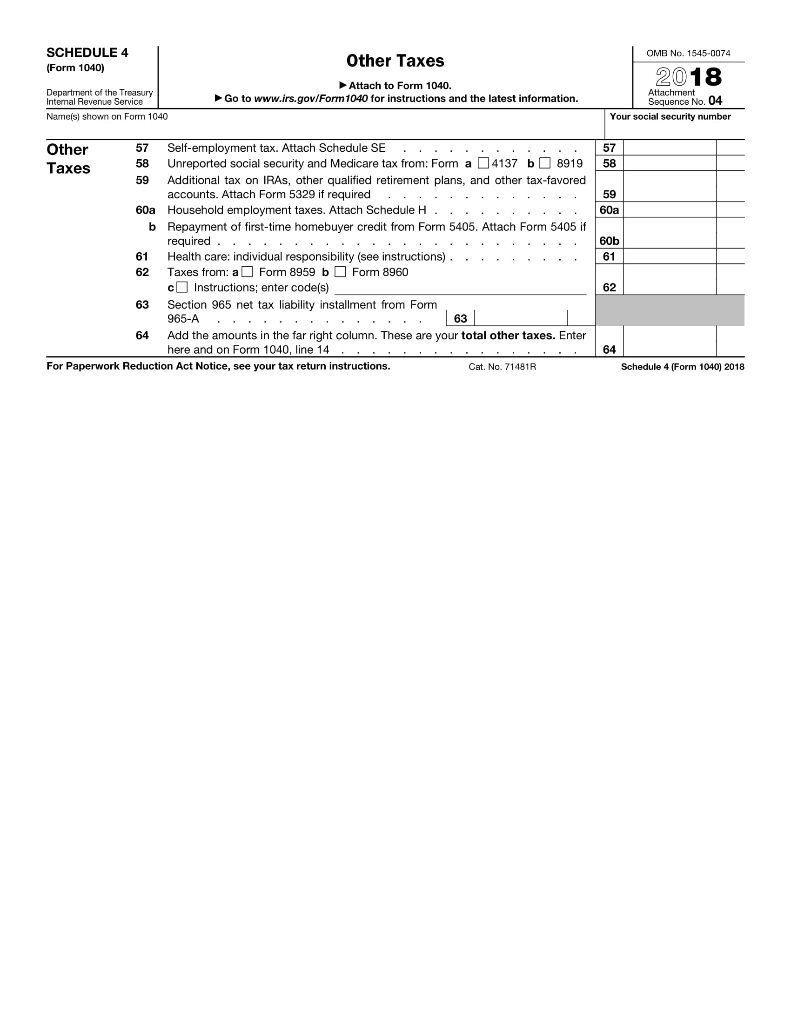

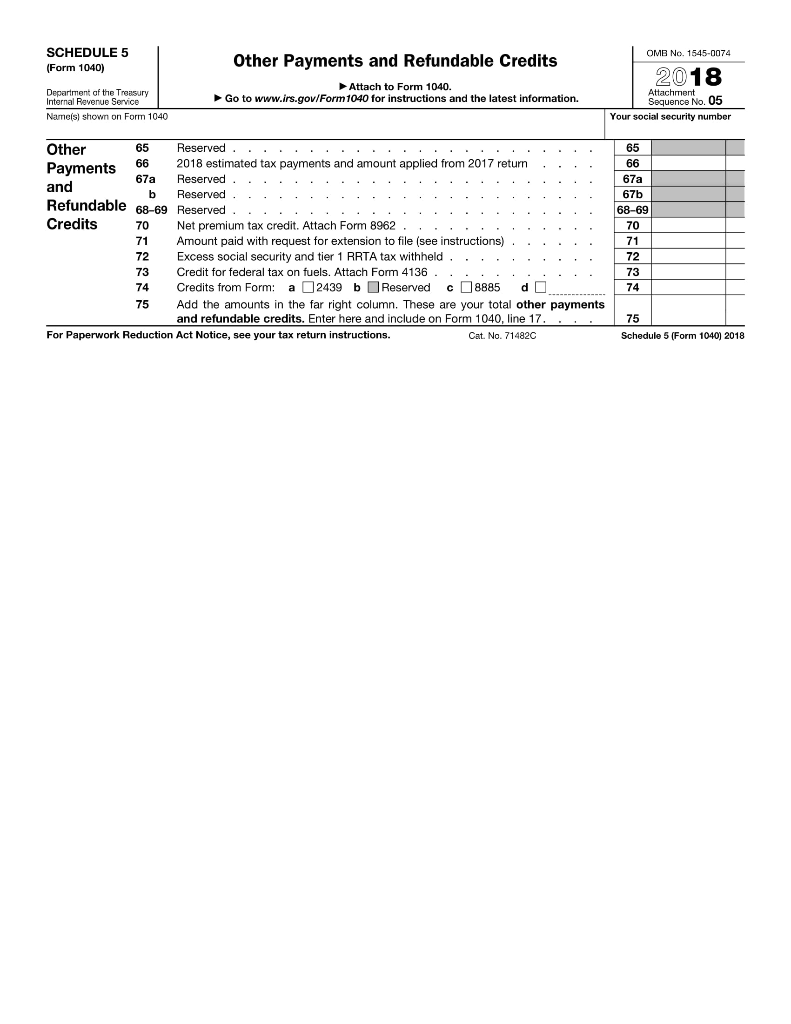

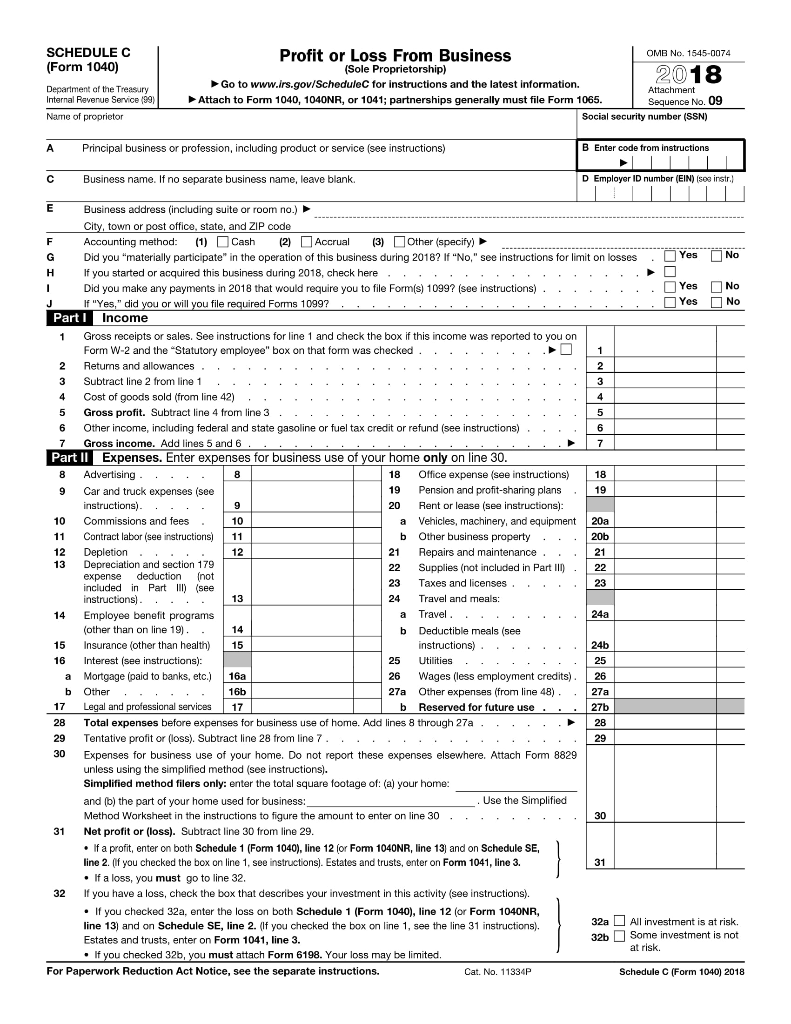

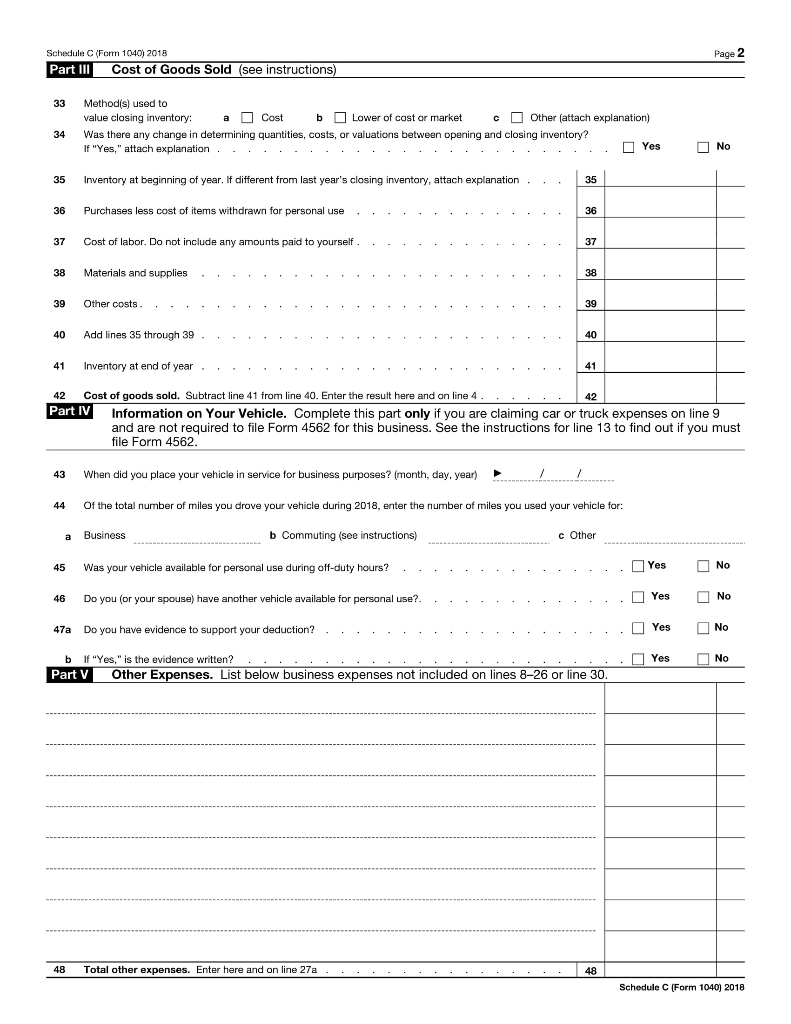

COMPREHENSIVE PROBLEM 32, Maria A. Solo (SSN 318-01-6921) lives at 190 Glenn Drive,Grand Rapids, Michigan 49527-2005. Maria (age 45 and single) claims her aunt, Selda Ray (SSN 282-61-4011), as a dependent. Selda lives with Maria. Maria owns and operates the Reliable Drug Store at 1816 First Street in Grand Rapids, Michigan 49503-1902, in which she materially participates the entire year. Her EIN is 38-9654321. Employer quarterly payroll tax returns were filed as required, and Maria values her inventory at cost. The income statement for 2018 is reproduced on the next page. Maria reports on the accrual method, but uses the "direct write-off" method to compute bad debt expense. Her business code is 446110. She does not deduct expenses for an office in her home. An examination of Maria's business. records reveals that the depreciable property includes furniture and fixtures, a delivery truck, and store equipment. The depreciation expense shown on the 2018 income statement meets the income tax requirements for depreciation for using the mentioned assets during 2018. Maria rounds calculations to the nearest dollar. Miscellaneous expenses include the following: Contributions to the Red Cross and United Way Chamber of Commerce dues Personal electric bill for August Total miscellaneous expenses $350 125 80 $555 Other income for Maria includes a salary of $100 each month for her services as a member of a working committee of the Drug Association. Her Form W-2 from the association shows gross wages of $1,200 and federal income tax withheld of $296. Through her work as an employee of the Drug Association, Maria is able to purchase her own full-year health insurance coverage. Thus, Maria is compliant with the ACA mandate. Maria also earned $320 in taxable interest. Maria made federal estimated tax payments totaling $5,000 during 2018. This amount is reported line 17 of Form 1040, page 2 on Schedule 5 (Form 1040), and on Prepare Form 1040, and Schedules 1, 4, 5, C, and SE for Maria Solo using the forms provided on the pages that follow. Maria does not want $3 to go to the Presidential election campaign fund. She signs her return on April 15, 2019. For purposes of this Problem, assume that Maria is aet claiming the qualified business income (QBI) deduction. 3,6 20 Q BI 0, 102 AGI = 97 Anorat Owey RELIABLE DRUG STORE Income Statement For the Year Ended December 31, 2018 Operating revenue: Sales Less sales returns and allowances Net sales $324,200 (3,390) $320,810 Cost of merchandise sold: Merchandise inventory, beginning $ 68,920 Purchases Less purchases returns and allowances Net purchases $198,240 (8,100) $190,140 Merchandise available for sale Less merchandise inventory, ending Cost of merchandise sold Gross profit $259,060 (69,185) (189,875) $130,935 on sales Operating expenses: Advertising expense Bad debt expense (direct write off method) Car and truck expense Depreciation expense Insurance expense (other than health) Miscellaneous expense Pyroll Rent expense (other business property) Telephone and utilities expense Travel expense Meals expense Wages expense Total operating expenses $ 6,541 850 7,967 3,396 644 125 3,471 12,000 2,395 256 70 62,500 taxes (100,215) $ 30,720 Net income Maria drove her personal automobile for 14,619 business miles during the year. Total miles for the year were 32,815. There were 1,300 commuting miles. This is Maria's only car. She has kept a written log documenting her business miles. Maria first used the car in her business on May 4 2017. She uses the standard mileage method. 1040 Departmant of the Treasury-Internel Revenue Service U.S. Individual Income Tax Return (99) 2018 IES Use Ony-Do rot wNTite or stapie in tt OMB No. 1545-0074 8 space Single Head of househokd Filing status: Married filing separately Qualifying widowiery Married filing jointly Your first name and initial Last name Your social security number a dependent You are blind Someone can claim you a You were bom before January 2, 1954 Your standard deduction: If joint return, spouse's first name and initial Last name Spouse's social security number Spouse was born before January 2, 1954 Spouse standard deduction: Scmeone can claim your spouse as a dependent ar coverage Spouse is blind Spouse itemizes on a separate retum or you were dual-status alien Home address inumber and street), If you have a l box, see instructions Apt. no. | Election Campaign (see inst.) You Spouse City, town or post office, state ZIP code. If you have a foreign address, attach Schedule 6 ndents, here cea inet and. Dependents (see instructions): (2) Social security number 3) Relationship to you qualif Credt for ether dependents Child tax credit (1) First name Last names Under penaties of perjury, I declare that I have examined this return and accomparnying schedules and statements, and to the best of my krowiedge and belef, they are true, corect, and complete. Decaration of proparer jather than taxpayer) is based on all information of which prcparer has Sign Here y knowiedgo Your occupation n Identity Protection Your signature Date sent you PIN enier Joint return? here Isee inst See instructions, PIN ente ycu an ldentity Protection here see inst. Spouse's signature. If a joint return, both must sign. Date Spouse's occupation for Preparer's name Preparer's signature PTIN Firm's EIN Check if ard Party Dasicnees Paid Preparer Use Only Self-employed Phone no Fim's name Firm's address Form 1040 (2018) For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Ca. No. 11320B Page 2 Form 1040 (2018) 1 Wages, salaries, tips, etc. Attach Formis) W-2 1 2a Tax-exempt interest 2a b Taxable interest 2H Attach Formis) w-2. Also attech b Ordinary dividends 31 3a Qualified dividends 3a IRAS, pensions, and annuities b Taxable amount th 48 4a withheld b Taxable amount 5a Social security benefits 5a 5b Total income. Add lines 1 through 5. Add any amount from Schedule 1, Ine 22 b euhtract Schedule 1 line 36, from line 6 ustments to inome, enter the amount from line 6; otherwise Standard deduction or itemized deductions (from Schedule A) Standard 7 Deduction for- 8 Qualified business income deduction (see instructions) $12.000 Taxable income. Subtract lines 8 and 9 from line 7. If zero or less, enter -0- a Tax (see inst.) 10 10 Calting 11 Foms) 8814 2 Form 4972 check if any from 3 b Add any amount from Schedule 2 and check here 11 15 Add any amount from Schedule 3 and check here Head of a Child tax credit/credit for other dependents 12 hole If zero or less, enter-0- Subtract line 12 from line 13 13 If you checked der Stanrard 14 Other taxes. Atach Schedule 4 14 Total tax. Add lines 13 and 14 15 intcticns 16 Foderal income tax withheld from Forms W-2 and 1099 6 17 Refundable credits: a EIC (see inst.) b Sch, 8812 c Form 8863 Add any amount from Schedule 5 17 Add lines 16 and 17. These are your total payments 11 8 19 If line 18 is more than line 15, subtract line 15 from line 18. This is the amount vou overpaid 19 Refund Amount of line 19 you want refunded 1 you. If Form 88BB is attached, check here 20a 0a Checking Savings b Routing number dAccount number cType: Scc inctouction 21 21 Amount of line 19 you want applied to your 2019 estimated tax Amount you owe. Subtract line 18 from line 15. For details on how to pay, see instructions . Amount You Owe 22 22 Estimated tax penalty (see instructions) 23 23 Go to www.irs.gov/Form 1040 for instructions and the latest information. Form 1040 (2018) SCHEDULE 1 OMB No. 1545-0074 Additional Income and Adjustments to Income (Form 1040) 2018 Attach to Form 1040. Go to www.irs.gov/Form1040 for instructions and the latest information. Department af the Treasury Internal Revenue Service Attachment Sequence No. 01 Names) shown on Form 1040 Your social security number Additional 1-9b Reserved ..... .... 1-9b .:. f state and local income taxes 10 Taxable refunds, credits, or offsets 10 Income 11 Alimony received . Business income or (loss). Attach Schedule C or C-EZ Capital gain or (loss). Attach Schedule D if required. If not required, check here 11 12 12 13 13 Other gains or losses). Attach Form 4797 SH 16a Po Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 17 17 18 Farm income or (loss). Attach Schedule F 18 Unemployment compensation 19 19 20a Reserved 20 Other income. List type and amount 21 21 22 Combine the amounts income, enter here and include on Form 1040, line 6. Otherwise, go to line 23 Educator expenses the far right column. If you don't have any adjustments to 22 Adjustments 23 to Income 23 Certain business expenses reservists, performing artists, 24 and fee-basis government officials. Attach Form 2106 24 25 25 Health savings account deduction. Attach Form 8889 26 Moving expenses for members of the Armed Forces. Attach Form 3903 26 27 Deductible part of self-employment tax. Attach Schedule SE Self-employed SEP, SIMPLE, and qualified plans Self-employed health insurance deduction 27 28 28 29 29 30 30 Penalty on early withdrawal of savings Alimony paid IRA deduction b Recipient's SSN 31a 31a 32 32 33 Student loan interest deduction 33 34 Reserved 34 35 Reserved 35 Add lines 23 through 35 36 36 For Paperwork Reduction Act Notice, see your tax return instructions. Schedule 1 (Form 1040) 2018 Cat. No. 71479P SCHEDULE 4 OMB No. 1545-0074 Other Taxes Form 1040) 2018 Attach to Form 1040. Go to www.irs.gov/Form1040 for instructions and the latest information. Department Intemal Revenue Service the Treasury Attachment Sequence No. 04 Nameis) shown on Form 1040 Your social security number Self-employment tax. Attach Schedule SE Unreported social security and Medicare tax from: Form a4137 b Other 57 57 58 58 8919 Taxes 59 Additional tax on IRAS, other qualified retirement plans, and other tax-favored accounts. Attach Form 5329 if required 59 60a Household employment taxes. Attach Schedule H b Repayment of first-time homebuyer credit from Form 5405. Attach Form 5405 if 60a 60b required icual roo ns 61 ctions) 61 Taxes from: a Form 8959 b Form 8960 c Instructions; enter code(s) Section 965 net tax liability installment from Form 62 62 63 965-A 63 Add the amounts in the far riaht column. These are your total other taxes. Enter 64 64 here and on Form 1040, line 14 For Paperwork Reduction Act Notice, see your tax return instructions. Cat, No. 71481R Schedule 4 (Form 1040) 2018 SCHEDULE 5 OMB No. 1545-0074 Other Payments and Refundable Credits (Form 1040) 2018 Attach to Form 1040. Department af the Treasury Internal Revenue Service Attachment Go to www.irs.gov/Form 1040 for instructions and the latest information. Sequence No. 05 Names) shown on Form 1040 Your social security number 65 Other Reserved , . .. ... . .. ... 65 ... 66 2018 estimated tax payments and amount applied from 2017 return 66 Payments Reserved 67a 67a and b Reserved 67b Refundable 68-69 Reserved 68-69 Credits 70 Net premium tax credit. Attach Form 8962 ... file (see instructions) equest RTA tax withbeldi Credit for federal tax on fuels, Attach Form 4136 73 73 a2439 b Reserved c 8885 Credits from Form: 74 d 74 total other payments 75 Add the amounts in the far right column. and refundable credits. Enter here and include on Form 1040, line 17, ese 75 For Paperwork Reduction Act Notice, see your tax return instructions. Cat, No. 71482C Schedule 5 (Form 1040) 2018 SCHEDULE C Profit or Loss From Business (Sole Proprietorship) OMB No. 1545-0074 (Form 1040) 2018 Go www.irs.gov/ScheduleC for instructions and the latest information. Department af the Treasury Internal Revenue Service (09) Attachment Attach to Form 1040, 1040NR, or 1041; partnerships generally must file Form 1065. Sequence No. 09 Name of proprietor Social security number (SSN) Principal business or profession, including product service (see instructions) B Enter code from instructions A Business name. If no separate business name, leave blank. D Employer IID number (EIN) (see instr.) Business address (including suite or room no.) City, town or post office, state, and ZIP code Accounting method: (1) Cash (3) Other (specify (2) Accrual Yes Did you "materially participate" in the operation of this business during 2018? If "No," see instructions for limit on losses you started or acquired this b No L s during 2018, check "* Yes No 2018 you to file Form(s) 1099? (see instructions) Yes No you file required Forms 10992 If "Yes," did or Part IIncome Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on 1 Form W-2 and the "Statutory emplovee" box on that form was checked 2 Returns and allowances 3 Subtract line 2 from line 1 Cost of goods sold (from line 42) Gross profit. Subtract line 4 from line 3 4 5 5 6 Other income, including federal and state gasoline fuel tax credit or refund (see instructions) 6 Gross income. Add lines 5 and 6. 7 Part IIExpenses. Enter expenses for business use of your home only on line 30. 8 Advertising 8 Office expense (see instructions) 18 18 Pension and profit-sharing plans Car and truck expenses (see 19 10 instructions) 20 Rent or lease (see instructions) 20a 10 Commissions and fees 10 Vehicles, machinery, and equipment Other business property a Contract labor (see instructions) b 20h 11 11 Repairs and maintenance 12 Depletion Depreciation and section 179 12 21 21 13 22 22 Supplies (not included in Part IIl) decuction hot suadxa Part (See Taxes and licenses 23 23 Travel and meals: instructions) 13 24 Travel 24a Employee benefit programs a 14 (other than on line 19) Deductible meals (see 14 b 15 24b Insurance (other than health) 15 instructions) 16 Interest (see instructions) 25 Utilities 25 Mortgage (paid to banks, etc.) 16a 26 Wages (less employment credits) 26 a Other . Legal and professional services 16b 27a Other expenses (from line 48) 27a Reserved for future use 17 17 b 27b home. Add lines 8 through 27a 28 Total expenses before expenses for business use 28 29 Tentative profit or (loss). Subtract line 28 from line 7. 29 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method (see instructions) Simplified method filers only: enter the total square footage of: (a) your home: and (b) the part of your home used for business: Use the Simplified Method Worksheet in the instructions to figure the amount to enter on line 30 30 Net profit or (loss). Subtract line 30 from line 29. If a profit, enter on both Schedule 1 (Form 1040), line 12 (or Form 1040NR, line 13) and on Schedule SE 31 line 2. (If you checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. 31 If a loss, you must go to line 32. If you have a loss, check the box that describes your investment in this activity (see instructions). 32 f you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 12 (or Form 1040NR, 32a All in 22 Some investment is not at risk. line 13) and on Schedule SE, line 2. (f you checked the box on line 1, see the line 31 instructions). Estates and trusts, enter on Form 1041, line 3. If you checked 32b, you must attach Form 6198. Your loss may be limited. For Paperwork Reduction Act Notice, see the separate instructions. Schedule C (Form 1040) 2018 Cat. No. 11334P Schedule C (Form 1040) 2018 Page 2 Cost of Goods Sold (see instructions) Part Il Methods) used to 33 value closing inventory: a Cost b Lowe Other (attach explanation) cost or market c Was there any change in deternmining quantities, costs, or valuations between opening and closing inventory? 34 Yes No If "Yes." attach explanation 35 Inventory beginning f different from last year's closing inventory, attach explanation 35 year Purchases less cost of items withdrawn for personal use 36 36 not include any amounts paid to yourself Cost of labor. 37 37 Materials and supplies 38 38 39 Other costs 39 Add lines 35 through 39 40 40 41 41 Inventory at end of year 42 Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4 42 Part IV Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562. When did you place your vehicle in service for business purposes? (month, day, year) 43 Of the total number fmiles you drove your vehicle during 2018, enter the number of miles you used your vehicle for: 44 c Other Business b Commuting (see instructions) Yes No 45 Was your vehicle available for personal use during off-duty hours? Yes No 46 Do you (or your spouse) have another vehicle available for personal use?. Yes No 47a Do you have evidence to support your deduction? Yes No b If "Yes," is the evidence written? Other Expenses. List below business expenses not included on lines 8-26 or line 30 Part V Total other expenses. Enter here and on line 27a 48 48 Schedule C (Form 1040) 2018 SCHEDULE SE OMB No. 1545-0074 Self-Employment Tax (Form 1040) 2018 Go to www.irs.gov/ScheduleSE for instructions and the latest information. Department of the Treasury Internal Revenue Service 99 Attachment Attach to Form 1040 or Form 1040NR. Sequence No. 17 Name of person with self-employment income (as shown on Form 1040 or Form 1040NR) Social security number with self-employment income person Before you begin: To determine if you must file Schedule SE, see the instructions. May I Use Short Schedule SE or Must I Use Long Schedule SE? Note: Use this flowchart only if you must file Schedule SE. If unsure, see Who Must File Schedule SE in the instructions. Did you receive wages or tips in 2018? No Yes fa religious order, or Christian Are you a minister, member Was the total of your wages and tips subject to social security es or railroad retirement (tier lf-employment more than $128,400? es tax plus your net eamings from on eprniogs from thaee sourcas but voLCwa self.emolovment tax on other eamings? No No Medicare tax Yes Did vou receive tips subiect to social security Are you using one of the optional methods t eamings (see instructions)? fiqure your net Yes that you didn't roport to your employer? I No No Did you report any wages on Form 8919, Uncollected Social Yes Security and Medicare Tax on Wages? No (see instructions) Yes reported on Form W-2 of $108.28 or more? No You may use Short Schedule SE below You must use Long Schedule SE on page 2 Section A-Short Schedule SE. Caution: Read above to see if you can use Short Schedule SE 1a Net farm profit or (loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A 1a b If you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH 1b 2 Net profit or (loss) from Schedule C, line 31; Schedule C-EZ, line 3; Schedule K-1 (Form 1065), box 14, code A (other than farming): and Schedule K-1 (Form 1065-B), box 9, code J1. Ministers and members of religious orders, see instructions for types of income to report on this line. See instructions for other income to report Combine lines 1a, 1b, and 2 .. .... 2 3 3 Multiply line 3 by 92.35% (0.9235). If less than $400, you don't owe self-employment tax; don't file this schedule unless you have an amount on line 1b Note: If line 4 is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. 4 4 5 Self-employment tax. If the amount on line 4 is: less, multiply line 4 by 15.3% (0.153). Enter the result here and on Schedule 4 (Form Form 1040NR, line 55 $128,400 1040), line 57 More than $128,400, multiply line 4 by 2.9% (0.029). Then, add $15,921.60 to the result. Enter the total here and on Schedule 4 (Form 1040), line 57, or Form 1040NR, line 55 5 6 Deduction for one-half of self-employment tax. here and on Schedule 1 (Form 1040), line 27, or Form 1040NR, line 27 6 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 1135BZ Schedule SE (Form 1040) 2018 Schedule SE (Form 1040) 2018 Page 2 Attachment Sequence No. 17 Social security number with self-employment income person Name of person with self-employment income (as shown on Form 1040 or Form 1040NR) Section B-Long Schedule SE Self-Employment Tax PartI Note: If your only income subject to self-employment tax is church employee income, see instructions. Also see instructions for the definition of church employee income. A If you are a minister, member of a religious order, or Christian Science practitioner and you filed Form 4361, but you had $400 or more of other net earnings from self-employment, check here and continue with Part I 1a Net farm profit or (loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A. Note: Skip lines 1a and 1b if you use the farm optional method (see instructions) 1a b If you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line Net profit or (loss) from Schedule C, line 31; Schedule C-EZ, line 3; Schedule K-1 (Form 1065) , or listed on Schedule K-1 (Form 1065), box 20, code AH 1h 2 Ministers and members of religious orders, see instructions for tvpes of income to report on this line. See instructions for other income to report. Note: Skip this line if you use the nonfarm optional method (see instructions) 2 Combine lines 1a, 1b, and 2 If line 3 is more than zero, multiply line 3 by 92.35% ( 0.9235), Otherwise, enter amount from line 3 Note: If line 4a is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. 3 3 4a 4a If you elect one or both of the optional methods, enter the total of lines 15 and 17 here 4b Combine lines 4a and 4b. If less than $400, stop; you don't owe self-employment tax. Exception: If less than $400 and you had church employee income, enter -0- and continue c 40 Enter your church employee income from Form W-2. See instructions for definition of church employee income Multiply line 5a by 92.35% (0.9235). 6 5a 5a less than $100, enter -0- b 5b Add lines 4c and 5b 6 social security 7 Maximum amount of combined wages and self-employment earnings subject f the 7.65% railroad retirement (tier tax for 2018. tax or the 6.2% portion 7 8a Total social security wages and tips (total of boxes 3 and 7 on Form(s) W-2) and railroad retirement (tier 1) compensation. If $128,400 or more, skip lines 8b through 10, and go to line 11 b Unreported tips subject to social security tax (from Form 4137, line 10) c Wages subject to social security tax (from Form 8919, line 10) d Add lines 8a, 8b, and 8c. .... . .. 8a 8b 8c 8d Subtract line 8d from line 7. If zero or less, enter -0- here and on line 10 and go to line 11 Multiply the smaller of line 6 or line 9 by 12.4 % (0.124) Multiply line 6 by 2.9% ( 0.029) 9 10 10 11 11 12 Self-employment tax. Add lines 10 and 11. Enter here and on Schedule 4 (Form 1040), line 57, or Form 1040NR, line 55 Deduction for one-half of self-employment tax. Multiply line 12 by 50 % (0.50). Enter the result here and on Schedule 1 (Form 1040), line 27, or Form 1040NR, line 27 12 13 13 Part II Optional Methods To Figure Net Earnings (see instructions) Farm Optional Method. You may use this method only if (a) your gross farm income' wasn't more than $7,920, or (b) your net farm profits2 were less than $5,717. Maximum income for optional methods .. Enter the smaller of: two-thirds () of gross farm income (not less than zero) or $5,280. Also include this amount on line 4b above . .... . .... . .. Nonfarm Optional Method. You may use this method only if (a) your net nonfarm profits were less than $5,717 14 14 15 15 ryour gross th pior ye Caution: You may uce thie mothed e fre te mployment of at least $400 in 2 method no more than es. Subtract line 15 from line 14. . . 16 16 Enter the smaller of: two-thirds (2/) of gross nonfarm income (not less than zero) or the 17 amount on line 16. Also include this amount on line 4b above 17 3 From Sch, C. line 31; Sch, C-EZ. line 3: Sch A: and Sch. K-1 (Form 1065-B), box 9, code Ji. (Form 1065), box 14, code 1 From Sch, F. Sch Form 1065), box 14, code E a 2 From Sch Elina 34 and Sch K-1 (Form 1065), bax 14, code A-minus the amount you would have entered on line 1b had you not used the optional From Sch. C, line 7; Sch. C-EZ, line 1; Sch. K-1 (Form 1065), box 14, code C: and Sch, K-1 (Form 1065-B), box 9, code J2 method. Schedule SE (Form 1040) 2018 COMPREHENSIVE PROBLEM 32, Maria A. Solo (SSN 318-01-6921) lives at 190 Glenn Drive,Grand Rapids, Michigan 49527-2005. Maria (age 45 and single) claims her aunt, Selda Ray (SSN 282-61-4011), as a dependent. Selda lives with Maria. Maria owns and operates the Reliable Drug Store at 1816 First Street in Grand Rapids, Michigan 49503-1902, in which she materially participates the entire year. Her EIN is 38-9654321. Employer quarterly payroll tax returns were filed as required, and Maria values her inventory at cost. The income statement for 2018 is reproduced on the next page. Maria reports on the accrual method, but uses the "direct write-off" method to compute bad debt expense. Her business code is 446110. She does not deduct expenses for an office in her home. An examination of Maria's business. records reveals that the depreciable property includes furniture and fixtures, a delivery truck, and store equipment. The depreciation expense shown on the 2018 income statement meets the income tax requirements for depreciation for using the mentioned assets during 2018. Maria rounds calculations to the nearest dollar. Miscellaneous expenses include the following: Contributions to the Red Cross and United Way Chamber of Commerce dues Personal electric bill for August Total miscellaneous expenses $350 125 80 $555 Other income for Maria includes a salary of $100 each month for her services as a member of a working committee of the Drug Association. Her Form W-2 from the association shows gross wages of $1,200 and federal income tax withheld of $296. Through her work as an employee of the Drug Association, Maria is able to purchase her own full-year health insurance coverage. Thus, Maria is compliant with the ACA mandate. Maria also earned $320 in taxable interest. Maria made federal estimated tax payments totaling $5,000 during 2018. This amount is reported line 17 of Form 1040, page 2 on Schedule 5 (Form 1040), and on Prepare Form 1040, and Schedules 1, 4, 5, C, and SE for Maria Solo using the forms provided on the pages that follow. Maria does not want $3 to go to the Presidential election campaign fund. She signs her return on April 15, 2019. For purposes of this Problem, assume that Maria is aet claiming the qualified business income (QBI) deduction. 3,6 20 Q BI 0, 102 AGI = 97 Anorat Owey RELIABLE DRUG STORE Income Statement For the Year Ended December 31, 2018 Operating revenue: Sales Less sales returns and allowances Net sales $324,200 (3,390) $320,810 Cost of merchandise sold: Merchandise inventory, beginning $ 68,920 Purchases Less purchases returns and allowances Net purchases $198,240 (8,100) $190,140 Merchandise available for sale Less merchandise inventory, ending Cost of merchandise sold Gross profit $259,060 (69,185) (189,875) $130,935 on sales Operating expenses: Advertising expense Bad debt expense (direct write off method) Car and truck expense Depreciation expense Insurance expense (other than health) Miscellaneous expense Pyroll Rent expense (other business property) Telephone and utilities expense Travel expense Meals expense Wages expense Total operating expenses $ 6,541 850 7,967 3,396 644 125 3,471 12,000 2,395 256 70 62,500 taxes (100,215) $ 30,720 Net income Maria drove her personal automobile for 14,619 business miles during the year. Total miles for the year were 32,815. There were 1,300 commuting miles. This is Maria's only car. She has kept a written log documenting her business miles. Maria first used the car in her business on May 4 2017. She uses the standard mileage method. 1040 Departmant of the Treasury-Internel Revenue Service U.S. Individual Income Tax Return (99) 2018 IES Use Ony-Do rot wNTite or stapie in tt OMB No. 1545-0074 8 space Single Head of househokd Filing status: Married filing separately Qualifying widowiery Married filing jointly Your first name and initial Last name Your social security number a dependent You are blind Someone can claim you a You were bom before January 2, 1954 Your standard deduction: If joint return, spouse's first name and initial Last name Spouse's social security number Spouse was born before January 2, 1954 Spouse standard deduction: Scmeone can claim your spouse as a dependent ar coverage Spouse is blind Spouse itemizes on a separate retum or you were dual-status alien Home address inumber and street), If you have a l box, see instructions Apt. no. | Election Campaign (see inst.) You Spouse City, town or post office, state ZIP code. If you have a foreign address, attach Schedule 6 ndents, here cea inet and. Dependents (see instructions): (2) Social security number 3) Relationship to you qualif Credt for ether dependents Child tax credit (1) First name Last names Under penaties of perjury, I declare that I have examined this return and accomparnying schedules and statements, and to the best of my krowiedge and belef, they are true, corect, and complete. Decaration of proparer jather than taxpayer) is based on all information of which prcparer has Sign Here y knowiedgo Your occupation n Identity Protection Your signature Date sent you PIN enier Joint return? here Isee inst See instructions, PIN ente ycu an ldentity Protection here see inst. Spouse's signature. If a joint return, both must sign. Date Spouse's occupation for Preparer's name Preparer's signature PTIN Firm's EIN Check if ard Party Dasicnees Paid Preparer Use Only Self-employed Phone no Fim's name Firm's address Form 1040 (2018) For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Ca. No. 11320B Page 2 Form 1040 (2018) 1 Wages, salaries, tips, etc. Attach Formis) W-2 1 2a Tax-exempt interest 2a b Taxable interest 2H Attach Formis) w-2. Also attech b Ordinary dividends 31 3a Qualified dividends 3a IRAS, pensions, and annuities b Taxable amount th 48 4a withheld b Taxable amount 5a Social security benefits 5a 5b Total income. Add lines 1 through 5. Add any amount from Schedule 1, Ine 22 b euhtract Schedule 1 line 36, from line 6 ustments to inome, enter the amount from line 6; otherwise Standard deduction or itemized deductions (from Schedule A) Standard 7 Deduction for- 8 Qualified business income deduction (see instructions) $12.000 Taxable income. Subtract lines 8 and 9 from line 7. If zero or less, enter -0- a Tax (see inst.) 10 10 Calting 11 Foms) 8814 2 Form 4972 check if any from 3 b Add any amount from Schedule 2 and check here 11 15 Add any amount from Schedule 3 and check here Head of a Child tax credit/credit for other dependents 12 hole If zero or less, enter-0- Subtract line 12 from line 13 13 If you checked der Stanrard 14 Other taxes. Atach Schedule 4 14 Total tax. Add lines 13 and 14 15 intcticns 16 Foderal income tax withheld from Forms W-2 and 1099 6 17 Refundable credits: a EIC (see inst.) b Sch, 8812 c Form 8863 Add any amount from Schedule 5 17 Add lines 16 and 17. These are your total payments 11 8 19 If line 18 is more than line 15, subtract line 15 from line 18. This is the amount vou overpaid 19 Refund Amount of line 19 you want refunded 1 you. If Form 88BB is attached, check here 20a 0a Checking Savings b Routing number dAccount number cType: Scc inctouction 21 21 Amount of line 19 you want applied to your 2019 estimated tax Amount you owe. Subtract line 18 from line 15. For details on how to pay, see instructions . Amount You Owe 22 22 Estimated tax penalty (see instructions) 23 23 Go to www.irs.gov/Form 1040 for instructions and the latest information. Form 1040 (2018) SCHEDULE 1 OMB No. 1545-0074 Additional Income and Adjustments to Income (Form 1040) 2018 Attach to Form 1040. Go to www.irs.gov/Form1040 for instructions and the latest information. Department af the Treasury Internal Revenue Service Attachment Sequence No. 01 Names) shown on Form 1040 Your social security number Additional 1-9b Reserved ..... .... 1-9b .:. f state and local income taxes 10 Taxable refunds, credits, or offsets 10 Income 11 Alimony received . Business income or (loss). Attach Schedule C or C-EZ Capital gain or (loss). Attach Schedule D if required. If not required, check here 11 12 12 13 13 Other gains or losses). Attach Form 4797 SH 16a Po Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 17 17 18 Farm income or (loss). Attach Schedule F 18 Unemployment compensation 19 19 20a Reserved 20 Other income. List type and amount 21 21 22 Combine the amounts income, enter here and include on Form 1040, line 6. Otherwise, go to line 23 Educator expenses the far right column. If you don't have any adjustments to 22 Adjustments 23 to Income 23 Certain business expenses reservists, performing artists, 24 and fee-basis government officials. Attach Form 2106 24 25 25 Health savings account deduction. Attach Form 8889 26 Moving expenses for members of the Armed Forces. Attach Form 3903 26 27 Deductible part of self-employment tax. Attach Schedule SE Self-employed SEP, SIMPLE, and qualified plans Self-employed health insurance deduction 27 28 28 29 29 30 30 Penalty on early withdrawal of savings Alimony paid IRA deduction b Recipient's SSN 31a 31a 32 32 33 Student loan interest deduction 33 34 Reserved 34 35 Reserved 35 Add lines 23 through 35 36 36 For Paperwork Reduction Act Notice, see your tax return instructions. Schedule 1 (Form 1040) 2018 Cat. No. 71479P SCHEDULE 4 OMB No. 1545-0074 Other Taxes Form 1040) 2018 Attach to Form 1040. Go to www.irs.gov/Form1040 for instructions and the latest information. Department Intemal Revenue Service the Treasury Attachment Sequence No. 04 Nameis) shown on Form 1040 Your social security number Self-employment tax. Attach Schedule SE Unreported social security and Medicare tax from: Form a4137 b Other 57 57 58 58 8919 Taxes 59 Additional tax on IRAS, other qualified retirement plans, and other tax-favored accounts. Attach Form 5329 if required 59 60a Household employment taxes. Attach Schedule H b Repayment of first-time homebuyer credit from Form 5405. Attach Form 5405 if 60a 60b required icual roo ns 61 ctions) 61 Taxes from: a Form 8959 b Form 8960 c Instructions; enter code(s) Section 965 net tax liability installment from Form 62 62 63 965-A 63 Add the amounts in the far riaht column. These are your total other taxes. Enter 64 64 here and on Form 1040, line 14 For Paperwork Reduction Act Notice, see your tax return instructions. Cat, No. 71481R Schedule 4 (Form 1040) 2018 SCHEDULE 5 OMB No. 1545-0074 Other Payments and Refundable Credits (Form 1040) 2018 Attach to Form 1040. Department af the Treasury Internal Revenue Service Attachment Go to www.irs.gov/Form 1040 for instructions and the latest information. Sequence No. 05 Names) shown on Form 1040 Your social security number 65 Other Reserved , . .. ... . .. ... 65 ... 66 2018 estimated tax payments and amount applied from 2017 return 66 Payments Reserved 67a 67a and b Reserved 67b Refundable 68-69 Reserved 68-69 Credits 70 Net premium tax credit. Attach Form 8962 ... file (see instructions) equest RTA tax withbeldi Credit for federal tax on fuels, Attach Form 4136 73 73 a2439 b Reserved c 8885 Credits from Form: 74 d 74 total other payments 75 Add the amounts in the far right column. and refundable credits. Enter here and include on Form 1040, line 17, ese 75 For Paperwork Reduction Act Notice, see your tax return instructions. Cat, No. 71482C Schedule 5 (Form 1040) 2018 SCHEDULE C Profit or Loss From Business (Sole Proprietorship) OMB No. 1545-0074 (Form 1040) 2018 Go www.irs.gov/ScheduleC for instructions and the latest information. Department af the Treasury Internal Revenue Service (09) Attachment Attach to Form 1040, 1040NR, or 1041; partnerships generally must file Form 1065. Sequence No. 09 Name of proprietor Social security number (SSN) Principal business or profession, including product service (see instructions) B Enter code from instructions A Business name. If no separate business name, leave blank. D Employer IID number (EIN) (see instr.) Business address (including suite or room no.) City, town or post office, state, and ZIP code Accounting method: (1) Cash (3) Other (specify (2) Accrual Yes Did you "materially participate" in the operation of this business during 2018? If "No," see instructions for limit on losses you started or acquired this b No L s during 2018, check "* Yes No 2018 you to file Form(s) 1099? (see instructions) Yes No you file required Forms 10992 If "Yes," did or Part IIncome Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on 1 Form W-2 and the "Statutory emplovee" box on that form was checked 2 Returns and allowances 3 Subtract line 2 from line 1 Cost of goods sold (from line 42) Gross profit. Subtract line 4 from line 3 4 5 5 6 Other income, including federal and state gasoline fuel tax credit or refund (see instructions) 6 Gross income. Add lines 5 and 6. 7 Part IIExpenses. Enter expenses for business use of your home only on line 30. 8 Advertising 8 Office expense (see instructions) 18 18 Pension and profit-sharing plans Car and truck expenses (see 19 10 instructions) 20 Rent or lease (see instructions) 20a 10 Commissions and fees 10 Vehicles, machinery, and equipment Other business property a Contract labor (see instructions) b 20h 11 11 Repairs and maintenance 12 Depletion Depreciation and section 179 12 21 21 13 22 22 Supplies (not included in Part IIl) decuction hot suadxa Part (See Taxes and licenses 23 23 Travel and meals: instructions) 13 24 Travel 24a Employee benefit programs a 14 (other than on line 19) Deductible meals (see 14 b 15 24b Insurance (other than health) 15 instructions) 16 Interest (see instructions) 25 Utilities 25 Mortgage (paid to banks, etc.) 16a 26 Wages (less employment credits) 26 a Other . Legal and professional services 16b 27a Other expenses (from line 48) 27a Reserved for future use 17 17 b 27b home. Add lines 8 through 27a 28 Total expenses before expenses for business use 28 29 Tentative profit or (loss). Subtract line 28 from line 7. 29 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method (see instructions) Simplified method filers only: enter the total square footage of: (a) your home: and (b) the part of your home used for business: Use the Simplified Method Worksheet in the instructions to figure the amount to enter on line 30 30 Net profit or (loss). Subtract line 30 from line 29. If a profit, enter on both Schedule 1 (Form 1040), line 12 (or Form 1040NR, line 13) and on Schedule SE 31 line 2. (If you checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. 31 If a loss, you must go to line 32. If you have a loss, check the box that describes your investment in this activity (see instructions). 32 f you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 12 (or Form 1040NR, 32a All in 22 Some investment is not at risk. line 13) and on Schedule SE, line 2. (f you checked the box on line 1, see the line 31 instructions). Estates and trusts, enter on Form 1041, line 3. If you checked 32b, you must attach Form 6198. Your loss may be limited. For Paperwork Reduction Act Notice, see the separate instructions. Schedule C (Form 1040) 2018 Cat. No. 11334P Schedule C (Form 1040) 2018 Page 2 Cost of Goods Sold (see instructions) Part Il Methods) used to 33 value closing inventory: a Cost b Lowe Other (attach explanation) cost or market c Was there any change in deternmining quantities, costs, or valuations between opening and closing inventory? 34 Yes No If "Yes." attach explanation 35 Inventory beginning f different from last year's closing inventory, attach explanation 35 year Purchases less cost of items withdrawn for personal use 36 36 not include any amounts paid to yourself Cost of labor. 37 37 Materials and supplies 38 38 39 Other costs 39 Add lines 35 through 39 40 40 41 41 Inventory at end of year 42 Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4 42 Part IV Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562. When did you place your vehicle in service for business purposes? (month, day, year) 43 Of the total number fmiles you drove your vehicle during 2018, enter the number of miles you used your vehicle for: 44 c Other Business b Commuting (see instructions) Yes No 45 Was your vehicle available for personal use during off-duty hours? Yes No 46 Do you (or your spouse) have another vehicle available for personal use?. Yes No 47a Do you have evidence to support your deduction? Yes No b If "Yes," is the evidence written? Other Expenses. List below business expenses not included on lines 8-26 or line 30 Part V Total other expenses. Enter here and on line 27a 48 48 Schedule C (Form 1040) 2018 SCHEDULE SE OMB No. 1545-0074 Self-Employment Tax (Form 1040) 2018 Go to www.irs.gov/ScheduleSE for instructions and the latest information. Department of the Treasury Internal Revenue Service 99 Attachment Attach to Form 1040 or Form 1040NR. Sequence No. 17 Name of person with self-employment income (as shown on Form 1040 or Form 1040NR) Social security number with self-employment income person Before you begin: To determine if you must file Schedule SE, see the instructions. May I Use Short Schedule SE or Must I Use Long Schedule SE? Note: Use this flowchart only if you must file Schedule SE. If unsure, see Who Must File Schedule SE in the instructions. Did you receive wages or tips in 2018? No Yes fa religious order, or Christian Are you a minister, member Was the total of your wages and tips subject to social security es or railroad retirement (tier lf-employment more than $128,400? es tax plus your net eamings from on eprniogs from thaee sourcas but voLCwa self.emolovment tax on other eamings? No No Medicare tax Yes Did vou receive tips subiect to social security Are you using one of the optional methods t eamings (see instructions)? fiqure your net Yes that you didn't roport to your employer? I No No Did you report any wages on Form 8919, Uncollected Social Yes Security and Medicare Tax on Wages? No (see instructions) Yes reported on Form W-2 of $108.28 or more? No You may use Short Schedule SE below You must use Long Schedule SE on page 2 Section A-Short Schedule SE. Caution: Read above to see if you can use Short Schedule SE 1a Net farm profit or (loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A 1a b If you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH 1b 2 Net profit or (loss) from Schedule C, line 31; Schedule C-EZ, line 3; Schedule K-1 (Form 1065), box 14, code A (other than farming): and Schedule K-1 (Form 1065-B), box 9, code J1. Ministers and members of religious orders, see instructions for types of income to report on this line. See instructions for other income to report Combine lines 1a, 1b, and 2 .. .... 2 3 3 Multiply line 3 by 92.35% (0.9235). If less than $400, you don't owe self-employment tax; don't file this schedule unless you have an amount on line 1b Note: If line 4 is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. 4 4 5 Self-employment tax. If the amount on line 4 is: less, multiply line 4 by 15.3% (0.153). Enter the result here and on Schedule 4 (Form Form 1040NR, line 55 $128,400 1040), line 57 More than $128,400, multiply line 4 by 2.9% (0.029). Then, add $15,921.60 to the result. Enter the total here and on Schedule 4 (Form 1040), line 57, or Form 1040NR, line 55 5 6 Deduction for one-half of self-employment tax. here and on Schedule 1 (Form 1040), line 27, or Form 1040NR, line 27 6 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 1135BZ Schedule SE (Form 1040) 2018 Schedule SE (Form 1040) 2018 Page 2 Attachment Sequence No. 17 Social security number with self-employment income person Name of person with self-employment income (as shown on Form 1040 or Form 1040NR) Section B-Long Schedule SE Self-Employment Tax PartI Note: If your only income subject to self-employment tax is church employee income, see instructions. Also see instructions for the definition of church employee income. A If you are a minister, member of a religious order, or Christian Science practitioner and you filed Form 4361, but you had $400 or more of other net earnings from self-employment, check here and continue with Part I 1a Net farm profit or (loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A. Note: Skip lines 1a and 1b if you use the farm optional method (see instructions) 1a b If you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line Net profit or (loss) from Schedule C, line 31; Schedule C-EZ, line 3; Schedule K-1 (Form 1065) , or listed on Schedule K-1 (Form 1065), box 20, code AH 1h 2 Ministers and members of religious orders, see instructions for tvpes of income to report on this line. See instructions for other income to report. Note: Skip this line if you use the nonfarm optional method (see instructions) 2 Combine lines 1a, 1b, and 2 If line 3 is more than zero, multiply line 3 by 92.35% ( 0.9235), Otherwise, enter amount from line 3 Note: If line 4a is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. 3 3 4a 4a If you elect one or both of the optional methods, enter the total of lines 15 and 17 here 4b Combine lines 4a and 4b. If less than $400, stop; you don't owe self-employment tax. Exception: If less than $400 and you had church employee income, enter -0- and continue c 40 Enter your church employee income from Form W-2. See instructions for definition of church employee income Multiply line 5a by 92.35% (0.9235). 6 5a 5a less than $100, enter -0- b 5b Add lines 4c and 5b 6 social security 7 Maximum amount of combined wages and self-employment earnings subject f the 7.65% railroad retirement (tier tax for 2018. tax or the 6.2% portion 7 8a Total social security wages and tips (total of boxes 3 and 7 on Form(s) W-2) and railroad retirement (tier 1) compensation. If $128,400 or more, skip lines 8b through 10, and go to line 11 b Unreported tips subject to social security tax (from Form 4137, line 10) c Wages subject to social security tax (from Form 8919, line 10) d Add lines 8a, 8b, and 8c. .... . .. 8a 8b 8c 8d Subtract line 8d from line 7. If zero or less, enter -0- here and on line 10 and go to line 11 Multiply the smaller of line 6 or line 9 by 12.4 % (0.124) Multiply line 6 by 2.9% ( 0.029) 9 10 10 11 11 12 Self-employment tax. Add lines 10 and 11. Enter here and on Schedule 4 (Form 1040), line 57, or Form 1040NR, line 55 Deduction for one-half of self-employment tax. Multiply line 12 by 50 % (0.50). Enter the result here and on Schedule 1 (Form 1040), line 27, or Form 1040NR, line 27 12 13 13 Part II Optional Methods To Figure Net Earnings (see instructions) Farm Optional Method. You may use this method only if (a) your gross farm income' wasn't more than $7,920, or (b) your net farm profits2 were less than $5,717. Maximum income for optional methods .. Enter the smaller of: two-thirds () of gross farm income (not less than zero) or $5,280. Also include this amount on line 4b above . .... . .... . .. Nonfarm Optional Method. You may use this method only if (a) your net nonfarm profits were less than $5,717 14 14 15 15 ryour gross th pior ye Caution: You may uce thie mothed e fre te mployment of at least $400 in 2 method no more than es. Subtract line 15 from line 14. . . 16 16 Enter the smaller of: two-thirds (2/) of gross nonfarm income (not less than zero) or the 17 amount on line 16. Also include this amount on line 4b above 17 3 From Sch, C. line 31; Sch, C-EZ. line 3: Sch A: and Sch. K-1 (Form 1065-B), box 9, code Ji. (Form 1065), box 14, code 1 From Sch, F. Sch Form 1065), box 14, code E a 2 From Sch Elina 34 and Sch K-1 (Form 1065), bax 14, code A-minus the amount you would have entered on line 1b had you not used the optional From Sch. C, line 7; Sch. C-EZ, line 1; Sch. K-1 (Form 1065), box 14, code C: and Sch, K-1 (Form 1065-B), box 9, code J2 method. Schedule SE (Form 1040) 2018