Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the year ended 31 December 2020 HKU Company had: Net income for the year of $18,120,000 8,705,000 ordinary shares outstanding at the beginning

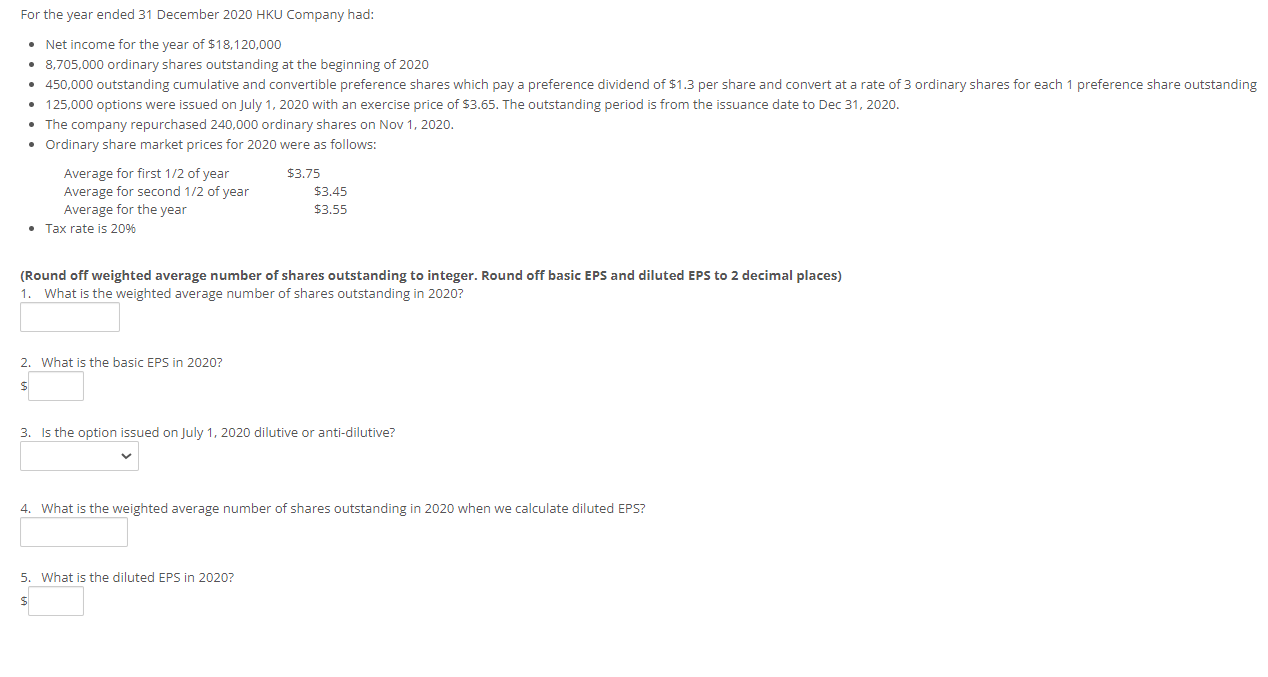

For the year ended 31 December 2020 HKU Company had: Net income for the year of $18,120,000 8,705,000 ordinary shares outstanding at the beginning of 2020 450,000 outstanding cumulative and convertible preference shares which pay a preference dividend of $1.3 per share and convert at a rate of 3 ordinary shares for each 1 preference share outstanding 125,000 options were issued on July 1, 2020 with an exercise price of $3.65. The outstanding period is from the issuance date to Dec 31, 2020. The company repurchased 240,000 ordinary shares on Nov 1, 2020. Ordinary share market prices for 2020 were as follows: Average for first 1/2 of year $3.75 Average for second 1/2 of year Average for the year $3.45 $3.55 Tax rate is 20% (Round off weighted average number of shares outstanding to integer. Round off basic EPS and diluted EPS to 2 decimal places) 1. What is the weighted average number of shares outstanding in 2020? 2. What is the basic EPS in 2020? $ 3. Is the option issued on July 1, 2020 dilutive or anti-dilutive? 4. What is the weighted average number of shares outstanding in 2020 when we calculate diluted EPS? 5. What is the diluted EPS in 2020? $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To answer your questions lets go through each one 1 Weighted average number of shares outstanding in 2020 To calculate the weighted average number of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started