Question

For the year ended December 31, 2020, you were assigned to audit Zed Foods Corporation, a company produces candies and sweets. You are asked by

For the year ended December 31, 2020, you were assigned to audit Zed Foods Corporation, a company produces candies and sweets. You are asked by your senior to perform procedures on liability accounts. Based on your inquiries with your client and understanding of the business, you were able to gather the following:

LOANS AND LEASES

- The short-term loan is a 90-day, 4.5% term loan obtained from a local bank on November 1, 2020 to support working capital needs. The principal amount of P125,000 and the interest are payable on January 30, 2021. No accrual for interest had been made as of December 31, 2020.

- On September 1, 2020, the company obtained a P1-million term loan to finance acquisition of plant assets. It is payable on semi-annual installments at 5.5% interest p.a. (effective interest is 2.75% semi-annually), every 180 days beginning February 28, 2021. No accrual for interest had been made as of December 31, 2020.

- On July 1, 2020, the company entered into a lease agreement for a warehouse and office space. Excerpts from the lease contract follow:

Lease commencement | July 1, 2020 |

Lease term | Five years, with an option to extend for another five years (Audit note: the management plans to install significant improvements on the leased property with a useful life extending beyond the initial five-year term. It is reasonably certain that the management will exercise the option to extend.) |

Lease payments | P1,500,000 annually in advance, starting lease commencement, for the noncancelable five-year term

With escalation clause – increase of 20% in annual rent after the noncancelable period; fixed for the next five-year term |

No interest rate is implied in the agreement. However, it shows that Zed Foods can borrow money at 5% to finance the acquisition of a similar property under the similar terms, with similar collateral.

In addition, Zed Foods incurred P169,706.14 initial direct costs.

- On January 2, 2019, the Zed Foods Corporation issued P2,000,000 of 8% convertible bonds at par. The bonds will mature on January 1, 2023 and interest is payable annually every January 1. The bond contract entitles bondholders to receive 6, P100 par value, ordinary shares in exchange for each P1,000 bond. On the date of issue, the prevailing interest rate for similar debt without the conversion option is 10%. At the beginning of the current year, the holders of the bonds with total face

- value of P1,000,000 exercised their conversion privilege. On that date, the bonds were selling at 110 and the ordinary share at P42.

Requirements:

1. Propose AJEs to accrue interest on short-term and long-term bank loans and bonds payable

2. Propose AJEs to take up current portion of long-term loans.

3. Propose AJEs to accrue interest on lease liability

4. What adjustment, if any, should be proposed for bonds payable as at January 1, 2020?

5. What should be the journal entry as at January 1, 2020 to record the conversion of bonds into ordinary shares?

6. How much is the increase in equity in 2019 related to the convertible bonds? ______________

7. How much is the increase in equity in 2020 related to the convertible bonds? ______________

8. How much should the Right-of-Use (ROU) asset be initially recognized? ______________

9. How much should be reported as ROU as of December 31, 2020? ______________

10. How much is the total lease liability as of December 31, 2020? ______________

11. How much should be presented under the line item “current portion of long-term debt and lease obligation” in the financial statements as of December 31, 2020? ______________

12. How much should be presented under the line item “noncurrent portion of long-term debt and lease obligation” in the financial statements as of December 31, 2020? ______________

13. How much should be presented under the line item “bonds payable” under the noncurrent liabilities section of the statement of financial position as of December 31, 2020? ______________

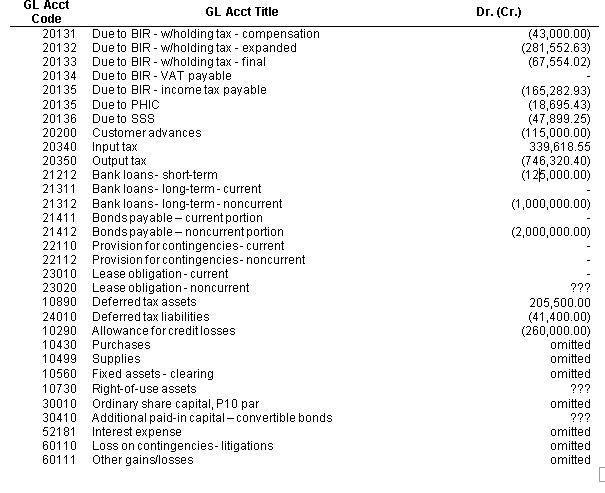

GL Acct GL Acct Title Dr. (Cr.) Code Due to BIR - W/holding tax - compensation Due to BIR - wiholding tax - Due to BIR - wholding tax - final Due to BIR - VAT payable Due to BIR - income tax payable (43,000.00) (281,552.63) (67,554.02) 20131 20132 20133 20134 20135 (165,282.93) (18,695.43) (47,899.25) (115,000.00) 339,618.55 (746,320.40) (125,000.00) 20135 Due to PHIC 20136 Due to SSS Customer advances 20200 20340 Input tax 20350 Output tax 21212 Bank loans- short-term Bank loans- long-term-current Bank loans- long-term- noncurrent Bonds payable - current portion 21412 Bondspayable noncurrent portion Provision for contingencies- current 22112 Provision for contingencies-noncurrent Lease obligation- current 23020 Lease obligation- noncurrent Deferred tax assets 21311 21312 (1,000,000.00) 21411 (2,000,000.00) 22110 23010 ??? 10890 205,500.00 (41,400.00) (260,000.00) 24010 Deferred tax liabilities 10290 Allowance for creditlosses 10430 10499 Purchases omitted omitted Supplies Fixed assets - clearing 10560 omitted 10730 Right-of-use assets 30010 Ordinary share capital, P10 par 30410 Additional paid-in capital-convertible bonds 52181 ??? omitted ??? Interest expense Loss on contingencies- litigations Other gains/losses omitted 60110 omitted 60111 omitted

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Accrue interest on shortterm and longterm bank loans and bonds payable Date Account Debit Credit Dec 31 2020 Interest expense 186954 Accrued interes...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started