Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the year ended December 31, 2023, Blossom Ltd. reported income before income taxes of $212,200. Prior to 2023 taxable income and accounting income was

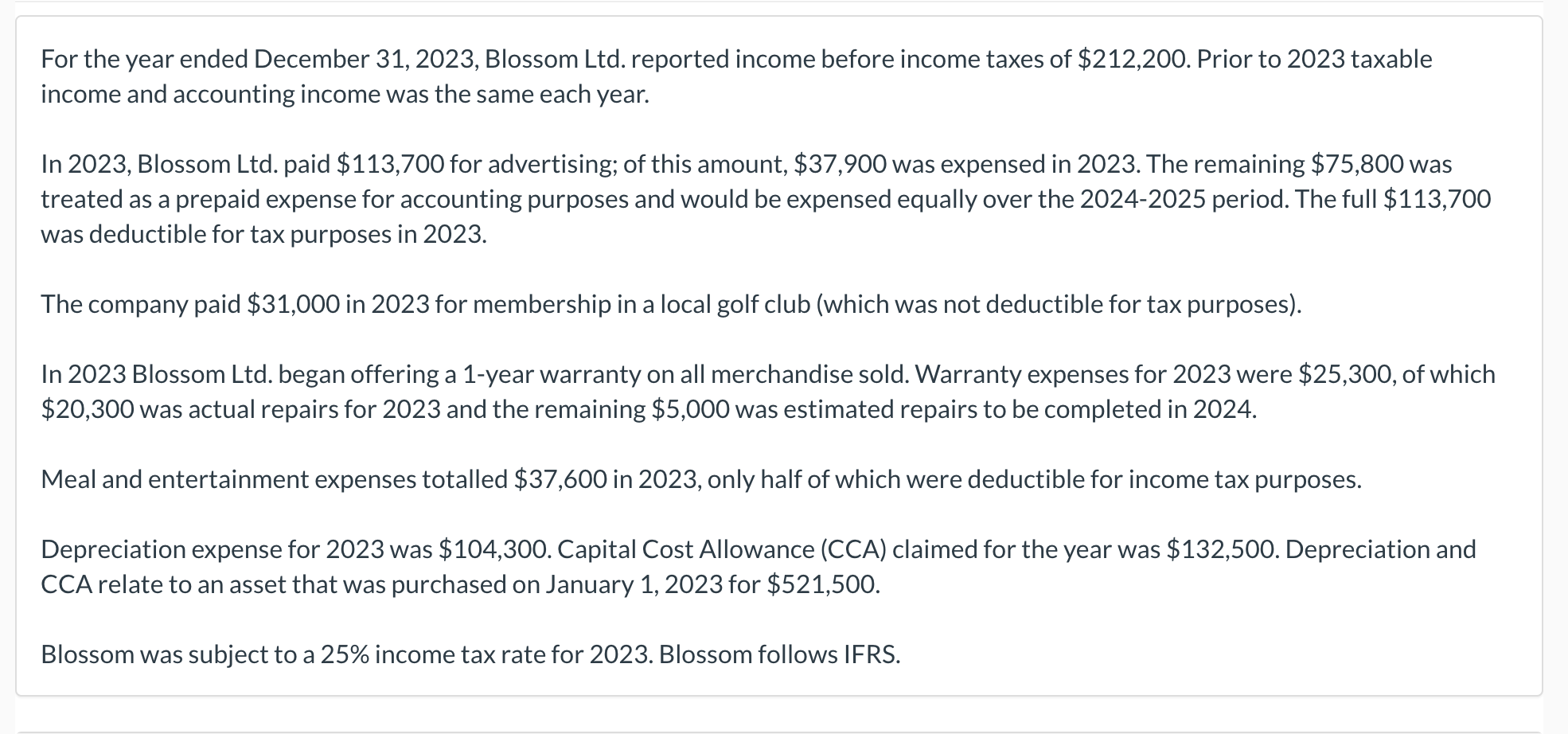

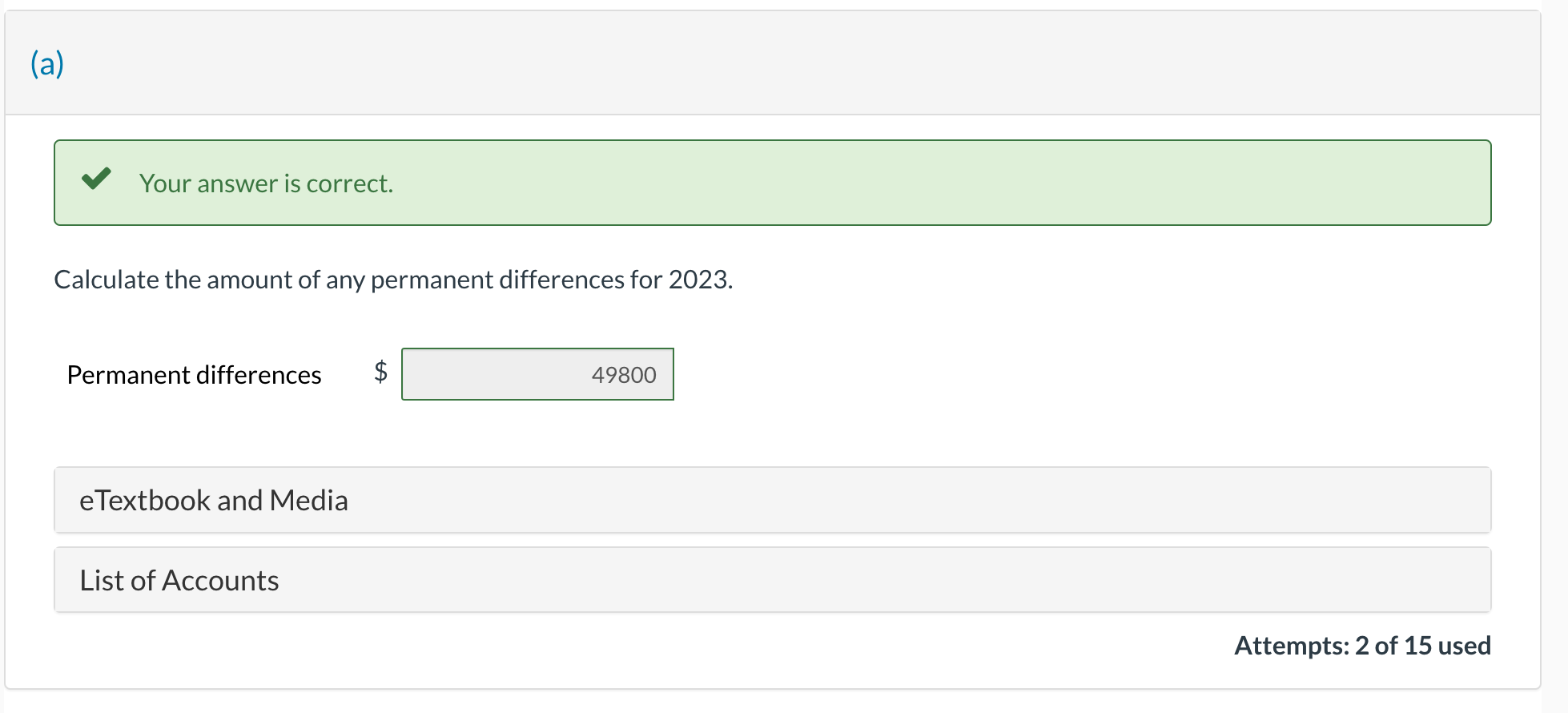

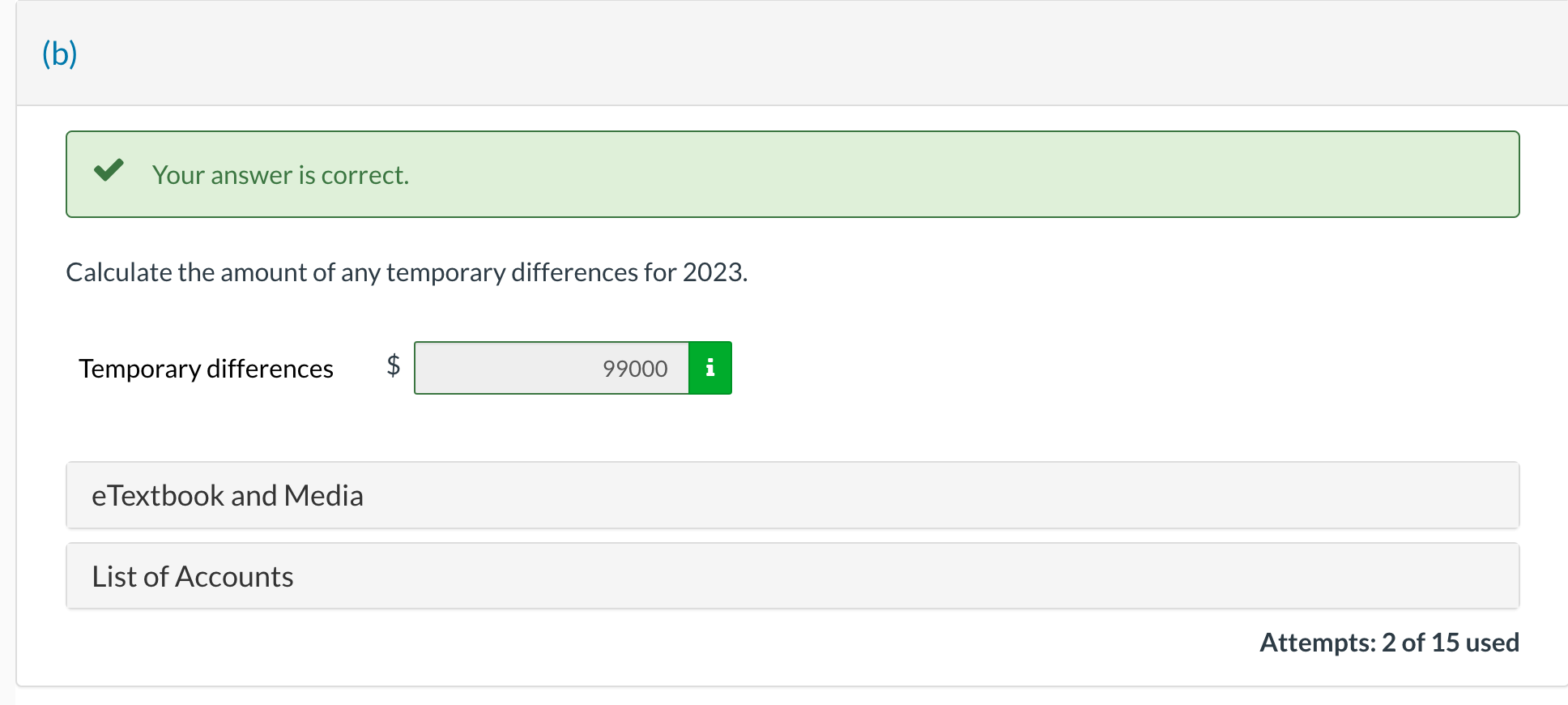

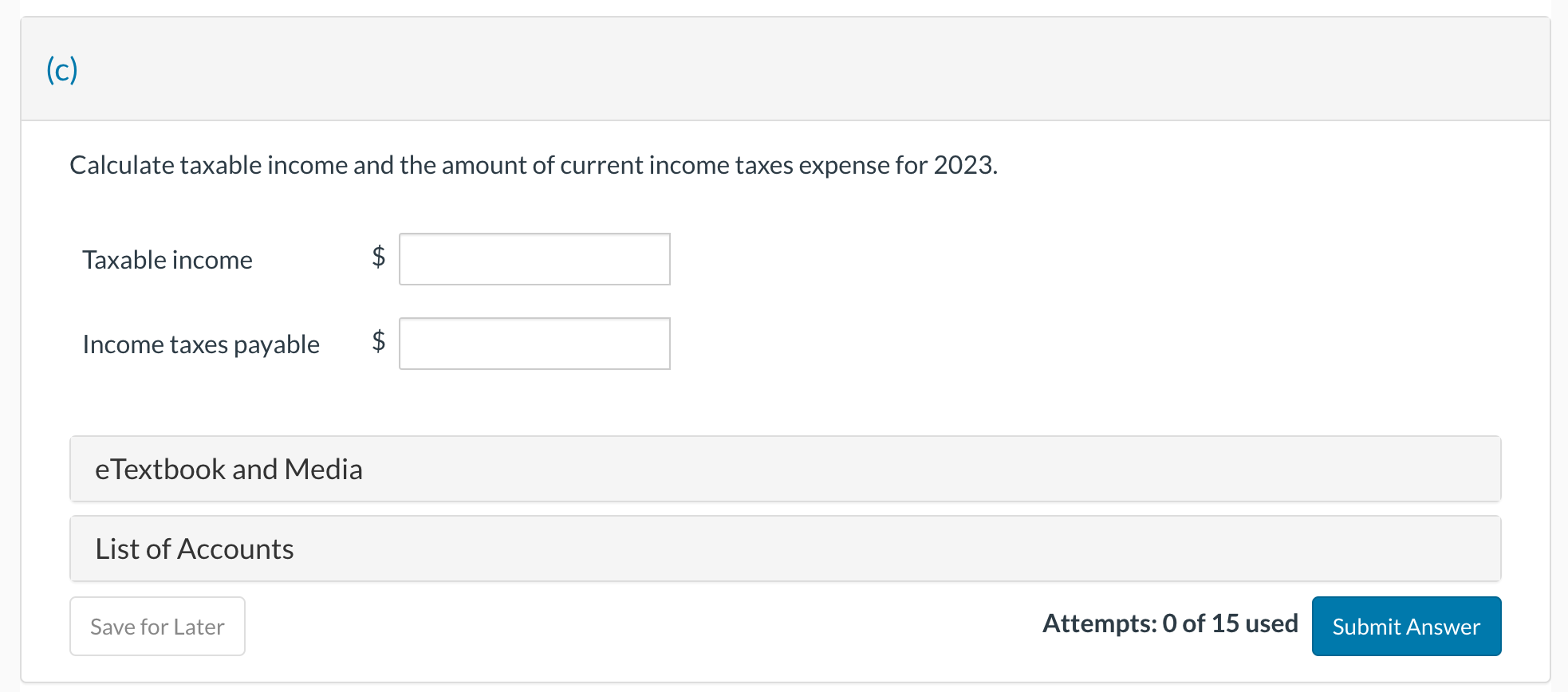

For the year ended December 31, 2023, Blossom Ltd. reported income before income taxes of $212,200. Prior to 2023 taxable income and accounting income was the same each year. In 2023, Blossom Ltd. paid $113,700 for advertising; of this amount, $37,900 was expensed in 2023 . The remaining $75,800 was treated as a prepaid expense for accounting purposes and would be expensed equally over the 20242025 period. The full $113,700 was deductible for tax purposes in 2023. The company paid $31,000 in 2023 for membership in a local golf club (which was not deductible for tax purposes). In 2023 Blossom Ltd. began offering a 1-year warranty on all merchandise sold. Warranty expenses for 2023 were $25,300, of which $20,300 was actual repairs for 2023 and the remaining $5,000 was estimated repairs to be completed in 2024 . Meal and entertainment expenses totalled $37,600 in 2023 , only half of which were deductible for income tax purposes. Depreciation expense for 2023 was $104,300. Capital Cost Allowance (CCA) claimed for the year was $132,500. Depreciation and CCA relate to an asset that was purchased on January 1,2023 for $521,500. Blossom was subject to a 25% income tax rate for 2023. Blossom follows IFRS. Your answer is correct. Calculate the amount of any permanent differences for 2023. Permanent differences $ eTextbook and Media (b) Your answer is correct. Calculate the amount of any temporary differences for 2023. Temporary differences $ (c) Calculate taxable income and the amount of current income taxes expense for 2023. Taxable income $ Income taxes payable $ eTextbook and Media List of Accounts Attempts: 0 of 15 used

For the year ended December 31, 2023, Blossom Ltd. reported income before income taxes of $212,200. Prior to 2023 taxable income and accounting income was the same each year. In 2023, Blossom Ltd. paid $113,700 for advertising; of this amount, $37,900 was expensed in 2023 . The remaining $75,800 was treated as a prepaid expense for accounting purposes and would be expensed equally over the 20242025 period. The full $113,700 was deductible for tax purposes in 2023. The company paid $31,000 in 2023 for membership in a local golf club (which was not deductible for tax purposes). In 2023 Blossom Ltd. began offering a 1-year warranty on all merchandise sold. Warranty expenses for 2023 were $25,300, of which $20,300 was actual repairs for 2023 and the remaining $5,000 was estimated repairs to be completed in 2024 . Meal and entertainment expenses totalled $37,600 in 2023 , only half of which were deductible for income tax purposes. Depreciation expense for 2023 was $104,300. Capital Cost Allowance (CCA) claimed for the year was $132,500. Depreciation and CCA relate to an asset that was purchased on January 1,2023 for $521,500. Blossom was subject to a 25% income tax rate for 2023. Blossom follows IFRS. Your answer is correct. Calculate the amount of any permanent differences for 2023. Permanent differences $ eTextbook and Media (b) Your answer is correct. Calculate the amount of any temporary differences for 2023. Temporary differences $ (c) Calculate taxable income and the amount of current income taxes expense for 2023. Taxable income $ Income taxes payable $ eTextbook and Media List of Accounts Attempts: 0 of 15 used

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started