Question

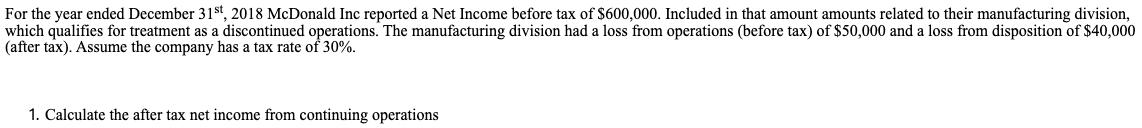

For the year ended December 31st, 2018 McDonald Inc reported a Net Income before tax of $600,000. Included in that amount amounts related to

![]()

For the year ended December 31st, 2018 McDonald Inc reported a Net Income before tax of $600,000. Included in that amount amounts related to their manufacturing division, which qualifies for treatment as a discontinued operations. The manufacturing division had a loss from operations (before tax) of $50,000 and a loss from disposition of $40,000 (after tax). Assume the company has a tax rate of 30%. 1. Calculate the after tax net income from continuing operations 2. Prepare the "discontinued" operations section that would appear on McDonald Inc's statement of comprehensive income

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting: A Business Process Approach

Authors: Jane L. Reimers

3rd edition

978-013611539, 136115276, 013611539X, 978-0136115274

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App