Question

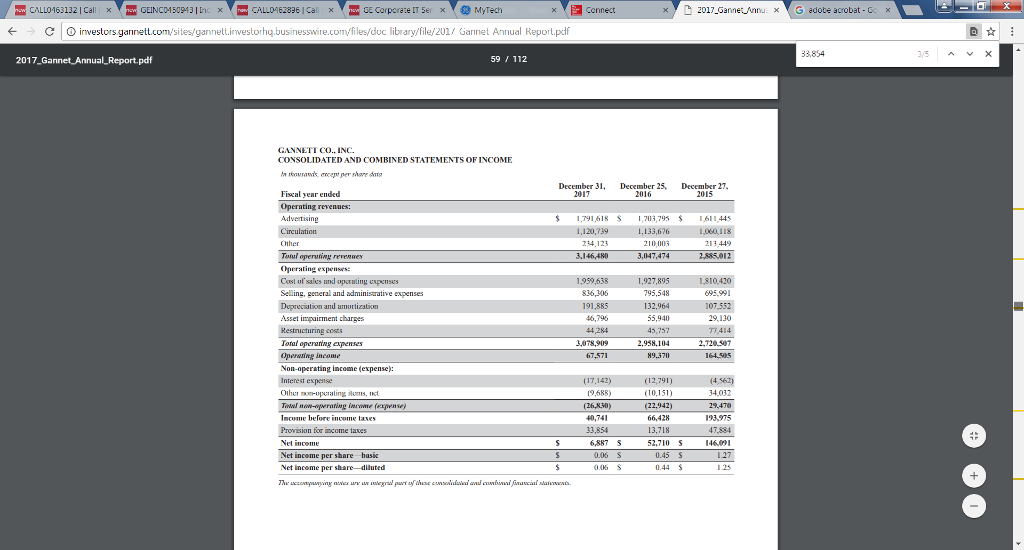

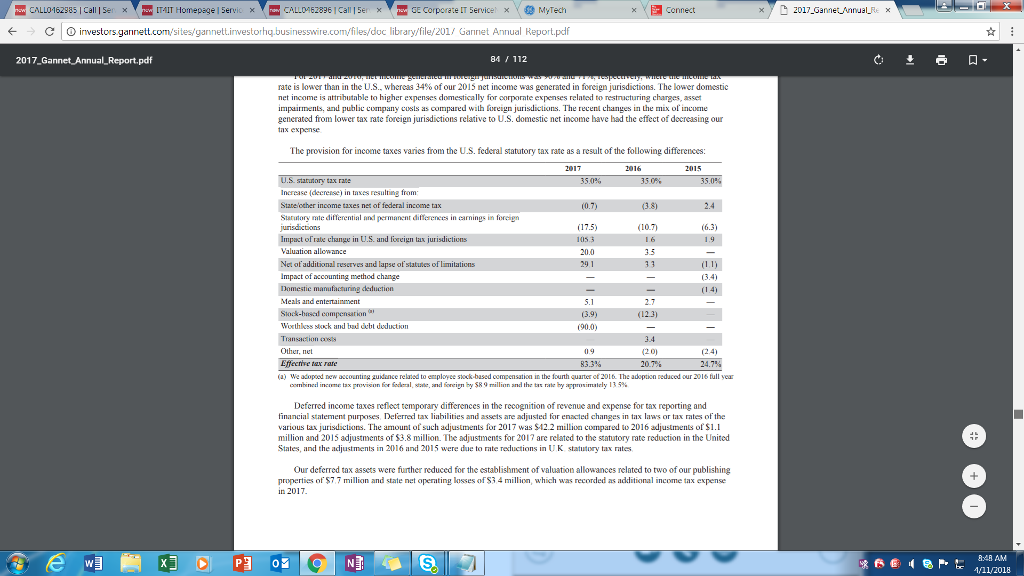

For the year ending December 31, 2017, refer to the annual report for Gannett Co. Inc. Gannett's stock symbol is GCI and is traded on

For the year ending December 31, 2017, refer to the annual report for Gannett Co. Inc. Gannett's stock symbol is GCI and is traded on the New York Stock Exchange. Answer the following three questions in a Word document (or other software) and submit it online. Here are the questions: 1. What was Gannett's effective tax rate for the year ending 12/31/2017? 2. Where (or how) did you find that information, what's your source? (Just identify the source, I don't need a full citation.) 3. Why is Gannett's effective tax rate different from 35% (the rate in effect for 2017)? What's the BIG reason for the difference, just identify one or two reasons. You don't need to explain it, just identify the source of the difference.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started