Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the year just completed, Hanna Company had net income of $40,000. Balances in the company's current asset and current liability accounts at the

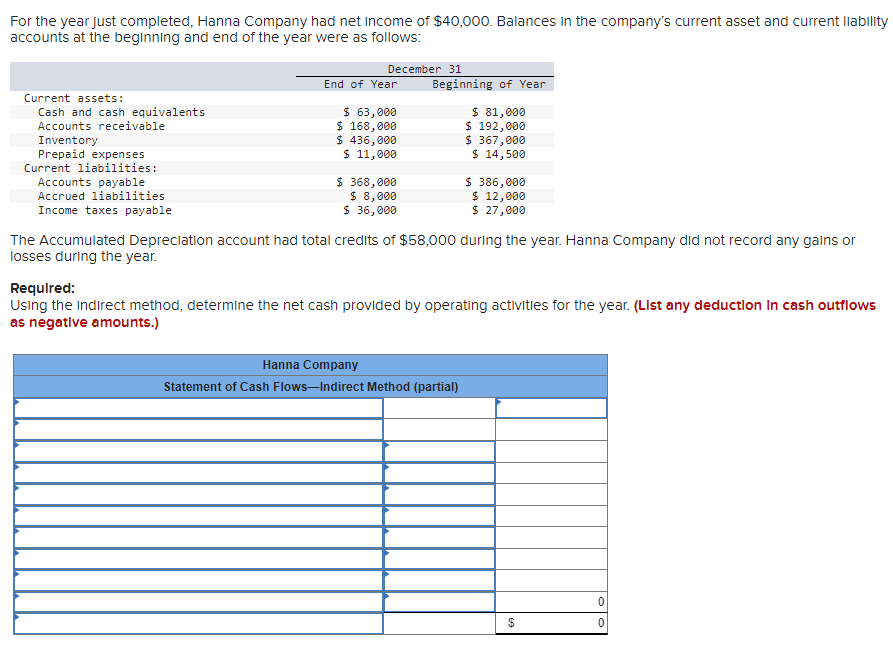

For the year just completed, Hanna Company had net income of $40,000. Balances in the company's current asset and current liability accounts at the beginning and end of the year were as follows: December 31 End of Year Beginning of Year Current assets: Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Current liabilities: Accounts payable Accrued liabilities Income taxes payable $ 63,000 $ 168,000 $ 436,000 $ 11,000 $ 368,000 $ 8,000 $ 36,000 $ 81,000 $ 192,000 $ 367,000 $ 14,500 $ 386,000 $ 12,000 $ 27,000 The Accumulated Depreciation account had total credits of $58,000 during the year. Hanna Company did not record any gains or losses during the year. Required: Using the indirect method, determine the net cash provided by operating activities for the year. (List any deduction in cash outflows as negative amounts.) Hanna Company Statement of Cash Flows-Indirect Method (partial) 0 $ 0

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate the net cash provided by operating activities using the indirect method we start ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started