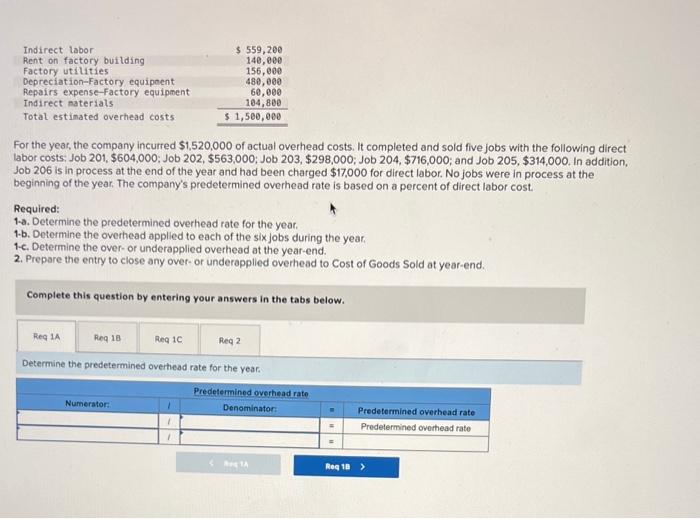

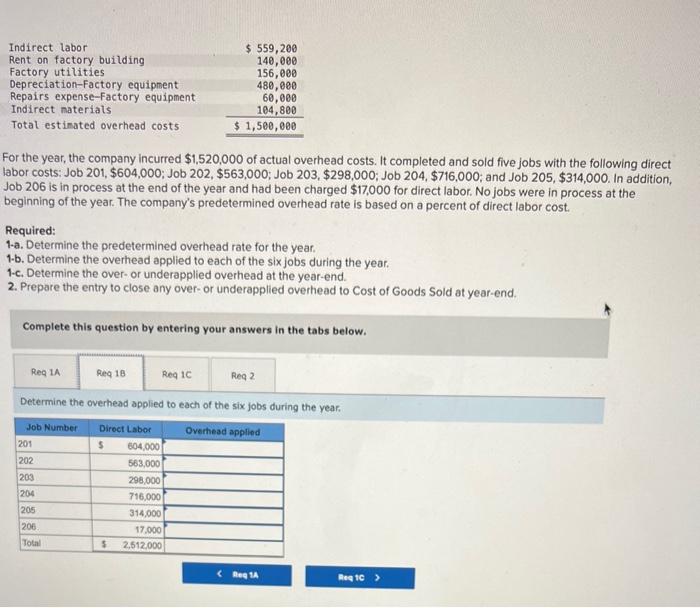

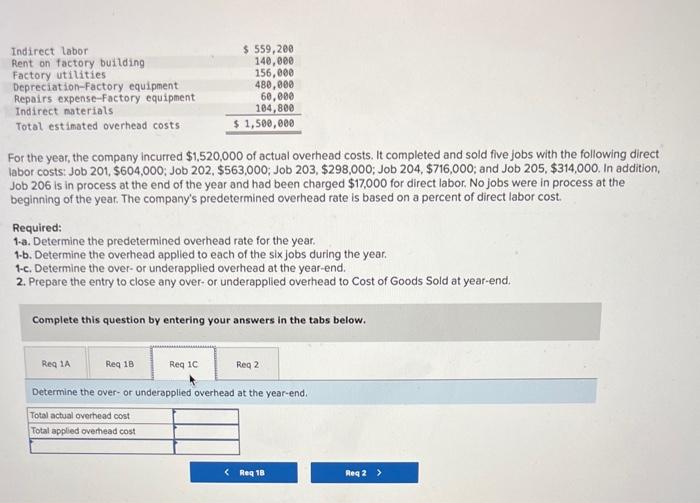

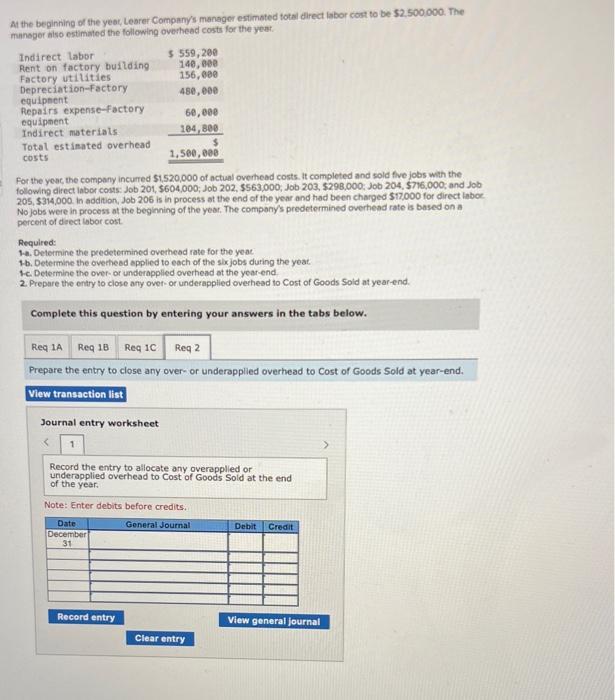

For the year, the company incurred $1,520,000 of actual overhead costs. It completed and sold five jobs with the following direct labor costs: Job 201, \$604,000; Job 202, \$563,000; Job 203, \$298,000; Job 204, \$716,000; and Job 205, \$314,000. In addition, Job 206 is in process at the end of the year and had been charged $17,000 for direct labor. No jobs were in process at the beginning of the year. The company's predetermined overhead rate is based on a percent of direct labor cost. Required: 1-a. Determine the predetermined overhead rate for the year. 1.b. Determine the overhead applied to each of the six jobs during the year. 1-c. Determine the over-or underapplied overhead at the year-end. 2. Prepare the entry to close any over- or underapplied overhead to Cost of Goods Sold at year-end. Complete this question by entering your answers in the tabs below. Determine the predetermined overhead rate for the year. For the year, the company incurred $1,520,000 of actual overhead costs. It completed and sold five jobs with the following direct labor costs: Job 201, \$604,000; Job 202, \$563,000; Job 203, \$298,000; Job 204, \$716,000; and Job 205, \$314,000. In addition, Job 206 is in process at the end of the year and had been charged $17,000 for direct labor. No jobs were in process at the beginning of the year. The company's predetermined overhead rate is based on a percent of direct labor cost. Required: 1-a. Determine the predetermined overhead rate for the year. 1-b. Determine the overhead applied to each of the six jobs during the year. 1-c. Determine the over-or underapplied overhead at the year-end. 2. Prepare the entry to close any over-or underapplied overhead to Cost of Goods Sold at year-end. Complete this question by entering your answers in the tabs below. Determine the overhead applied to each of the six jobs during the year. For the year, the company incurred $1,520,000 of actual overhead costs. It completed and sold five jobs with the following direct abor costs: Job 201, \$604,000; Job 202, \$563,000; Job 203, \$298,000; Job 204, \$716,000; and Job 205, \$314,000. In addition, Job 206 is in process at the end of the year and had been charged $17,000 for direct labor. No jobs were in process at the beginning of the year. The company's predetermined overhead rate is based on a percent of direct labor cost. Required: 1.a. Determine the predetermined overhead rate for the year. 1-b. Determine the overhead applied to each of the six jobs during the year. 1-c. Determine the over- or underapplied overhead at the year-end. 2. Prepare the entry to close any over- or underapplied overhead to Cost of Goods Sold at year-end. Complete this question by entering your answers in the tabs below. Determine the over- or underapplied overhead at the year-end. At the beginning of the yeat, Learer Companys manager estimated total direct labor cost to be 52,500,000. The manegor also estimated the following overhead costs for the year. For the yeac the company incurred 51,520,000 of actual overthead costs. It completed and sold five jobs with the followine direct iabor couts: Job 201, $604,000;, Job 202, 5563,000,Job203,5298,000; Job 204, 5716,000; and Job 205,$314,000. in addition, Job 206 is in process at the end of the year and had been charged $17,000 for direct labce. No jobs were in process at the beginning of the year. The company's predetermined overhead rate is based on a percent of direct labor cost. Required: 1.a. Determine the peedetermined overhead rate for the yeac 1b. Determine the ovechesd applied to each of the sixjobs during the yeat. 1.c. Determine the over-or underapplied overhead at the ycar-end. 2. Prepare the entry to close any ovet-or underapplied overhead to Cost of Goods Sold at year-end. Complete this question by entering your answers in the tabs below. Prepare the entry to close any over- or underapplied overhead to Cost of Goods Sold at year-end. Journal entry worksheet Record the entry to allocate any overapplied or underapplied overhead to Cost of Goods Sold at the end of the year. Note: Enter debits before credits