Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the years to maturity for the CYE Bond, I got 10.169 years, or 10.17 years. I'm not sure if you would round that up

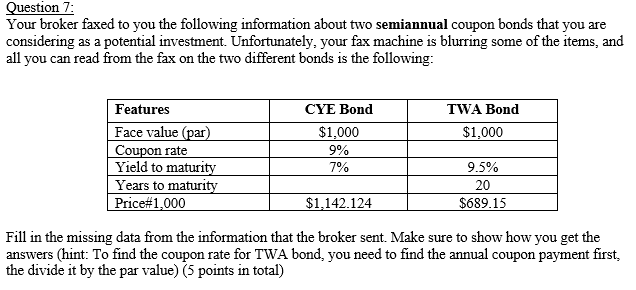

For the years to maturity for the CYE Bond, I got 10.169 years, or 10.17 years. I'm not sure if you would round that up to 11 years or not.

For the coupon payment for the TWA Bond, I got 59.725, and I got 5.97% for the coupon rate.

I am not sure if you have to take into account semi-annual changes to the variables. Please help.

Question 7: Your broker faxed to you the following information about two semiannual coupon bonds that you are considering as a potential investment. Unfortunately, your fax machine is blurring some of the items, and all you can read from the fax on the two different bonds is the following: Fill in the missing data from the information that the broker sent. Make sure to show how you get the answers (hint: To find the coupon rate for TWA bond, you need to find the annual coupon payment first, the divide it by the par value) (5 points in total)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started