Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FOR THESE PROBLEMS CAN YOU PLEASE GIVE ME THE ANSWERS USING THE FINANCIAL PROFESSIONAL CALCULATOR KEYS ONLY. PLEASE CAN YOU GIVE ME THE BEST WAYVTO

FOR THESE PROBLEMS CAN YOU PLEASE GIVE ME THE ANSWERS USING THE FINANCIAL PROFESSIONAL CALCULATOR KEYS ONLY. PLEASE CAN YOU GIVE ME THE BEST WAYVTO SOLVE THESE PLEASE AND THANK YOU.

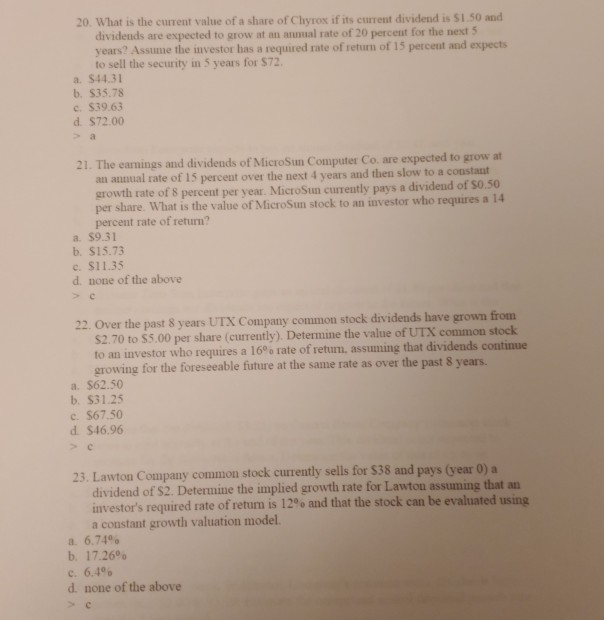

20. What is the current value of a share of Chyrox if its current dividend is S150 and dividends are expected to grow at an annual rate of 20 percent for the next 5 years? Assume the investor has a required rate of return of 15 percent and expects to sell the security in 5 years for $72 a. $44.31 b. $35.78 c. $39.63 d $72.00 >a 21. The earnings and dividends of MicroSun Computer Co are expected to grow at an annual rate of 15 percent over the next 4 years and then slow to a constant growth rate of 8 percent per year. MicroSun currently pays a dividend of $0.50 per share. What is the value of MicroSun stock to an investor who requires a 1 percent rate of return? a. $9.31 b. $15.73 c. $11.35 d. none of the above >c 22. Over the past 8 years UTX Company common stock dividends have grown from S2.70 to $5.00 per share (currently). Determine the value of UTX common stock to an investor who requires a 16% rate of return, assuming that dividends continue growing for the foreseeable future at the same rate as over the past 8 years. a. $62.50 b. S31.25 c. $67.50 d $46.96 23. Lawton Company common stock currently sells for $38 and pays (year 0) a dividend of $2. Deternine the implied growth rate for Lawton assuming that an investor's required rate of return is 12% and that the stock can be evaluated using a constant growth valuation model. a. 6.74% b. 17.26 c. 6.4% d none of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started