Question

For this assignment, due in Module Four, you will submit both a horizontal and vertical analysis of Starbucks accounts receivable, fixed assets, and debt financing.

For this assignment, due in Module Four, you will submit both a horizontal and vertical analysis of Starbucks’ accounts receivable, fixed assets, and debt financing. Use basic financial analysis to examine any horizontal and any vertical changes in Starbucks’ accounts receivable, fixed assets, and debt financing balances over time. Be sure also to discuss how Starbucks’ methods for accounting for receivables and evaluating uncollectible receivables, purchase of fixed assets, and methods of debt financing impact the recording process and presentation of financial statements (Critical Element II). In other words, what are this company’s methods for accounting for receivables and evaluating uncollectible receivables? What types of fixed assets are acquired, and what methods are preferred for debt financing? How do those affect how financial information is communicated?

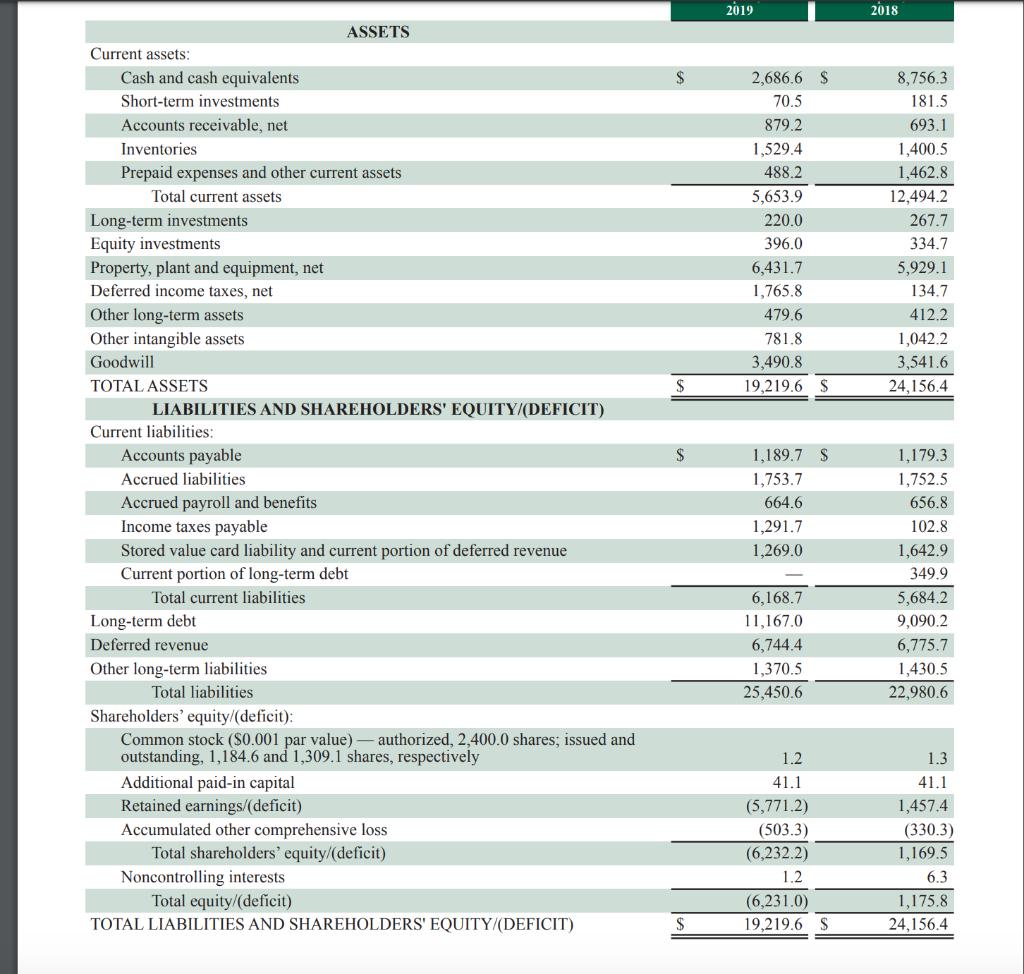

II. Horizontal and Vertical Analysis: In this section, you will conduct horizontal and vertical analyses for the balance sheet and income statement accounts and report any significant observations for a two-year period. You should include a table of your calculations as an appendix to your analysis. Include all calculations in an Excel document. Specifically discuss the following categories: A. Accounts Receivable:

1. Use basic financial analysis to examine any horizontal changes in Starbucks’ accounts receivable balances over time.

2. Use basic financial analysis to examine any vertical changes in Starbucks’ accounts receivable balances over time.

3. Analyze how Starbucks’ methods for accounting for receivables and evaluating uncollectible receivables impact the recording process and presentation of financial statements. In other words, what are this company’s methods for accounting for receivables and evaluating uncollectible receivables, and how do those affect how financial information is communicated? B. Asset

Acquisition, Depreciation, and Amortization:

1. Use basic financial analysis to examine any horizontal changes in Starbucks’ fixed assets, intangible assets, depreciation, and amortization over time.

2. Use basic financial analysis to examine any vertical changes in Starbucks’ fixed assets, intangible assets, depreciation, and amortization over time.

3. Analyze Starbucks’ methods for fixed asset and intangible asset acquisitions as well as depreciation and amortization, including asset categorization. How do these methods affect the balance sheet, income statement, and statement of cash flows?

C. Debt Financing

1. Use basic financial analysis to examine any horizontal changes in Starbucks’ short- and long-term debt over time.

2. Use basic financial analysis to examine any vertical changes in Starbucks’ short- and long-term debt over time.

3. Analyze Starbucks’ method of debt financing. In your analysis, you should address both current and long-term liabilities, including the issuance of bonds.

Current assets: Cash and cash equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets. Long-term investments Equity investments Property, plant and equipment, net Deferred income taxes, net Other long-term assets Other intangible assets Goodwill TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY/(DEFICIT) Current liabilities: Accounts payable Accrued liabilities ASSETS Accrued payroll and benefits Income taxes payable Stored value card liability and current portion of deferred revenue Current portion of long-term debt Total current liabilities Long-term debt Deferred revenue Other long-term liabilities Total liabilities Shareholders' equity/(deficit): Common stock ($0.001 par value) - authorized, 2,400.0 shares; issued and outstanding, 1,184.6 and 1,309.1 shares, respectively Additional paid-in capital Retained earnings/(deficit) Accumulated other comprehensive loss Total shareholders' equity/(deficit) Noncontrolling interests Total equity/(deficit) TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY/(DEFICIT) $ $ S 2019 2,686.6 S 70.5 879.2 1,529.4 488.2 5,653.9 220.0 396.0 6,431.7 1,765.8 479.6 781.8 3,490.8 19,219.6 $ 1,189.7 S 1,753.7 664.6 1,291.7 1,269.0 6,168.7 11,167.0 6,744.4 1,370.5 25,450.6 1.2 41.1 (5,771.2) (503.3) (6,232.2) 1.2 (6,231.0) 19,219.6 S 2018 8,756.3 181.5 693.1 1,400.5 1,462.8 12,494.2 267.7 334.7 5,929.1 134.7 412.2 1,042.2 3,541.6 24,156.4 1,179.3 1,752.5 656.8 102.8 1,642.9 349.9 5,684.2 9,090.2 6,775.7 1,430.5 22,980.6 1.3 41.1 1,457.4 (330.3) 1,169.5 6.3 1,175.8 24,156.4

Step by Step Solution

3.43 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Here is the horizontal and vertical analysis of Starbucks accounts receivable fixed assets and debt financing Accounts Receivable Horizontal analysis The horizontal analysis shows that Starbucks accou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started