Question

For this assignment, you are tasked to analyse two alternatives for the company to choose from when making a strategic decision. To assist in the

For this assignment, you are tasked to analyse two alternatives for the company to choose

from when making a strategic decision.

To assist in the comparative analysis, complete a 10-column worksheet,

Income Statements, Closing entries and Balance sheets.

Moscato Vitis is a wine business trading in Australia. It's dated back to 1965 when it started

as a humble family business supplying mainly Cronulla. Over the years, it has grown

exponentially becoming one of the main distributors for wine retailers in New South Wales

(NSW).

As part of its growth strategy, the business is now considering expanding its market to

Victoria (VIC). As a professional accountant, you are being tasked to prepare reports

outlining the possible outcomes and risks if the company is to remain at its current

operation scale or go ahead with the expansion (stay in NSW or expand to VIC).

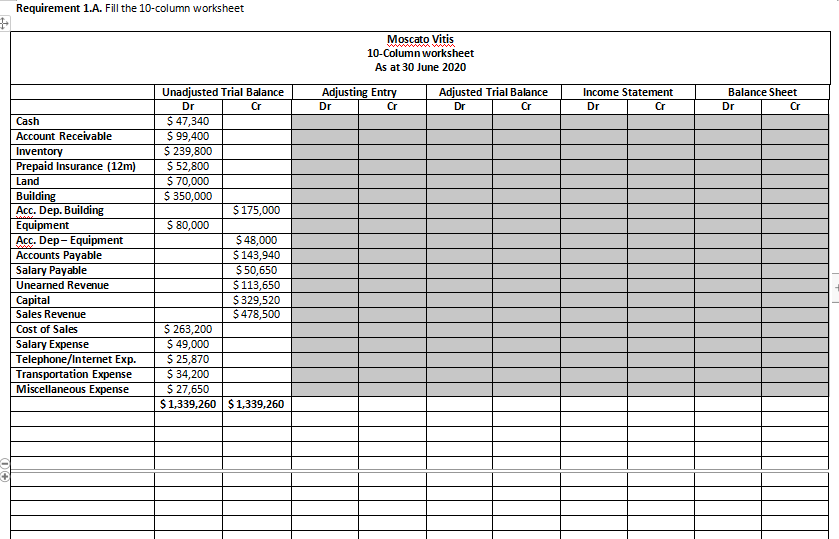

The unadjusted Trial Balance at end of 30 June 2020 is as such:

Moscato Vitis

Unadjusted Trial Balance

As at 30 June 2020

Debits

Cash

$ 47,340

Accounts Receivable

$ 99,400

Inventory

$ 239,800

Prepaid Insurance (12m)

$ 52,800

Land

$ 70,000

Building

$ 350,000

Equipment

$ 80,000

Cost of Sales

$ 263,200

Salary Expense

$ 49,000

Telephone/internet Expense

$ 25,870

Transportation Expenses

$ 34,200

Miscellaneous Expense

$ 27,650

Credits

Acc. Depreciation - Building

$ 175,000

Acc. Depreciation - Equipment

$ 48,000

Accounts Payable

$ 143,940

Salary Payable

$ 50,650

Unearned Revenue

$ 113,650

Capital

$ 329,520

Sales Revenue

$ 478,500

$ 1,339,260

$ 1,339,260When reviewing the end of financial year report, you discovered the following items need

attention.

1. Employee salaries owed but not recorded, $5,500.

2. Unearned revenue now earned, $30,000.

3. One of the owners has invested $95,000 in forms of $37,000 cash and a parcel of land

valued at $58,000 into the business.

4. Depreciations for the year are not recorded. Annual rates for both assets are 10%

straight line.

5. Insurance purchased on 1st of March 2020 was partially consumed.

The company is also wary about possible interruption to demand e.g. due to pandemic.

For expansion, the company will need to hire more employees and more frequent delivery

interstate. This will increase operational cost in form of labour and land transportation

which are estimated around 50% and 30% respectively. The company is also considering a

more environmental friendly approach by using renewable packaging and cutting off

plastic usage and waste. This will increase COS by 15%.

Sales revenue is estimated to increase 13% every year however, long-term profit cannot be

guaranteed if the company go ahead with the expansion without improvement on its

revenue or expenditure. The silver lining with this strategy is that the HR department is

planning to hire more female workers and also to convert more staffs into permanent

basis. The company also believes that the risk will pay off in the future once the operation

has stabilised.

Requirements

1. A complete 10-columns worksheet, Closing entry, Income statement and Balance

sheet for year ended 30 June 2020.

2. For this part, you need to (approx.l):

? Evaluate which option is better for the company.

? State clearly your reasons using Triple Bottom Line reporting and give at least 2

possible outcomes for each TBL elements.

? Provide and justify 2 real-life examples for each elements.

? Lastly, suggest on strategies that can be deployed to achieve balanced TBL reporting.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started