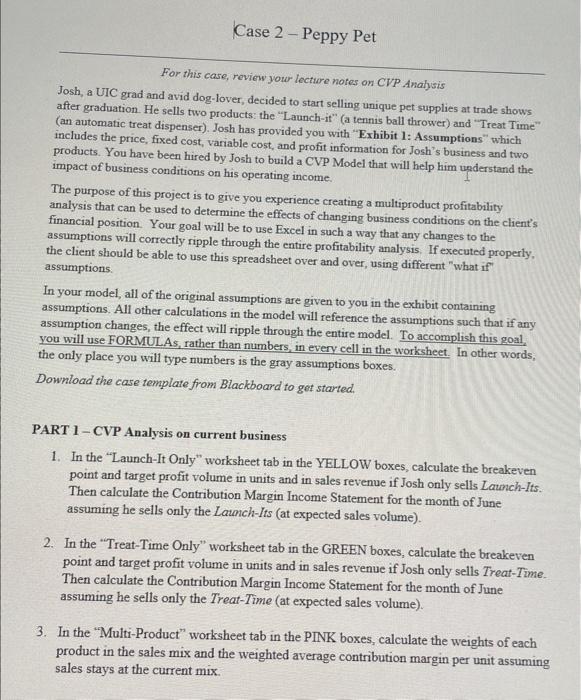

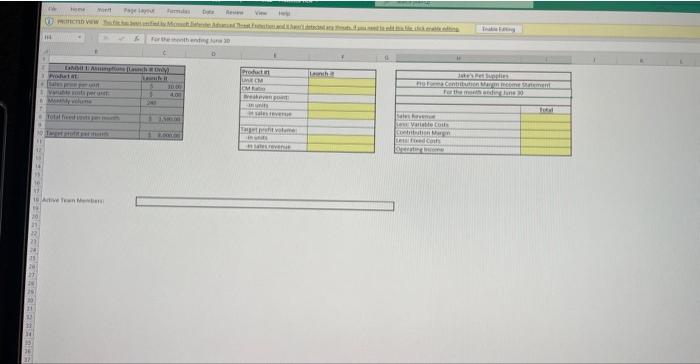

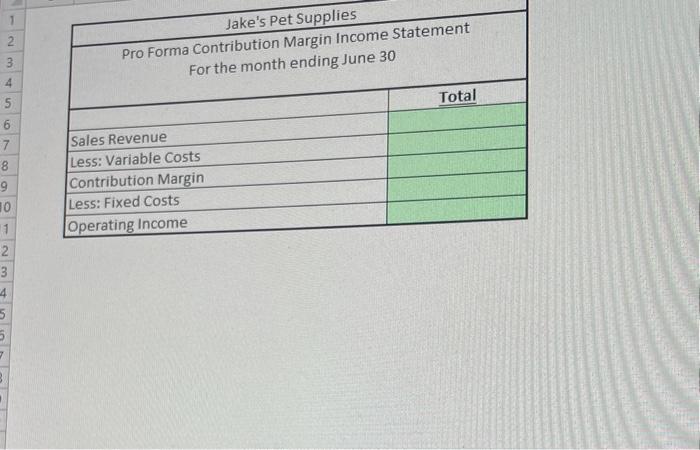

For this case, review yow lectiwe notes on CVP Analysis Josh, a UIC grad and avid dog-lover, decided to start selling unique pet supplies at trade shows after graduation. He sells two products: the "Launch-it" (a tennis ball thrower) and "Treat Time" (an automatic treat dispenser). Josh has provided you with "Exhibit 1: Assumptions" which includes the price, fixed cost, variable cost, and profit information for Josh's business and two products. You have been hired by Josh to build a CVP Model that will help him understand the impact of business conditions on his operating income. The purpose of this project is to give you experience creating a multiproduct profitability analysis that can be used to determine the effects of changing business conditions on the client's financial position. Your goal will be to use Excel in such a way that any changes to the assumptions will correctly ripple through the entire profitability analysis. If executed properly, the client should be able to use this spreadsheet over and over, using different "what if" assumptions. In your model, all of the original assumptions are given to you in the exhibit containing assumptions. All other calculations in the model will reference the assumptions such that if any assumption changes, the effect will ripple through the entire model. To accomplish this goal. you will use FORMULAs, rather than numbers, in every cell in the worksheet. In other words, the only place you will type numbers is the gray assumptions boxes. Download the case template from Blackboard to get started. PART 1 - CVP Analysis on current business 1. In the "Launch-It Only" worksheet tab in the YELLOW boxes, calculate the breakeven point and target profit volume in units and in sales revenue if Josh only sells Lawch-Its. Then calculate the Contribution Margin Income Statement for the month of June assuming he sells only the Latmch-Its (at expected sales volume). 2. In the "Treat-Time Only" worksheet tab in the GREEN boxes, calculate the breakeven point and target profit volume in units and in sales revenue if Josh only sells Treat-Time. Then calculate the Contribution Margin Income Statement for the month of June assuming he sells only the Treat-Time (at expected sales volume). 3. In the "Multi-Product" worksheet tab in the PINK boxes, calculate the weights of each product in the sales mix and the weighted average contribution margin per unit assuming sales stays at the current mix. Jake's Pet Supplies \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Pro Format Contribution Margin income Statement } \\ \hline & Fonth ending June 30 \\ \hline Sales Revenue & Total \\ \hline Less: Variable Costs & \\ \hline Contribution Margin & \\ \hline Less: Fixed Costs & \\ \hline Operating Income & \\ \hline \end{tabular} For this case, review yow lectiwe notes on CVP Analysis Josh, a UIC grad and avid dog-lover, decided to start selling unique pet supplies at trade shows after graduation. He sells two products: the "Launch-it" (a tennis ball thrower) and "Treat Time" (an automatic treat dispenser). Josh has provided you with "Exhibit 1: Assumptions" which includes the price, fixed cost, variable cost, and profit information for Josh's business and two products. You have been hired by Josh to build a CVP Model that will help him understand the impact of business conditions on his operating income. The purpose of this project is to give you experience creating a multiproduct profitability analysis that can be used to determine the effects of changing business conditions on the client's financial position. Your goal will be to use Excel in such a way that any changes to the assumptions will correctly ripple through the entire profitability analysis. If executed properly, the client should be able to use this spreadsheet over and over, using different "what if" assumptions. In your model, all of the original assumptions are given to you in the exhibit containing assumptions. All other calculations in the model will reference the assumptions such that if any assumption changes, the effect will ripple through the entire model. To accomplish this goal. you will use FORMULAs, rather than numbers, in every cell in the worksheet. In other words, the only place you will type numbers is the gray assumptions boxes. Download the case template from Blackboard to get started. PART 1 - CVP Analysis on current business 1. In the "Launch-It Only" worksheet tab in the YELLOW boxes, calculate the breakeven point and target profit volume in units and in sales revenue if Josh only sells Lawch-Its. Then calculate the Contribution Margin Income Statement for the month of June assuming he sells only the Latmch-Its (at expected sales volume). 2. In the "Treat-Time Only" worksheet tab in the GREEN boxes, calculate the breakeven point and target profit volume in units and in sales revenue if Josh only sells Treat-Time. Then calculate the Contribution Margin Income Statement for the month of June assuming he sells only the Treat-Time (at expected sales volume). 3. In the "Multi-Product" worksheet tab in the PINK boxes, calculate the weights of each product in the sales mix and the weighted average contribution margin per unit assuming sales stays at the current mix. Jake's Pet Supplies \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Pro Format Contribution Margin income Statement } \\ \hline & Fonth ending June 30 \\ \hline Sales Revenue & Total \\ \hline Less: Variable Costs & \\ \hline Contribution Margin & \\ \hline Less: Fixed Costs & \\ \hline Operating Income & \\ \hline \end{tabular}