for this one how did they get the tax refund what is the tax refund number. also, how did they get the opening balance of 0.6 you will see it in the solution with a question mark.

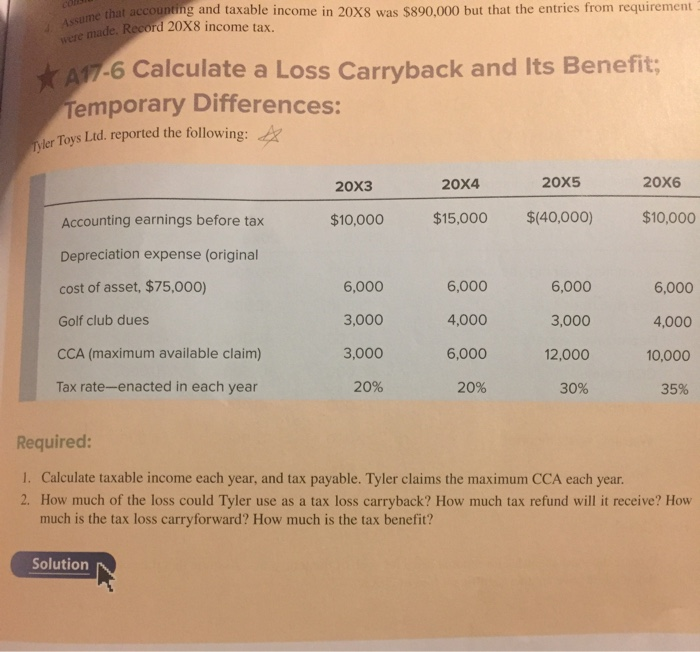

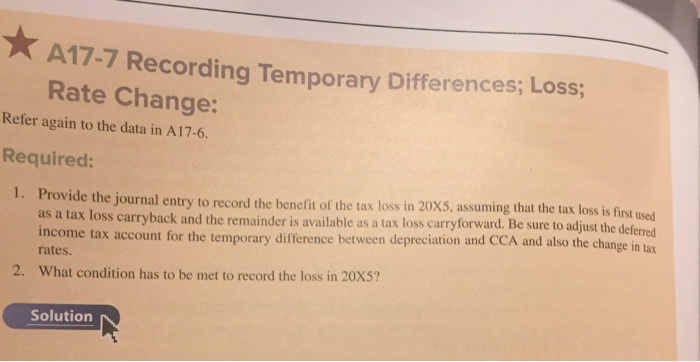

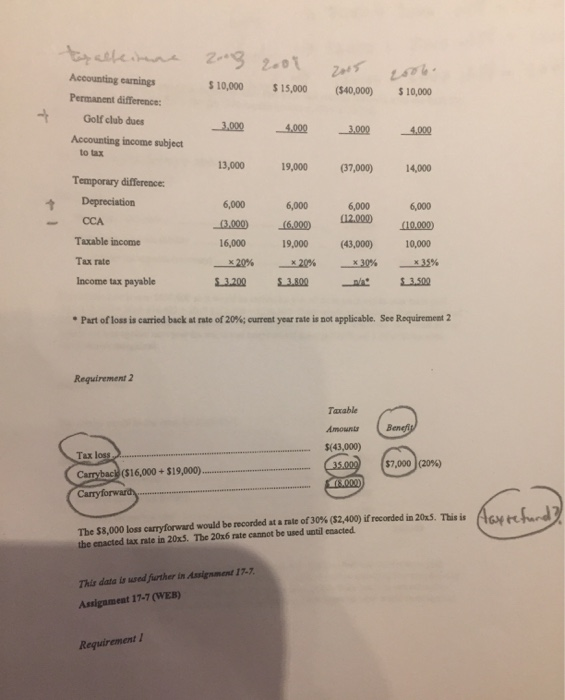

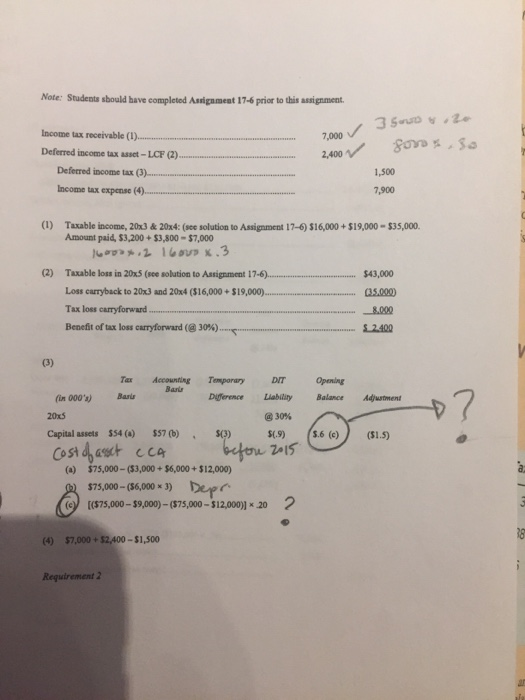

Assume that that accounting and taxable income in 20X8 was $890.000 but that the entries from requirement made. Record 20X8 income tax. were made. Recor A17-6 Calculate a Loss Carryback and Its Benefit; Temporary Differences: der Toys Ltd. reported the following: 20x3 20X4 20X5 20x6 Accounting earnings before tax $10,000 $15,000 $140,000) $10,000 Depreciation expense (original cost of asset, $75,000) 6,000 6,000 Golf club dues 6,000 3,000 3,000 4,000 3,000 6,000 4,000 10,000 35% 6,000 12,000 CCA (maximum available claim) Tax rate-enacted in each year 20% 20% 30% Required: 1. Calculate taxable income each year, and tax payable. Tyler claims the maximum CCA each year. 2. How much of the loss could Tyler use as a tax loss carryback? How much tax refund will it receive? How much is the tax loss carryforward? How much is the tax benefit? Solution A17-7 Recording Temporary Differences; Loss; Rate Change: Refer again to the data in A17-6. Required: 1. Provide the journal entry to record the benefit of the tax loss in 20X5, assuming that the tax loss is first used as a tax loss carryback and the remainder is available as a tax loss carryforward. Be sure to adjust the deferred income tax account for the temporary difference between depreciation and CCA and also the change in tax rates. 2. What condition has to be met to record the loss in 20X5? Solution (540,000) $10,000 3.000 __ 4,000 txalleine 2.3 2001 Accounting earnings $ 10,000 $15,000 Permanent difference: Golf club dues 3.000 4,000 Accounting income subject to tax 13,000 19,000 Temporary difference: Depreciation 6,000 6,000 CCA 13.000 (6.000 Tatable income 16,000 19,000 Tax rate x 20% * 20% Income tax payable 5.3.200 $ 3.800 (37,000) 14,000 6,000 (12.000 (43,000) x30% 6,000 (10,000) 10,000 35% $ 3.500 Part of loss is carried back at rate of 20%; current year rate is not applicable. See Requirement 2 Requirement 2 Taxable Amour Benefit $(43,000) 35.000 18.000 Tax loss Carrybacid (516,000+ $19,000). Carryforward $7,000 (20%) a The $8.000 lost curryforward would be recorded at a rate of 30% (52,400) if recorded in 2015. This is the enacted tax rate in 20x5. The 20x6 rate cannot be used until enacted. This data is wed further in Assignment 17-7. Assignment 17-7 (WEB) Requirement / Note: Students should have completed Assignment 17-6 prior to this assignment 7,000 2,400 3 Sout Son .20 Se Income tax receivable (1). Deferred income tax asset -LCF (2)..... Deferred income tax (3) Income tax expense (4)..... 1,500 7,900 (1) Taxable income, 20x3 & 20x4: (sce solution to Assignment 17-6) 316,000+ $19,000 - $35,000. Amount paid, $3,200 + $3,800 - $7,000 1 .2 16V 2.3 (2) $43,000 (35.000 Taxable loss in 20x5 (sce solution to Assignment 17-6). Loss carryback to 20x3 and 20x4 ($16,000+ $19,000).... Tax loss carryforward.. Benefit of tax loss carryforward (@30%). S. 2.400 Opening Balance Adjustment $.6 (c) ($1.5) Tax Accounting Temporary DIT DIT Bar fin 000's) Baru Diference Liability 20x5 @ 30% Capital assets $54() $57() $(3) $0.9) Cost of asset CCA before 2015 (a) $75,000 - (53,000 + $6,000+ $12,000) $75,000 - (56,000* 3) Depr (575,000 -- 89,000) (575,000 - $12,000)) * 20 2 (4) $7,000+ $2,400 - $1,500 Requirement 2 Assume that that accounting and taxable income in 20X8 was $890.000 but that the entries from requirement made. Record 20X8 income tax. were made. Recor A17-6 Calculate a Loss Carryback and Its Benefit; Temporary Differences: der Toys Ltd. reported the following: 20x3 20X4 20X5 20x6 Accounting earnings before tax $10,000 $15,000 $140,000) $10,000 Depreciation expense (original cost of asset, $75,000) 6,000 6,000 Golf club dues 6,000 3,000 3,000 4,000 3,000 6,000 4,000 10,000 35% 6,000 12,000 CCA (maximum available claim) Tax rate-enacted in each year 20% 20% 30% Required: 1. Calculate taxable income each year, and tax payable. Tyler claims the maximum CCA each year. 2. How much of the loss could Tyler use as a tax loss carryback? How much tax refund will it receive? How much is the tax loss carryforward? How much is the tax benefit? Solution A17-7 Recording Temporary Differences; Loss; Rate Change: Refer again to the data in A17-6. Required: 1. Provide the journal entry to record the benefit of the tax loss in 20X5, assuming that the tax loss is first used as a tax loss carryback and the remainder is available as a tax loss carryforward. Be sure to adjust the deferred income tax account for the temporary difference between depreciation and CCA and also the change in tax rates. 2. What condition has to be met to record the loss in 20X5? Solution (540,000) $10,000 3.000 __ 4,000 txalleine 2.3 2001 Accounting earnings $ 10,000 $15,000 Permanent difference: Golf club dues 3.000 4,000 Accounting income subject to tax 13,000 19,000 Temporary difference: Depreciation 6,000 6,000 CCA 13.000 (6.000 Tatable income 16,000 19,000 Tax rate x 20% * 20% Income tax payable 5.3.200 $ 3.800 (37,000) 14,000 6,000 (12.000 (43,000) x30% 6,000 (10,000) 10,000 35% $ 3.500 Part of loss is carried back at rate of 20%; current year rate is not applicable. See Requirement 2 Requirement 2 Taxable Amour Benefit $(43,000) 35.000 18.000 Tax loss Carrybacid (516,000+ $19,000). Carryforward $7,000 (20%) a The $8.000 lost curryforward would be recorded at a rate of 30% (52,400) if recorded in 2015. This is the enacted tax rate in 20x5. The 20x6 rate cannot be used until enacted. This data is wed further in Assignment 17-7. Assignment 17-7 (WEB) Requirement / Note: Students should have completed Assignment 17-6 prior to this assignment 7,000 2,400 3 Sout Son .20 Se Income tax receivable (1). Deferred income tax asset -LCF (2)..... Deferred income tax (3) Income tax expense (4)..... 1,500 7,900 (1) Taxable income, 20x3 & 20x4: (sce solution to Assignment 17-6) 316,000+ $19,000 - $35,000. Amount paid, $3,200 + $3,800 - $7,000 1 .2 16V 2.3 (2) $43,000 (35.000 Taxable loss in 20x5 (sce solution to Assignment 17-6). Loss carryback to 20x3 and 20x4 ($16,000+ $19,000).... Tax loss carryforward.. Benefit of tax loss carryforward (@30%). S. 2.400 Opening Balance Adjustment $.6 (c) ($1.5) Tax Accounting Temporary DIT DIT Bar fin 000's) Baru Diference Liability 20x5 @ 30% Capital assets $54() $57() $(3) $0.9) Cost of asset CCA before 2015 (a) $75,000 - (53,000 + $6,000+ $12,000) $75,000 - (56,000* 3) Depr (575,000 -- 89,000) (575,000 - $12,000)) * 20 2 (4) $7,000+ $2,400 - $1,500 Requirement 2