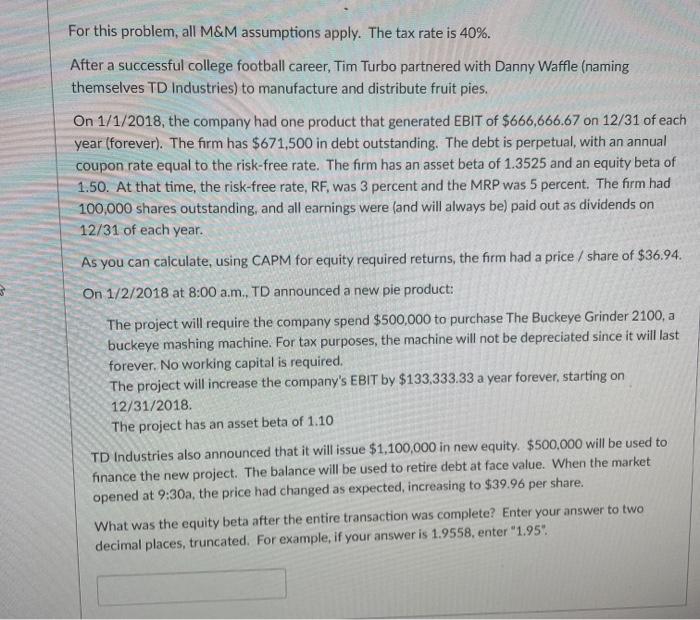

For this problem, all M&M assumptions apply. The tax rate is 40%. After a successful college football career, Tim Turbo partnered with Danny Waffle (naming themselves TD Industries) to manufacture and distribute fruit pies. On 1/1/2018, the company had one product that generated EBIT of $666,666.67 on 12/31 of each year (forever). The firm has $671,500 in debt outstanding. The debt is perpetual, with an annual coupon rate equal to the risk-free rate. The firm has an asset beta of 1.3525 and an equity beta of 1.50. At that time, the risk-free rate, RF, was 3 percent and the MRP was 5 percent. The firm had 100,000 shares outstanding, and all earnings were (and will always be) paid out as dividends on 12/31 of each year. As you can calculate, using CAPM for equity required returns, the firm had a price / share of $36.94. On 1/2/2018 at 8:00 a.m., TD announced a new pie product: The project will require the company spend $500,000 to purchase The Buckeye Grinder 2100, a buckeye mashing machine. For tax purposes, the machine will not be depreciated since it will last forever. No working capital is required. The project will increase the company's EBIT by $133,333.33 a year forever, starting on 12/31/2018 The project has an asset beta of 1.10 TD Industries also announced that it will issue $1,100,000 in new equity. $500,000 will be used to finance the new project. The balance will be used to retire debt at face value. When the market opened at 9:30a, the price had changed as expected, increasing to $39.96 per share. What was the equity beta after the entire transaction was complete? Enter your answer to two decimal places, truncated. For example, if your answer is 1.9558, enter "1.95'. For this problem, all M&M assumptions apply. The tax rate is 40%. After a successful college football career, Tim Turbo partnered with Danny Waffle (naming themselves TD Industries) to manufacture and distribute fruit pies. On 1/1/2018, the company had one product that generated EBIT of $666,666.67 on 12/31 of each year (forever). The firm has $671,500 in debt outstanding. The debt is perpetual, with an annual coupon rate equal to the risk-free rate. The firm has an asset beta of 1.3525 and an equity beta of 1.50. At that time, the risk-free rate, RF, was 3 percent and the MRP was 5 percent. The firm had 100,000 shares outstanding, and all earnings were (and will always be) paid out as dividends on 12/31 of each year. As you can calculate, using CAPM for equity required returns, the firm had a price / share of $36.94. On 1/2/2018 at 8:00 a.m., TD announced a new pie product: The project will require the company spend $500,000 to purchase The Buckeye Grinder 2100, a buckeye mashing machine. For tax purposes, the machine will not be depreciated since it will last forever. No working capital is required. The project will increase the company's EBIT by $133,333.33 a year forever, starting on 12/31/2018 The project has an asset beta of 1.10 TD Industries also announced that it will issue $1,100,000 in new equity. $500,000 will be used to finance the new project. The balance will be used to retire debt at face value. When the market opened at 9:30a, the price had changed as expected, increasing to $39.96 per share. What was the equity beta after the entire transaction was complete? Enter your answer to two decimal places, truncated. For example, if your answer is 1.9558, enter "1.95